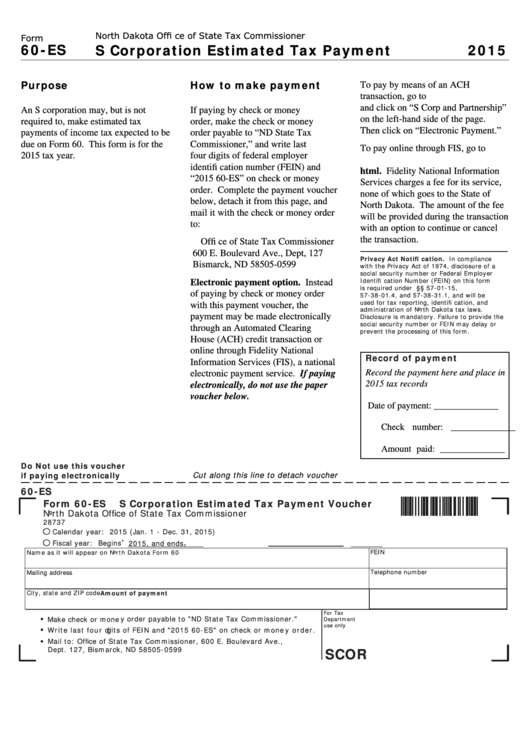

North Dakota Offi ce of State Tax Commissioner

Form

60-ES

S Corporation Estimated Tax Payment

2015

Purpose

How to make payment

To pay by means of an ACH

transaction, go to

and click on “S Corp and Partnership”

An S corporation may, but is not

If paying by check or money

on the left-hand side of the page.

required to, make estimated tax

order, make the check or money

Then click on “Electronic Payment.”

payments of income tax expected to be

order payable to “ND State Tax

due on Form 60. This form is for the

Commissioner,” and write last

To pay online through FIS, go to

2015 tax year.

four digits of federal employer

/make-payment.

identifi cation number (FEIN) and

html. Fidelity National Information

“2015 60-ES” on check or money

Services charges a fee for its service,

order. Complete the payment voucher

none of which goes to the State of

below, detach it from this page, and

North Dakota. The amount of the fee

mail it with the check or money order

will be provided during the transaction

to:

with an option to continue or cancel

the transaction.

Offi ce of State Tax Commissioner

600 E. Boulevard Ave., Dept, 127

Privacy Act Notifi cation. In compliance

Bismarck, ND 58505-0599

with the Privacy Act of 1974, disclosure of a

social security number or Federal Employer

Identifi cation Number (FEIN) on this form

Electronic payment option. Instead

is required under N.D.C.C. §§ 57-01-15,

of paying by check or money order

57-38-01.4, and 57-38-31.1, and will be

used for tax reporting, identifi cation, and

with this payment voucher, the

administration of North Dakota tax laws.

payment may be made electronically

Disclosure is mandatory. Failure to provide the

social security number or FEIN may delay or

through an Automated Clearing

prevent the processing of this form.

House (ACH) credit transaction or

online through Fidelity National

Record of payment

Information Services (FIS), a national

Record the payment here and place in

electronic payment service. If paying

2015 tax records

electronically, do not use the paper

voucher below.

Date of payment: ______________

Check number: ______________

Amount paid: ______________

Do Not use this voucher

if paying electronically

Cut along this line to detach voucher

60-ES

Form 60-ES

S Corporation Estimated Tax Payment Voucher

North Dakota Office of State Tax Commissioner

28737

Calendar year: 2015 (Jan. 1 - Dec. 31, 2015)

,

Fiscal year: Begins

2015, and ends

,

FEIN

Name as it will appear on North Dakota Form 60

Telephone number

Mailing address

City, state and ZIP code

Amount of payment

For Tax

Make check or money order payable to "ND State Tax Commissioner."

•

Department

use only

Write last four digits of FEIN and "2015 60-ES" on check or money order.

•

Mail to: Office of State Tax Commissioner, 600 E. Boulevard Ave.,

•

Dept. 127, Bismarck, ND 58505-0599

SCOR

1

1