West Virginia Employer'S Return Of Income Tax Witthed Form

ADVERTISEMENT

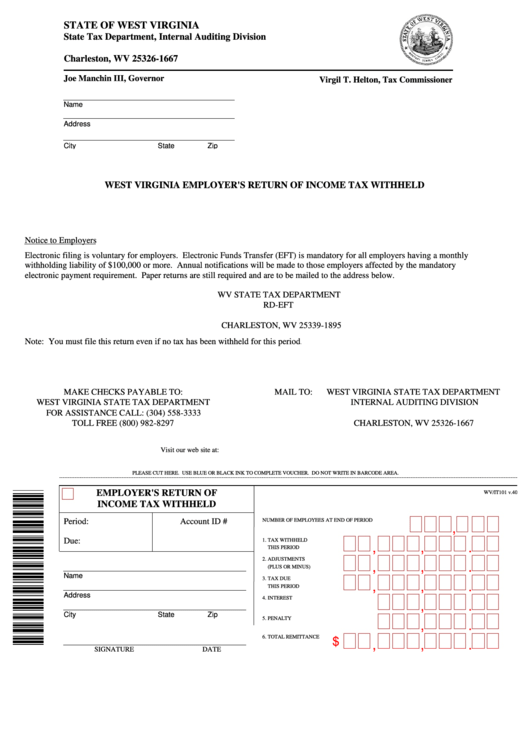

STATE OF WEST VIRGINIA

State Tax Department, Internal Auditing Division

P.O. Box 1667

Charleston, WV 25326-1667

Joe Manchin III, Governor

Virgil T. Helton, Tax Commissioner

Name

Address

City

State

Zip

WEST VIRGINIA EMPLOYER'S RETURN OF INCOME TAX WITHHELD

Notice to Employers

Electronic filing is voluntary for employers. Electronic Funds Transfer (EFT) is mandatory for all employers having a monthly

withholding liability of $100,000 or more. Annual notifications will be made to those employers affected by the mandatory

electronic payment requirement. Paper returns are still required and are to be mailed to the address below.

WV STATE TAX DEPARTMENT

RD-EFT

P.O. BOX 11895

CHARLESTON, WV 25339-1895

Note: You must file this return even if no tax has been withheld for this period.

MAKE CHECKS PAYABLE TO:

MAIL TO:

WEST VIRGINIA STATE TAX DEPARTMENT

WEST VIRGINIA STATE TAX DEPARTMENT

INTERNAL AUDITING DIVISION

FOR ASSISTANCE CALL: (304) 558-3333

P.O. BOX 1667

TOLL FREE (800) 982-8297

CHARLESTON, WV 25326-1667

Visit our web site at: for on-line filing information.

PLEASE CUT HERE. USE BLUE OR BLACK INK TO COMPLETE VOUCHER. DO NOT WRITE IN BARCODE AREA.

EMPLOYER'S RETURN OF

WV/IT101 v.40

INCOME TAX WITHHELD

Period:

Account ID #

NUMBER OF EMPLOYEES AT END OF PERIOD

,

Due:

1. TAX WITHHELD

,

,

.

THIS PERIOD

2. ADJUSTMENTS

,

,

.

(PLUS OR MINUS)

Name

3. TAX DUE

,

,

.

THIS PERIOD

Address

4. INTEREST

,

.

City

State

Zip

5. PENALTY

,

.

6. TOTAL REMITTANCE

$

,

,

.

SIGNATURE

DATE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1