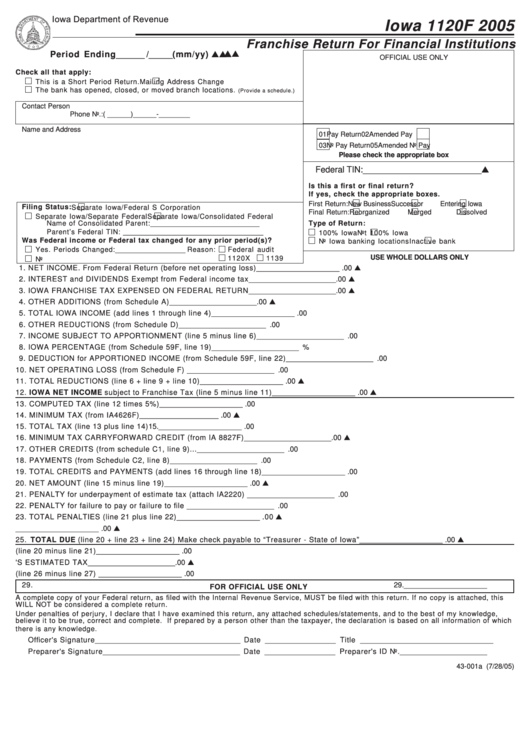

Form 1120f - Franchise Return For Financial Institutions - 2005

ADVERTISEMENT

Iowa Department of Revenue

Iowa 1120F 2005

Franchise Return For Financial Institutions

Period Ending ______ / _____ (mm/yy)

OFFICIAL USE ONLY

Check all that apply:

This is a Short Period Return.

Mailing Address Change

The bank has opened, closed, or moved branch locations.

(Provide a schedule.)

Contact Person

Phone No.: ( ______ ) ______-________

Name and Address

01 Pay Return

02 Amended Pay

03 No Pay Return

05 Amended No Pay

Please check the appropriate box

Federal TIN: _________________________

Is this a first or final return?

If yes, check the appropriate boxes.

First Return:

New Business

Successor

Entering Iowa

Filing Status:

Separate Iowa/Federal S Corporation

Final Return:

Reorganized

Merged

Dissolved

Separate Iowa/Separate Federal

Separate Iowa/Consolidated Federal

Type of Return:

Name of Consolidated Parent: ____________________________

Parent’s Federal TIN: ____________________________________

100% Iowa

Not 100% Iowa

Was Federal income or Federal tax changed for any prior period(s)?

No Iowa banking locations

Inactive bank

Yes. Periods Changed: __________________ Reason:

Federal audit

USE WHOLE DOLLARS ONLY

1120X

1139

No

1. NET INCOME. From Federal Return (before net operating loss) ................................................................. 1 . ____________________ .00

2. INTEREST and DIVIDENDS Exempt from Federal income tax ........................................................ 2. _____________________ .00

3. IOWA FRANCHISE TAX EXPENSED ON FEDERAL RETURN ........................................................ 3. _____________________ .00

4. OTHER ADDITIONS (from Schedule A) ............................................................................................... 4. _____________________ .00

5. TOTAL IOWA INCOME (add lines 1 through line 4) ......................................................................................... 5. ____________________ .00

6. OTHER REDUCTIONS (from Schedule D) .......................................................................................... 6. _____________________ .00

7. INCOME SUBJECT TO APPORTIONMENT (line 5 minus line 6) .................................................... 7. _____________________ .00

8. IOWA PERCENTAGE (from Schedule 59F, line 19) .......................................................................... 8. _____________________ %

9. DEDUCTION for APPORTIONED INCOME (from Schedule 59F, line 22) ..................................... 9. _____________________ .00

10. NET OPERATING LOSS (from Schedule F) ..................................................................................... 10. _____________________ .00

11. TOTAL REDUCTIONS (line 6 + line 9 + line 10) ............................................................................................. 11. ____________________ .00

12. IOWA NET INCOME subject to Franchise Tax (line 5 minus line 11) ......................................................... 12. ____________________ .00

13. COMPUTED TAX (line 12 times 5%) ................................................................................................................. 13. ____________________ .00

14. MINIMUM TAX (from IA4626F) ........................................................................................................................... 14. ____________________ .00

15. TOTAL TAX (line 13 plus line 14) ...................................................................................................................... 15. ____________________ .00

16. MINIMUM TAX CARRYFORWARD CREDIT (from IA 8827F) ........................................................ 16. _____________________ .00

17. OTHER CREDITS (from schedule C1, line 9) ................................................................................... 17. _____________________ .00

18. PAYMENTS (from Schedule C2, line 8) ............................................................................................. 18. _____________________ .00

19. TOTAL CREDITS and PAYMENTS (add lines 16 through line 18) .............................................................. 19. ____________________ .00

20. NET AMOUNT (line 15 minus line 19) ............................................................................................................... 20. ____________________ .00

21. PENALTY for underpayment of estimate tax (attach IA2220) ....................................................... 21. _____________________ .00

22. PENALTY for failure to pay or failure to file ..................................................................................... 22. _____________________ .00

23. TOTAL PENALTIES (line 21 plus line 22) ........................................................................................................ 23. ____________________ .00

24. INTEREST ............................................................................................................................................................. 24. ____________________ .00

25. TOTAL DUE (line 20 + line 23 + line 24) Make check payable to “Treasurer - State of Iowa” .............. 25. ____________________ .00

26. NET OVERPAYMENT (line 20 minus line 21) ................................................................................................. 26. ____________________ .00

27. CREDIT TO NEXT PERIOD'S ESTIMATED TAX ............................................................................. 27. _____________________ .00

28. REFUND REQUESTED (line 26 minus line 27) .............................................................................................. 28. ____________________ .00

29.

29. ____________________

FOR OFFICIAL USE ONLY

A complete copy of your Federal return, as filed with the Internal Revenue Service, MUST be filed with this return. If no copy is attached, this

WILL NOT be considered a complete return.

Under penalties of perjury, I declare that I have examined this return, any attached schedules/statements, and to the best of my knowledge,

believe it to be true, correct and complete. If prepared by a person other than the taxpayer, the declaration is based on all information of which

there is any knowledge.

Officer's Signature ___________________________________ Date _________________ Title ________________________________

Preparer's Signature _________________________________ Date _________________ Preparer's ID No. _____________________

43-001a (7/28/05)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2