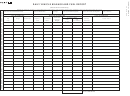

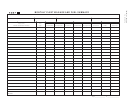

Daily Vehicle Mileage And Fuel Report Form - 2000 Page 2

ADVERTISEMENT

7.

Purchaser’s name (in the case of

with the Department for a fuel tax refund

a lessee/lessor agreement, receipts

account in order to receive a refund (See

will be accepted in either name,

FYI Excise 7 “Tax Refunds for Exempt

provided a legal connection can be

Use of Fuel” for information on applying

made to the reporting party).

for refunds.)

In the case of withdrawals from licensee-

Users should apply to the state where the

owned, tax-paid bulk storage, credit may

fuel is purchased/used, when fuel pur-

be obtained if the following detailed

chased in other states is used for exempt

records are maintained:

purposes. Please contact the state(s) for

information about filing requirements.

1.

Date of withdrawal.

2.

Number of gallons.

FURTHER INFORMATION

3.

Fuel type.

For more information on related topics,

4.

Unit number.

consult the following DOR publications:

5.

Purchase and inventory records to

•

FYI General 1 “Department of

substantiate that tax was paid on all

Revenue Publications”;

bulk purchases.

•

FYI General 8 “The FYI Program —

Index and General Information”;

MILEAGE AND FUEL SUMMARIES

•

FYI Sales 29 “Special Regulation:

Summaries are not acceptable for audit

Freight, Delivery and Transporta-

purposes without source documents. The

tion”;

IRP requires summarization on a monthly

or quarterly basis by vehicle and jurisdic-

•

FYI Sales 57 “Sales and Use Tax

tion. The IFTA requires a monthly fleet

Applicable to Gasoline and Special

summary for all qualified motor vehicles.

Fuels”;

•

FYI Excise 14 “Passenger Mile Tax”;

Acceptable daily vehicle mileage and fuel

report and monthly fleet mileage and fuel

•

FYI Excise 8 “International Fuel Tax

summary documents are attached (pages

Agreement.”

3 & 4). These forms are offered as a

Single FYIs are free from the Taxpayer

suggestion only. Company forms contain-

Service Division. They may be obtained at

ing the same information may be used.

any statewide Taxpayer Service Center;

Every carrier is periodically audited to

or by writing to the Colorado Department

ensure proper records maintenance. The

of Revenue, 1375 Sherman St., Denver,

IRP requires that mileage records be kept

CO 80261; or by calling the DOR Forms

for 4 1/2 years on each qualified motor

Hotline at (303) 232-2414. Please use the

vehicle. The IFTA requires that mileage

FYI number (General 1, Sales 9, etc.,)

records and fuel receipts and/or invoices

when ordering FYI publications. FYIs

be kept for 4 years on each qualified

and commonly used forms are available

motor vehicle. If an audit reveals deficien-

on the Web at

cies, additional charges may result.

FUEL USED FOR EXEMPT

PURPOSES

Colorado allows an exemption for fuel

used for exempt purposes such as refrig-

eration units. IFTA carriers can apply for

a refund for the use of tax-paid fuel in

refrigeration units for exempt purposes.

Colorado does not have exempt miles, just

exempt fuel use. A user will need to apply

PAGE 2 OF 4

EXCISE 10 (09/00)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4