Form Ct-1096 Athen - Connecticut Annual Summary Andtransmittal Of Information Returns - 2016

ADVERTISEMENT

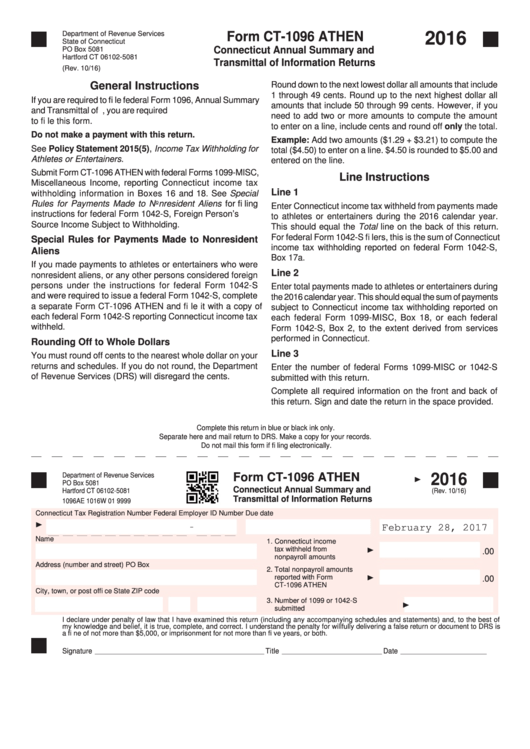

Department of Revenue Services

Form CT-1096 ATHEN

2016

State of Connecticut

Connecticut Annual Summary and

PO Box 5081

Hartford CT 06102-5081

Transmittal of Information Returns

(Rev. 10/16)

General Instructions

Round down to the next lowest dollar all amounts that include

1 through 49 cents. Round up to the next highest dollar all

If you are required to fi le federal Form 1096, Annual Summary

amounts that include 50 through 99 cents. However, if you

and Transmittal of U.S. Information Returns, you are required

need to add two or more amounts to compute the amount

to fi le this form.

to enter on a line, include cents and round off only the total.

Do not make a payment with this return.

Example: Add two amounts ($1.29 + $3.21) to compute the

See Policy Statement 2015(5), Income Tax Withholding for

total ($4.50) to enter on a line. $4.50 is rounded to $5.00 and

Athletes or Entertainers.

entered on the line.

Submit Form CT-1096 ATHEN with federal Forms 1099-MISC,

Line Instructions

Miscellaneous Income, reporting Connecticut income tax

Line 1

withholding information in Boxes 16 and 18. See Special

Rules for Payments Made to Nonresident Aliens for fi ling

Enter Connecticut income tax withheld from payments made

instructions for federal Form 1042-S, Foreign Person’s U.S.

to athletes or entertainers during the 2016 calendar year.

Source Income Subject to Withholding.

This should equal the Total line on the back of this return.

For federal Form 1042-S fi lers, this is the sum of Connecticut

Special Rules for Payments Made to Nonresident

income tax withholding reported on federal Form 1042-S,

Aliens

Box 17a.

If you made payments to athletes or entertainers who were

Line 2

nonresident aliens, or any other persons considered foreign

persons under the instructions for federal Form 1042-S

Enter total payments made to athletes or entertainers during

and were required to issue a federal Form 1042-S, complete

the 2016 calendar year. This should equal the sum of payments

a separate Form CT-1096 ATHEN and fi le it with a copy of

subject to Connecticut income tax withholding reported on

each federal Form 1042-S reporting Connecticut income tax

each federal Form 1099-MISC, Box 18, or each federal

withheld.

Form 1042-S, Box 2, to the extent derived from services

performed in Connecticut.

Rounding Off to Whole Dollars

Line 3

You must round off cents to the nearest whole dollar on your

returns and schedules. If you do not round, the Department

Enter the number of federal Forms 1099-MISC or 1042-S

of Revenue Services (DRS) will disregard the cents.

submitted with this return.

Complete all required information on the front and back of

this return. Sign and date the return in the space provided.

Complete this return in blue or black ink only.

Separate here and mail return to DRS. Make a copy for your records.

Do not mail this form if fi ling electronically.

Department of Revenue Services

Form CT-1096 ATHEN

2016

PO Box 5081

Connecticut Annual Summary and

Hartford CT 06102-5081

(Rev. 10/16)

Transmittal of Information Returns

1096AE 1016W 01 9999

Connecticut Tax Registration Number

Federal Employer ID Number

Due date

February 28, 2017

Name

1. Connecticut income

tax withheld from

.00

nonpayroll amounts

Address (number and street)

PO Box

2. Total nonpayroll amounts

reported with Form

.00

CT-1096 ATHEN

City, town, or post offi ce

State

ZIP code

3. Number of 1099 or 1042-S

submitted

I declare under penalty of law that I have examined this return (including any accompanying schedules and statements) and, to the best of

my knowledge and belief, it is true, complete, and correct. I understand the penalty for willfully delivering a false return or document to DRS is

a fi ne of not more than $5,000, or imprisonment for not more than fi ve years, or both.

Signature

Title

Date

_____________________________________________________________

____________________________________

_______________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2