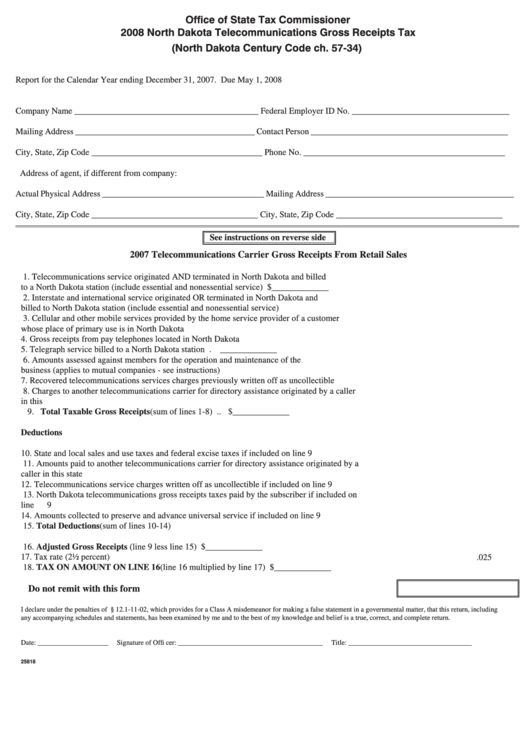

Office of State Tax Commissioner

2008 North Dakota Telecommunications Gross Receipts Tax

(North Dakota Century Code ch. 57-34)

Report for the Calendar Year ending December 31, 2007.

Due May 1, 2008

Company Name __________________________________________ Federal Employer ID No. ____________________________________

Mailing Address

_________________________________________ Contact Person _____________________________________________

City, State, Zip Code _______________________________________ Phone No.

______________________________________________

Address of agent, if different from company:

Actual Physical Address _____________________________________ Mailing Address ___________________________________________

City, State, Zip Code

______________________________________ City, State, Zip Code

______________________________________

See instructions on reverse side

2007 Telecommunications Carrier Gross Receipts From Retail Sales

1. Telecommunications service originated AND terminated in North Dakota and billed

to a North Dakota station (include essential and nonessential service) .......................................... $_____________

2. Interstate and international service originated OR terminated in North Dakota and

billed to North Dakota station (include essential and nonessential service) ...................................

_____________

3. Cellular and other mobile services provided by the home service provider of a customer

whose place of primary use is in North Dakota ..............................................................................

_____________

4. Gross receipts from pay telephones located in North Dakota .........................................................

_____________

5. Telegraph service billed to a North Dakota station .........................................................................

_____________

6. Amounts assessed against members for the operation and maintenance of the

business (applies to mutual companies - see instructions) ..............................................................

_____________

7. Recovered telecommunications services charges previously written off as uncollectible ..............

_____________

8. Charges to another telecommunications carrier for directory assistance originated by a caller

in this state.......................................................................................................................................

_____________

9. Total Taxable Gross Receipts (sum of lines 1-8) ............................................................................................................. $_____________

Deductions

10. State and local sales and use taxes and federal excise taxes if included on line 9 ..........................

_____________

11. Amounts paid to another telecommunications carrier for directory assistance originated by a

caller in this state .............................................................................................................................

_____________

12. Telecommunications service charges written off as uncollectible if included on line 9 .................

_____________

13. North Dakota telecommunications gross receipts taxes paid by the subscriber if included on

line 9 ................................................................................................................................................

_____________

14. Amounts collected to preserve and advance universal service if included on line 9 ......................

_____________

15. Total Deductions (sum of lines 10-14) ..........................................................................................

_____________

16. Adjusted Gross Receipts (line 9 less line 15) .................................................................................................................

$_____________

17. Tax rate (2½ percent) ........................................................................................................................................................

_____________

.025

18. TAX ON AMOUNT ON LINE 16 (line 16 multiplied by line 17) .................................................................................

$_____________

Do not remit with this form

I declare under the penalties of N.D.C.C. § 12.1-11-02, which provides for a Class A misdemeanor for making a false statement in a governmental matter, that this return, including

any accompanying schedules and statements, has been examined by me and to the best of my knowledge and belief is a true, correct, and complete return.

Date: ____________________

Signature of Offi cer: _________________________________________

Title: ___________________________________

25818

1

1 2

2