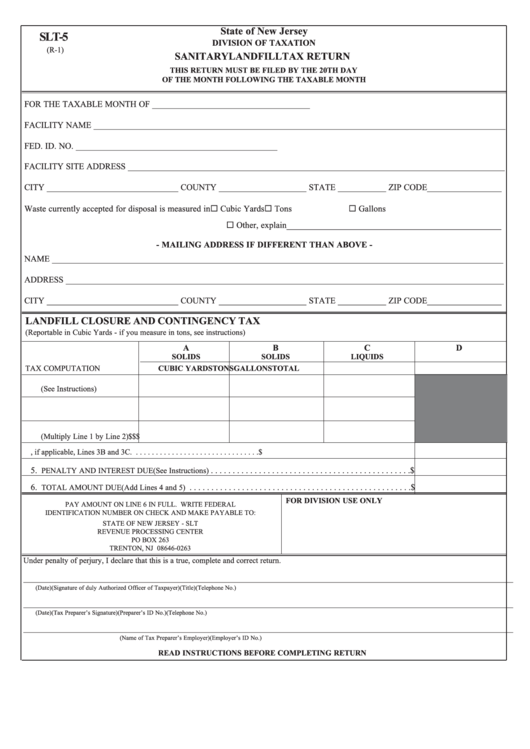

State of New Jersey

SLT-5

DIVISION OF TAXATION

(R-1)

SANITARY LANDFILL TAX RETURN

THIS RETURN MUST BE FILED BY THE 20TH DAY

OF THE MONTH FOLLOWING THE TAXABLE MONTH

FOR THE TAXABLE MONTH OF ____________________________________

FACILITY NAME ______________________________________________________________________________________________

FED. ID. NO. ______________________________________________ D.E.P. FACILITY NO. ________________________________

FACILITY SITE ADDRESS ______________________________________________________________________________________

CITY ______________________________ COUNTY ____________________ STATE ___________ ZIP CODE _________________

Waste currently accepted for disposal is measured in

Cubic Yards

Tons

Gallons

Other, explain_________________________________________________

- MAILING ADDRESS IF DIFFERENT THAN ABOVE -

NAME _______________________________________________________________________________________________________

ADDRESS ____________________________________________________________________________________________________

CITY ______________________________ COUNTY ____________________ STATE ___________ ZIP CODE _________________

LANDFILL CLOSURE AND CONTINGENCY TAX

(Reportable in Cubic Yards - if you measure in tons, see instructions)

A

B

C

D

SOLIDS

SOLIDS

LIQUIDS

CUBIC YARDS

TONS

GALLONS

TOTAL

TAX COMPUTATION

1. TAX BASE

(See Instructions)

2. TAX RATE

.15

.50

.002

3. TAX AMOUNT

(Multiply Line 1 by Line 2)

$

$

$

4. TOTAL TAX DUE Add Lines 3A and 3C or, if applicable, Lines 3B and 3C. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

5.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

PENALTY AND INTEREST DUE (See Instructions)

6.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

TOTAL AMOUNT DUE (Add Lines 4 and 5)

FOR DIVISION USE ONLY

PAY AMOUNT ON LINE 6 IN FULL. WRITE FEDERAL

IDENTIFICATION NUMBER ON CHECK AND MAKE PAYABLE TO:

STATE OF NEW JERSEY - SLT

REVENUE PROCESSING CENTER

PO BOX 263

TRENTON, NJ 08646-0263

Under penalty of perjury, I declare that this is a true, complete and correct return.

__________________________________________________________________________________________________________________________

(Date)

(Signature of duly Authorized Officer of Taxpayer)

(Title)

(Telephone No.)

__________________________________________________________________________________________________________________________

(Date)

(Tax Preparer’s Signature)

(Preparer’s ID No.)

(Telephone No.)

__________________________________________________________________________________________________________________________

(Name of Tax Preparer’s Employer)

(Employer’s ID No.)

READ INSTRUCTIONS BEFORE COMPLETING RETURN

1

1 2

2