Form Wv/it-103 - Withholding Annual Reconciliation

ADVERTISEMENT

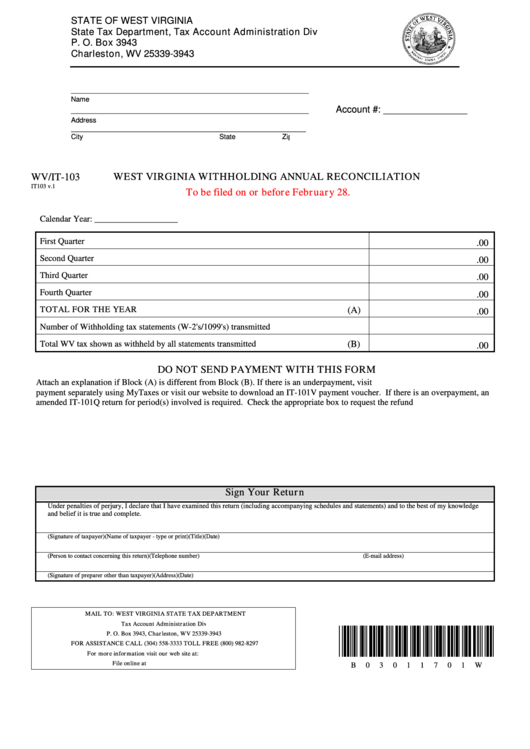

STATE OF WEST VIRGINIA

State Tax Department, Tax Account Administration Div

P. O. Box 3943

Charleston, WV 25339-3943

_____________________________________________________________

Name

Account #: ________________

_____________________________________________________________

Address

_____________________________________________________________

City

State

Zip

B0

WV/IT-103

WEST VIRGINIA WITHHOLDING ANNUAL RECONCILIATION

30

IT103 v.1

To be filed on or before February 28.

Calendar Year: ___________________

First Quarter

.00

Second Quarter

.00

Third Quarter

.00

Fourth Quarter

.00

TOTAL FOR THE YEAR

(A)

.00

Number of Withholding tax statements (W-2's/1099's) transmitted

Total WV tax shown as withheld by all statements transmitted

(B)

.00

DO NOT SEND PAYMENT WITH THIS FORM

Attach an explanation if Block (A) is different from Block (B). If there is an underpayment, visit https://mytaxes.wvtax.gov to remit

payment separately using MyTaxes or visit our website to download an IT-101V payment voucher. If there is an overpayment, an

amended IT-101Q return for period(s) involved is required. Check the appropriate box to request the refund.

Sign Your Return

Under penalties of perjury, I declare that I have examined this return (including accompanying schedules and statements) and to the best of my knowledge

and belief it is true and complete.

(Signature of taxpayer)

(Name of taxpayer - type or print)

(Title)

(Date)

(Person to contact concerning this return)

(Telephone number)

(E-mail address)

(Signature of preparer other than taxpayer)

(Address)

(Date)

MAIL TO: WEST VIRGINIA STATE TAX DEPARTMENT

Tax Account Administration Div

P. O. Box 3943, Charleston, WV 25339-3943

FOR ASSISTANCE CALL (304) 558-3333 TOLL FREE (800) 982-8297

For more information visit our web site at:

File online at https://mytaxes.wvtax.gov

B

0

3

0

1

1

7

0

1

W

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2