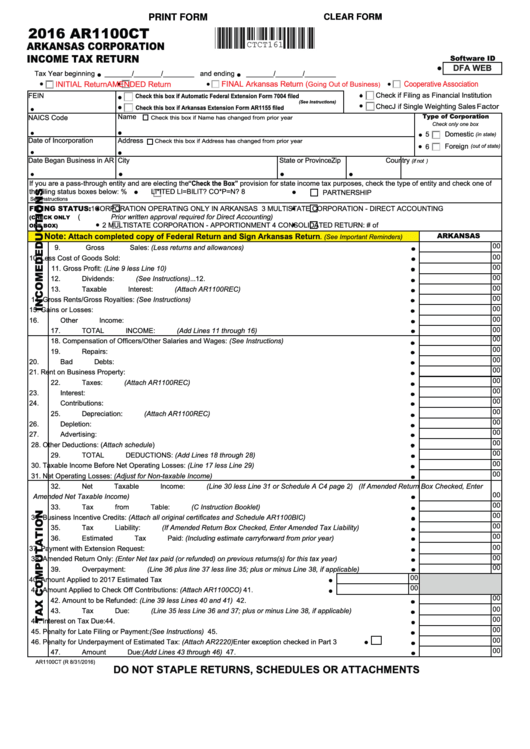

PRINT FORM

CLEAR FORM

2016 AR1100CT

CTCT161

ARKANSAS CORPORATION

INCOME TAX RETURN

Software ID

DFA WEB

Tax Year beginning

_______/_______/________ and ending

_______/_______/________

FINAL Arkansas Return (

Cooperative Association

INITIAL Return

AMENDED Return

Going Out of Business

)

Check if Filing as Financial Institution

FEIN

&KHFN WKLV ER[ LI $XWRPDWLF )HGHUDO ([WHQVLRQ )RUP ���� ¿OHG

(See Instructions)

&KHFN LI 6LQJOH :HLJKWLQJ 6DOHV Factor

&KHFN WKLV ER[ LI $UNDQVDV ([WHQVLRQ )RUP $5���� ¿OHG

Name

Type of Corporation

NAICS Code

Check this box if Name has changed from prior year

Check only one box

5

Domestic

(in state)

Date of Incorporation

Address

Check this box if Address has changed from prior year

Foreign

6

(out of state)

Date Began Business in AR

City

State or Province

Zip

Country

(if not U.S.)

If you are a pass-through entity and are electing the “Check the Box” provision for state income tax purposes, check the type of entity and check one of

WKH ¿OLQJ VWDWXV ER[HV EHORZ�

�

/,0,7(' /,$%,/,7< &203$1<

�

PARTNERSHIP

See Instructions

FILING STATUS:

1

CORPORATION OPERATING ONLY IN ARKANSAS

3

MULTISTATE CORPORATION - DIRECT ACCOUNTING

(Prior written approval required for Direct Accounting)

(CHECK ONLY

2

MULTISTATE CORPORATION - APPORTIONMENT

4

CONSOLIDATED RETURN: # of corp.entities in AR___

ONE BOX)

Note:

ARKANSAS

Attach completed copy of Federal Return and Sign Arkansas Return.

(See Important Reminders)

00

9. Gross Sales: (Less returns and allowances) ...........................................................................................................9.

00

10. Less Cost of Goods Sold: ......................................................................................................................................10.

00

��� *URVV 3UR¿W� (Line 9 less Line 10) ..........................................................................................................................11.

00

12. Dividends: (See Instructions) .................................................................................................................................12.

00

13. Taxable Interest: (Attach AR1100REC) ..................................................................................................................13.

00

14. Gross Rents/Gross Royalties: (See Instructions) ..................................................................................................14.

00

15. Gains or Losses: ....................................................................................................................................................15.

00

16. Other Income: ........................................................................................................................................................16.

00

17. TOTAL INCOME: (Add Lines 11 through 16) .........................................................................................................17.

00

��� &RPSHQVDWLRQ RI 2I¿FHUV�2WKHU 6DODULHV DQG :DJHV� (See Instructions) .............................................................18.

00

19. Repairs: ..................................................................................................................................................................19.

00

20. Bad Debts: .............................................................................................................................................................20.

00

21. Rent on Business Property: ...................................................................................................................................21.

00

22. Taxes: (Attach AR1100REC) ..................................................................................................................................22.

00

23. Interest: ..................................................................................................................................................................23.

00

24. Contributions: .........................................................................................................................................................24.

00

25. Depreciation: (Attach AR1100REC) .......................................................................................................................25.

00

26. Depletion: ...............................................................................................................................................................26.

00

27. Advertising: ............................................................................................................................................................27.

00

28. Other Deductions: (Attach schedule) .....................................................................................................................28.

00

29. TOTAL DEDUCTIONS: (Add Lines 18 through 28) ...............................................................................................29.

00

30. Taxable Income Before Net Operating Losses: (Line 17 less Line 29) ..................................................................30.

00

31. Net Operating Losses: (Adjust for Non-taxable Income) .......................................................................................31.

32. Net Taxable Income: (Line 30 less Line 31 or Schedule A C4 page 2) (If Amended Return Box Checked, Enter

00

Amended Net Taxable Income).............................................................................................................................. 32.

00

33. Tax from Table: (C Instruction Booklet) ..................................................................................................................33.

00

34. Business Incentive Credits: �$WWDFK DOO RULJLQDO FHUWL¿FDWHV DQG 6FKHGXOH $5����%,&� ........................................34.

00

35. Tax Liability: (If Amended Return Box Checked, Enter Amended Tax Liability) .....................................................35.

00

36. Estimated Tax Paid: (Including estimate carryforward from prior year) .................................................................36.

00

37. Payment with Extension Request: .........................................................................................................................37.

00

38. Amended Return Only: (Enter Net tax paid (or refunded) on previous returns(s) for this tax year) .......................38.

00

39. Overpayment: (Line 36 plus line 37 less line 35; plus or minus Line 38, if applicable) ..........................................39.

00

40. Amount Applied to 2017 Estimated Tax ......................................................................40.

00

41. Amount Applied to Check Off Contributions: (Attach AR1100CO)...............................41.

00

42. Amount to be Refunded: (Line 39 less Lines 40 and 41) ...................................................................................... 42.

00

43. Tax Due: (Line 35 less Line 36 and 37; plus or minus Line 38, if applicable) ........................................................43.

00

44. Interest on Tax Due: ...............................................................................................................................................44.

00

45. Penalty for Late Filing or Payment: (See Instructions) ...........................................................................................45.

00

46. Penalty for Underpayment of Estimated Tax: (Attach AR2220) Enter exception checked in Part 3 ......................46.

00

47. Amount Due: (Add Lines 43 through 46) ...............................................................................................................47.

AR1100CT (R 8/31/2016)

DO NOT STAPLE RETURNS, SCHEDULES OR ATTACHMENTS

1

1 2

2