Form Ct-1120u - Unitary Corporation Business Tax Return - 2014 Page 2

ADVERTISEMENT

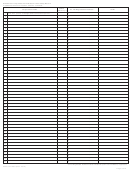

Schedule D – Computation of Net Income

1

1. Federal taxable income (loss) before net operating loss and special deductions ..........................................

00

2

2. Interest income wholly exempt from federal tax .............................................................................................

00

3

3. Unallowable deduction for corporation tax from Schedule F, Line 4 ..............................................................

00

4

4. Interest expenses paid to a related member from Form CT-1120AB, Part I A, Line 1 ................................

00

5

5. Intangible expenses and costs paid to a related member from Form CT-1120AB, Part I B, Line 3 ............

00

6

6. Federal bonus depreciation: See instructions. ...............................................................................................

00

7

7. Reserved for future use ..................................................................................................................................

8

8. IRC §199 domestic production activities deduction from federal Form 1120, Line 25 ....................................

00

9

9. Other: Attach explanation. ..............................................................................................................................

00

10

10. Total: Add Lines 1 through 9. ..........................................................................................................................

00

11

11. Dividend deduction from Form CT-1120 ATT,

Schedule I, Line 5

..................................................................

00

12

12. Capital loss carryover (if not deducted in computing federal capital gain) .....................................................

00

13

13. Capital gain from sale of preserved land ........................................................................................................

00

14

14. Federal bonus depreciation recovery from Form CT-1120 ATT, Schedule J, Line 15 ...................................

00

15

15. Exceptions to interest add back from Form CT-1120AB, Part II A, Line 1 .....................................................

00

16

16. Exceptions to interest add back from Form CT-1120AB, Part II A, Line 2 .....................................................

00

17

17. Exceptions to interest add back from Form CT-1120AB, Part II A, Line 3 .....................................................

00

18. Exceptions to add back of intangible expenses paid to a related member

18

from Form CT-1120AB, Part II B, Line 1 .....................................................................................................

00

19

19. Deferred cancellation of debt income. See instructions. .................................................................................

00

20

20. Other: See instructions. ..................................................................................................................................

00

21

21. Total: Add Lines 11 through 20. ......................................................................................................................

00

22

22. Net income: Subtract Line 21 from Line 10. Enter here and on Schedule A, Line 1. .....................................

00

Column A

Column B

Column C

Schedule E – Computation of Minimum Tax Base

Beginning of Year

End of Year

See instructions.

(Column A plus

1. Capital stock from federal Schedule L, Line 22a and Line 22b ..............................

00

00

Column B)

2. Surplus and undivided profi ts from federal Schedule L, Lines 23, 24, and 25 .......

00

00

Divided by 2

3. Surplus reserves: Attach schedule. ........................................................................

00

00

4. Total: Add Lines 1, 2, and 3. Enter average in Column C. ......................................

00

00

00

5. Holdings of stock of private corporations: Attach schedule. Enter average in Column C.

00

00

00

6. Balance: Subtract Line 5, Column C, from Line 4, Column C. Enter here and on Schedule B, Line 1. ............................................

00

Schedule F – Taxes

1. Connecticut corporation business taxes deducted in the computation of federal taxable income ......................

1

00

2. Other taxes: See instructions. .............................................................................................................................

2

00

3. Tax on or measured by income or profi ts imposed by other states or political subdivisions deducted in the

computation of federal taxable income: Attach schedule. ...................................................................................

3

00

4. Total unallowable deduction for corporation business tax purposes: Add Line 1 and Line 3. Enter here and on

Schedule D, Line 3. .............................................................................................................................................

4

00

Declaration:

I declare under penalty of law that I have examined this return (including any accompanying schedules and statements) and, to the best

of my knowledge and belief, it is true, complete, and correct. I understand the penalty for willfully delivering a false return or document to the Department

of Revenue Services (DRS) is a fi ne of not more than $5,000, imprisonment for not more than fi ve years, or both. The declaration of a paid preparer

other than the taxpayer is based on all information of which the preparer has any knowledge.

Corporate offi cer’s name (print)

Corporate offi cer’s signature

Date

May DRS contact the preparer

This return MUST be fi led electronically!

shown below about this return?

Sign Here

Corporate offi cer’s email address (print)

Yes

No

Keep a copy

DO NOT MAIL paper return to DRS.

of this

Title

Telephone number

return for

(

)

your

records.

Paid preparer’s name (print)

Paid preparer’s signature

Date

Preparer’s SSN or PTIN

Firm’s name and address

FEIN

Telephone number

(

)

Form CT-1120U Back (Rev. 12/14)

Page 2 of 3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3