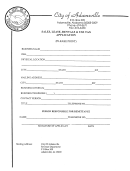

Sales, Lease, Rental And Use Tax Report Form - City Of Graysville, Alabama Page 2

ADVERTISEMENT

STANDARD

DEDUCTION SUMMARY

TABLE

{SUMMARY

BELOW

MUST BE COMPLETED

TO

CORRESPOND WITH TOTAL DEDUCTIONS

ON

FRONT OF

TAX

REPORT

TYPE OF TAX

WHOLESALE

SALES

AUTO

TRADE.INS

LABOR/NON.

TAXABI E SERV

SALES DELIV.

nr

rrcrntr

.il tFlts

SALES

TO

GOVT

OR

ITS

AGENCIES

SALES

OF

GAS

OR

LUBE OILS

)THER

ALLOWABLE

DEDUCTIONS

TOTAL

DEDUCTIONS

Sales

Use

Vending

Amusement

Manufacturing

Farm Mach.

&

Eouioment

Automotive

General

Lease/Rental

Auto

Lease/Rental

TOTAL

DEDUCTIONS

INSTRUCTIONS

&

INFORMATION CONCERNING

THE

COMPLETION OF

THIS

REPORT

To

avoid

the application ot

penalty,

and/or

interest amounts,

this

report must be filed

on or

before

the

20th of

the

month

following the

period

for

which

the

report is

submitted. Cancellation

postmark

will

determine timely filing.

A remittance for the

total amount due made

payable

to

City

of

Graysville must be

submitted

with

this

report.

This

report

should be submitted on a monthly

basis unless

you have

requested

and

been approved

for

a different

filing

frequency.

Any

credit for

prior

overpayment

must be

approved

in

advance

by

the

City

of

Graysville.

No

duplicate or

replicated

forms acceptable

except

with

prior approval of

the

City

of

Graysville.

lndicate Any Account Changes Below

Business Name:

Physical Address:

Mailing Address:

Phone:

FAX:

City:

Contact

Person

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2