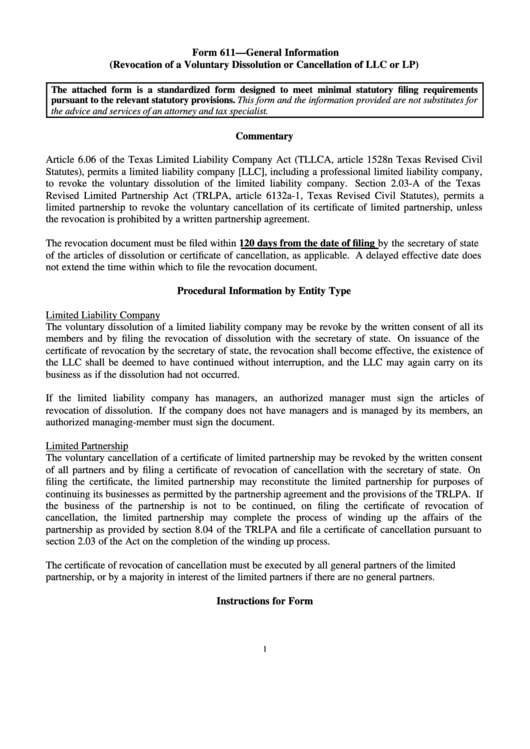

Form 611—General Information

(Revocation of a Voluntary Dissolution or Cancellation of LLC or LP)

The attached form is a standardized form designed to meet minimal statutory filing requirements

pursuant to the relevant statutory provisions. This form and the information provided are not substitutes for

the advice and services of an attorney and tax specialist.

Commentary

Article 6.06 of the Texas Limited Liability Company Act (TLLCA, article 1528n Texas Revised Civil

Statutes), permits a limited liability company [LLC], including a professional limited liability company,

to revoke the voluntary dissolution of the limited liability company. Section 2.03-A of the Texas

Revised Limited Partnership Act (TRLPA, article 6132a-1, Texas Revised Civil Statutes), permits a

limited partnership to revoke the voluntary cancellation of its certificate of limited partnership, unless

the revocation is prohibited by a written partnership agreement.

The revocation document must be filed within 120 days from the date of filing by the secretary of state

of the articles of dissolution or certificate of cancellation, as applicable. A delayed effective date does

not extend the time within which to file the revocation document.

Procedural Information by Entity Type

Limited Liability Company

The voluntary dissolution of a limited liability company may be revoke by the written consent of all its

members and by filing the revocation of dissolution with the secretary of state. On issuance of the

certificate of revocation by the secretary of state, the revocation shall become effective, the existence of

the LLC shall be deemed to have continued without interruption, and the LLC may again carry on its

business as if the dissolution had not occurred.

If the limited liability company has managers, an authorized manager must sign the articles of

revocation of dissolution. If the company does not have managers and is managed by its members, an

authorized managing-member must sign the document.

Limited Partnership

The voluntary cancellation of a certificate of limited partnership may be revoked by the written consent

of all partners and by filing a certificate of revocation of cancellation with the secretary of state. On

filing the certificate, the limited partnership may reconstitute the limited partnership for purposes of

continuing its businesses as permitted by the partnership agreement and the provisions of the TRLPA. If

the business of the partnership is not to be continued, on filing the certificate of revocation of

cancellation, the limited partnership may complete the process of winding up the affairs of the

partnership as provided by section 8.04 of the TRLPA and file a certificate of cancellation pursuant to

section 2.03 of the Act on the completion of the winding up process.

The certificate of revocation of cancellation must be executed by all general partners of the limited

partnership, or by a majority in interest of the limited partners if there are no general partners.

Instructions for Form

1

1

1 2

2 3

3 4

4