Form C-159b - Certificate Of Dissolution (Without A Meeting Of Shareholders)

ADVERTISEMENT

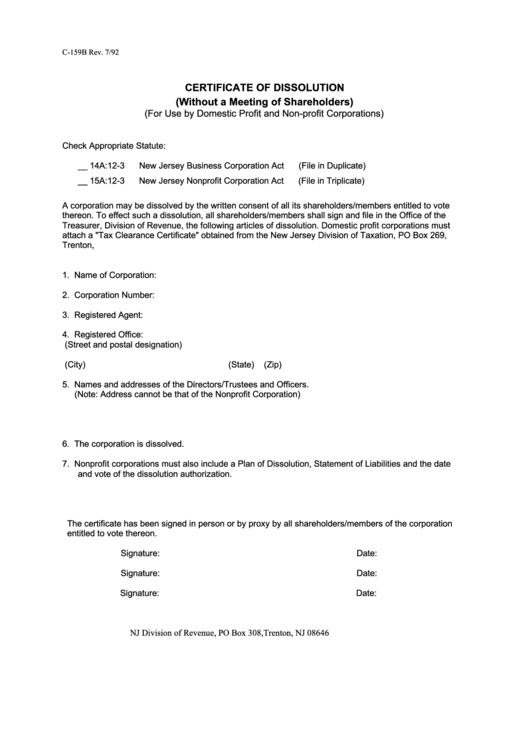

C-159B Rev. 7/92

CERTIFICATE OF DISSOLUTION

(Without a Meeting of Shareholders)

(For Use by Domestic Profit and Non-profit Corporations)

Check Appropriate Statute:

__ 14A:12-3

New Jersey Business Corporation Act

(File in Duplicate)

__ 15A:12-3

New Jersey Nonprofit Corporation Act

(File in Triplicate)

A corporation may be dissolved by the written consent of all its shareholders/members entitled to vote

thereon. To effect such a dissolution, all shareholders/members shall sign and file in the Office of the

Treasurer, Division of Revenue, the following articles of dissolution. Domestic profit corporations must

attach a "Tax Clearance Certificate" obtained from the New Jersey Division of Taxation, PO Box 269,

Trenton, N.J. 08625.

1. Name of Corporation:

2. Corporation Number:

3. Registered Agent:

4. Registered Office:

(Street and postal designation)

(City)

(State)

(Zip)

5. Names and addresses of the Directors/Trustees and Officers.

(Note: Address cannot be that of the Nonprofit Corporation)

6. The corporation is dissolved.

7. Nonprofit corporations must also include a Plan of Dissolution, Statement of Liabilities and the date

and vote of the dissolution authorization.

The certificate has been signed in person or by proxy by all shareholders/members of the corporation

entitled to vote thereon.

Signature:

Date:

Signature:

Date:

Signature:

Date:

NJ Division of Revenue, PO Box 308, Trenton, NJ 08646

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1