Estimated Tax Form 2017 - City Of Maumee, Ohio

ADVERTISEMENT

Every taxpayer having or anticipating any income under

Computation of Estimated Tax on worksheet below:

withheld or not subject to local Withholding by Employer,

1. Enter here the total estimated income subject to Maumee

must file a declaration setting forth the estimated annual

Income Tax as indicated in the general Instructions.

income, together with an estimate of the amount of tax due if

2. Enter here 1.5% (0.015) of amount shown on line 1.

the amount payable is at least $200. If you are uncertain as to

3. Enter here line 2 less withholding credits.

whether or not you should pay estimates, please phone the

4.

Multiply Line 3 by 22-1/2% for Voucher 1, 45% for

income tax office at 419-897-7120.

Voucher 2, 67-1/2% for Voucher 3 and 90% for Voucher

4 and enter on the appropriate line and in column B of

The taxpayer’s annual estimated tax liability shall be

the worksheet.

multiplied by 22-1/2%, 45%, 67-1/2% and 90% to determine

5.

Enter here overpayment on last year’s return to be

the estimated quarterly tax to be paid. A taxpayer may amend

deducted in column C of the worksheet.

a declaration and the unpaid balance shown due shall be paid

in equal installments on or before the remaining due dates.

How to Use the Declaration – Voucher

Due Dates:

1.

Enter amount shown on line 3 of the worksheet on line A

of the voucher.

Voucher 1 – April 15, 2017

2.

Enter amount shown on line 4 of the appropriate

voucher on line B of the voucher.

Voucher 2 – June 15, 2017

3.

Enter amount of overpayment from last year on line C of

the voucher.

Voucher 3 – September 15, 2017

4.

Subtract line C from line B and enter on line D. If the

Voucher 4 – December 15, 2017

credit applied is in excess of voucher 1 payment, carry

the difference down to voucher 2. Voucher must still be

filed even if amount due is zero.

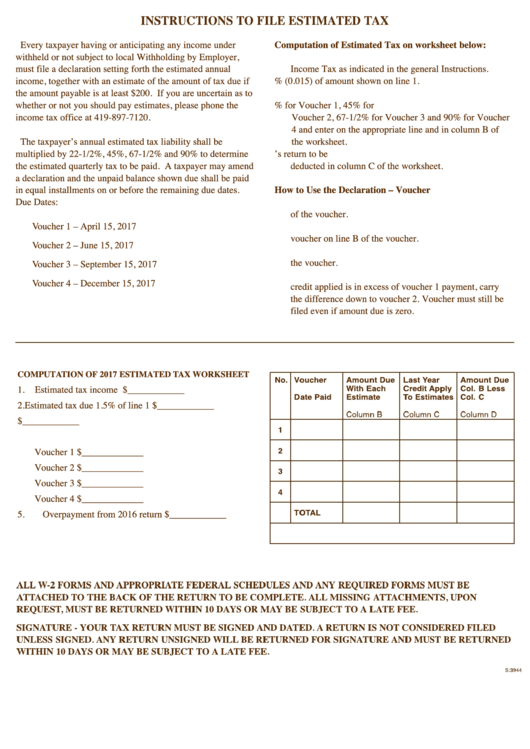

COMPUTATION OF 2017 ESTIMATED TAX WORKSHEET

1.

Estimated tax income

$____________

2.

Estimated tax due 1.5% of line 1

$____________

3.

Net estimated tax due

$____________

4.

Amount Due with each estimate

Voucher 1 $_____________

Voucher 2 $_____________

Voucher 3 $_____________

Voucher 4 $_____________

5.

Overpayment from 2016 return

$____________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2