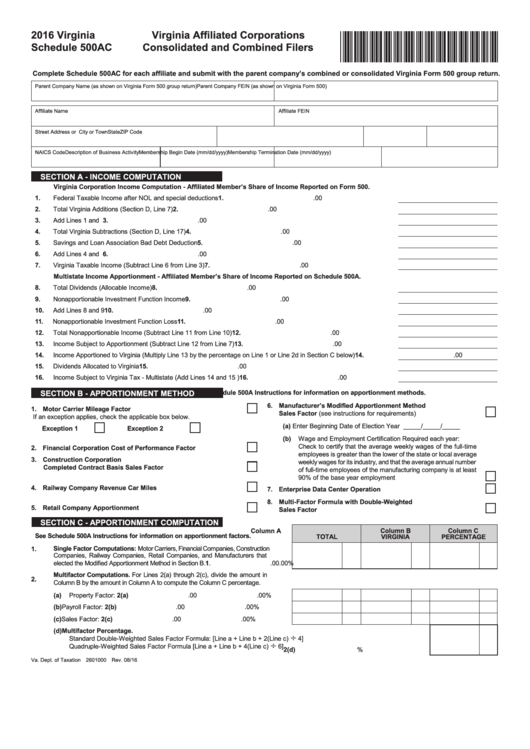

2016 Virginia

Virginia Affiliated Corporations

*VASCAC116888*

Schedule 500AC

Consolidated and Combined Filers

Complete Schedule 500AC for each affiliate and submit with the parent company’s combined or consolidated Virginia Form 500 group return.

Parent Company Name (as shown on Virginia Form 500 group return)

Parent Company FEIN (as shown on Virginia Form 500)

Affiliate Name

Affiliate FEIN

Street Address or P.O. Box

City or Town

State

ZIP Code

NAICS Code

Description of Business Activity

Membership Begin Date (mm/dd/yyyy)

Membership Termination Date (mm/dd/yyyy)

SECTION A - INCOME COMPUTATION

Virginia Corporation Income Computation - Affiliated Member’s Share of Income Reported on Form 500.

1.

Federal Taxable Income after NOL and special deductions .....................................................................................

1.

.00

2.

Total Virginia Additions (Section D, Line 7) ...............................................................................................................

2.

.00

3.

Add Lines 1 and 2.....................................................................................................................................................

3.

.00

4.

Total Virginia Subtractions (Section D, Line 17) .......................................................................................................

4.

.00

5.

5.

Savings and Loan Association Bad Debt Deduction ................................................................................................

.00

6.

Add Lines 4 and 5.....................................................................................................................................................

6.

.00

7.

Virginia Taxable Income (Subtract Line 6 from Line 3) .............................................................................................

7.

.00

Multistate Income Apportionment - Affiliated Member’s Share of Income Reported on Schedule 500A.

8.

Total Dividends (Allocable Income) ..........................................................................................................................

8.

.00

9.

9.

Nonapportionable Investment Function Income .......................................................................................................

.00

10.

Add Lines 8 and 9.....................................................................................................................................................

10.

.00

11.

Nonapportionable Investment Function Loss ...........................................................................................................

11.

.00

12.

Total Nonapportionable Income (Subtract Line 11 from Line 10) .............................................................................

12.

.00

13.

Income Subject to Apportionment (Subtract Line 12 from Line 7) ............................................................................

13.

.00

14.

14.

Income Apportioned to Virginia (Multiply Line 13 by the percentage on Line 1 or Line 2d in Section C below) .......

.00

15.

Dividends Allocated to Virginia .................................................................................................................................

15.

.00

16.

Income Subject to Virginia Tax - Multistate (Add Lines 14 and 15 ) .........................................................................

16.

.00

SECTION B - APPORTIONMENT METHOD

See Schedule 500A Instructions for information on apportionment methods.

6. Manufacturer’s Modified Apportionment Method

1. Motor Carrier Mileage Factor ...............................................................

Sales Factor (see instructions for requirements) ...................................

If an exception applies, check the applicable box below.

(a)

Enter Beginning Date of Election Year

_____/_____/_____

Exception 1

Exception 2

(b) Wage and Employment Certification Required each year:

Check to certify that the average weekly wages of the full-time

2. Financial Corporation Cost of Performance Factor ..........................

employees is greater than the lower of the state or local average

3. Construction Corporation

weekly wages for its industry, and that the average annual number

Completed Contract Basis Sales Factor .............................................

of full-time employees of the manufacturing company is at least

90% of the base year employment ................................................

4. Railway Company Revenue Car Miles ................................................

7. Enterprise Data Center Operation ........................................................

8. Multi-Factor Formula with Double-Weighted

5. Retail Company Apportionment ..........................................................

Sales Factor ............................................................................................

SECTION C - APPORTIONMENT COMPUTATION

Column A

Column B

Column C

See Schedule 500A Instructions for information on apportionment factors.

TOTAL

VIRGINIA

PERCENTAGE

Single Factor Computations: Motor Carriers, Financial Companies, Construction

1.

Companies, Railway Companies, Retail Companies, and Manufacturers that

elected the Modified Apportionment Method in Section B. .................................

1.

.00

.00

%

Multifactor Computations. For Lines 2(a) through 2(c), divide the amount in

2.

Column B by the amount in Column A to compute the Column C percentage.

(a)

2(a)

Property Factor: ...................................................................................

.00

.00

%

(b)

Payroll Factor: ......................................................................................

2(b)

.00

.00

%

(c)

Sales Factor: ........................................................................................

2(c)

.00

.00

%

(d)

Multifactor Percentage.

÷

Standard Double-Weighted Sales Factor Formula: [Line a + Line b + 2(Line c)

4]

÷

Quadruple-Weighted Sales Factor Formula [Line a + Line b + 4(Line c)

6] ..................................................................

2(d)

%

Va. Dept. of Taxation 2601000 Rev. 08/16

1

1 2

2