Assumed Name Certificate Form

ADVERTISEMENT

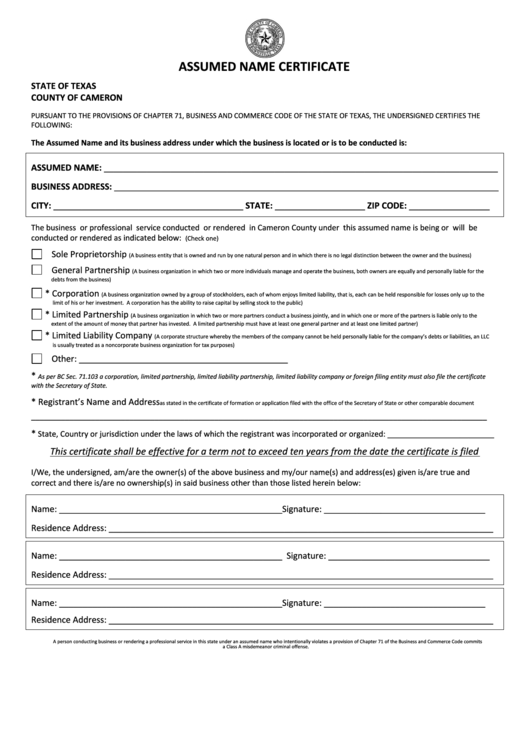

ASSUMED NAME CERTIFICATE

STATE OF TEXAS

COUNTY OF CAMERON

PURSUANT TO THE PROVISIONS OF CHAPTER 71, BUSINESS AND COMMERCE CODE OF THE STATE OF TEXAS, THE UNDERSIGNED CERTIFIES THE

FOLLOWING:

The Assumed Name and its business address under which the business is located or is to be conducted is:

ASSUMED NAME: ___________________________________________________________________________________

BUSINESS ADDRESS: _________________________________________________________________________________

CITY: ________________________________________ STATE: ___________________ ZIP CODE: _________________

The business or professional service conducted or rendered in Cameron County under this assumed name is being or will be

conducted or rendered as indicated below:

(Check one)

Sole Proprietorship

(A business entity that is owned and run by one natural person and in which there is no legal distinction between the owner and the business)

General Partnership

(A business organization in which two or more individuals manage and operate the business, both owners are equally and personally liable for the

debts from the business)

* Corporation

(A business organization owned by a group of stockholders, each of whom enjoys limited liability, that is, each can be held responsible for losses only up to the

limit of his or her investment. A corporation has the ability to raise capital by selling stock to the public)

* Limited Partnership

(A business organization in which two or more partners conduct a business jointly, and in which one or more of the partners is liable only to the

extent of the amount of money that partner has invested. A limited partnership must have at least one general partner and at least one limited partner)

* Limited Liability Company

(A corporate structure whereby the members of the company cannot be held personally liable for the company’s debts or liabilities, an LLC

is usually treated as a noncorporate business organization for tax purposes)

Other: ____________________________________________

*

As per BC Sec. 71.103 a corporation, limited partnership, limited liability partnership, limited liability company or foreign filing entity must also file the certificate

with the Secretary of State.

* Registrant’s Name and Address

as stated in the certificate of formation or application filed with the office of the Secretary of State or other comparable document

___________________________________________________________________________________________________________

*

State, Country or jurisdiction under the laws of which the registrant was incorporated or organized: _________________________

This certificate shall be effective for a term not to exceed ten years from the date the certificate is filed

I/We, the undersigned, am/are the owner(s) of the above business and my/our name(s) and address(es) given is/are true and

correct and there is/are no ownership(s) in said business other than those listed herein below:

Name: _______________________________________________ Signature: __________________________________

Residence Address: _________________________________________________________________________________

Name: _______________________________________________ Signature: __________________________________

Residence Address: _________________________________________________________________________________

Name: _______________________________________________ Signature: __________________________________

Residence Address: _________________________________________________________________________________

A person conducting business or rendering a professional service in this state under an assumed name who intentionally violates a provision of Chapter 71 of the Business and Commerce Code commits

a Class A misdemeanor criminal offense.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2