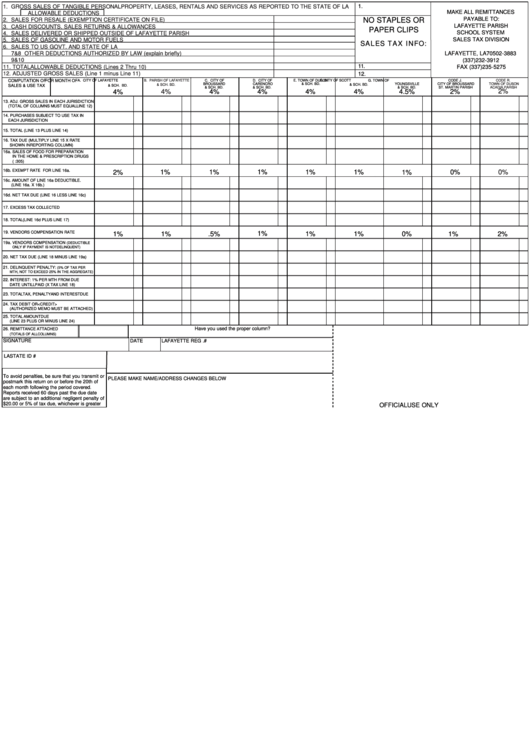

Sales Tax Form - Lafayette Parish School System

ADVERTISEMENT

1.

1. GROSS SALES OF TANGIBLE PERSONAL PROPERTY, LEASES, RENTALS AND SERVICES AS REPORTED TO THE STATE OF LA

MAKE ALL REMITTANCES

ALLOWABLE DEDUCTIONS

PAYABLE TO:

NO STAPLES OR

2. SALES FOR RESALE (EXEMPTION CERTIFICATE ON FILE)

LAFAYETTE PARISH

3. CASH DISCOUNTS, SALES RETURNS & ALLOWANCES

PAPER CLIPS

SCHOOL SYSTEM

4. SALES DELIVERED OR SHIPPED OUTSIDE OF LAFAYETTE PARISH

SALES TAX DIVISION

5. SALES OF GASOLINE AND MOTOR FUELS

SALES TAX INFO:

P.O. Box 3883

6. SALES TO US GOVT. AND STATE OF LA

or

LAFAYETTE, LA 70502-3883

7&8 OTHER DEDUCTIONS AUTHORIZED BY LAW (explain briefly)

9&10

(337)232-3912

11.

11. TOTAL ALLOWABLE DEDUCTIONS (Lines 2 Thru 10)

FAX (337)235-5275

12. ADJUSTED GROSS SALES (Line 1 minus Line 11)

12.

COMPUTATION OF

FOR MONTH OF

A. CITY OF LAFAYETTE

B. PARISH OF LAFAYETTE

C. CITY OF

D. CITY OF

E. TOWN OF DUSON

F. CITY OF SCOTT

G. TOWN OF

CODE J.

CODE R.

BROUSSARD

CARENCRO

& SCH. BD.

YOUNGSVILLE

CITY OF BROUSSARD

TOWN OF DUSON

& SCH. BD.

& SCH. BD.

SALES & USE TAX

& SCH. BD.

& SCH. BD.

& SCH. BD.

& SCH. BD.

ST. MARTIN PARISH

ACADIA PARISH

2%

4%

4%

4%

4%

4%

4%

4.5%

2%

13. ADJ. GROSS SALES IN EACH JURISDICTION

(TOTAL OF COLUMNS MUST EQUAL LINE 12)

14. PURCHASES SUBJECT TO USE TAX IN

EACH JURISDICTION

15. TOTAL (LINE 13 PLUS LINE 14)

16. TAX DUE (MULTIPLY LINE 15 X RATE

SHOWN INREPORTING COLUMN)

16a. SALES OF FOOD FOR PREPARATION

IN THE HOME & PRESCRIPTION DRUGS

(R.S. 47:305)

16b. EXEMPT RATE FOR LINE 16a.

1%

1%

1%

1%

1%

0%

0%

2%

1%

16c. AMOUNT OF LINE 16a DEDUCTIBLE.

(LINE 16a. X 16b.)

16d. NET TAX DUE (LINE 16 LESS LINE 16c)

17. EXCESS TAX COLLECTED

18. TOTAL (LINE 16d PLUS LINE 17)

19. VENDORS COMPENSATION RATE

1%

1%

1%

.5%

1%

1%

0%

1%

2%

19a. VENDORS COMPENSATION

(DEDUCTIBLE

ONLY IF PAYMENT IS NOT DELINQUENT)

20. NET TAX DUE (LINE 18 MINUS LINE 19a)

21. DELINQUENT PENALTY:

(5% OF TAX PER

MTH, NOT TO EXCEED 25% IN THE AGGREGATE)

22. INTEREST: 1% PER MTH FROM DUE

DATE UNTILL PAID (X TAX LINE 18)

23. TOTAL TAX, PENALTY AND INTEREST DUE

24. TAX DEBIT OR<CREDIT>

(AUTHORIZED MEMO MUST BE ATTACHED)

25. TOTAL AMOUNT DUE

(LINE 23 PLUS OR MINUS LINE 24)

Have you used the proper column?

26. REMITTANCE ATTACHED

(TOTALS OF ALL COLUMNS)

SIGNATURE

DATE

LAFAYETTE REG .#

LA STATE ID #

To avoid penalties, be sure that you transmit or

PLEASE MAKE NAME/ADDRESS CHANGES BELOW

postmark this return on or before the 20th of

each month following the period covered.

Reports received 60 days past the due date

are subject to an additional negligent penalty of

$20.00 or 5% of tax due, whichever is greater

OFFICIAL USE ONLY

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1