Form Ct-709 Ext - Application For Extension Of Time To File Connecticut Gift Tax Return December - 2001

ADVERTISEMENT

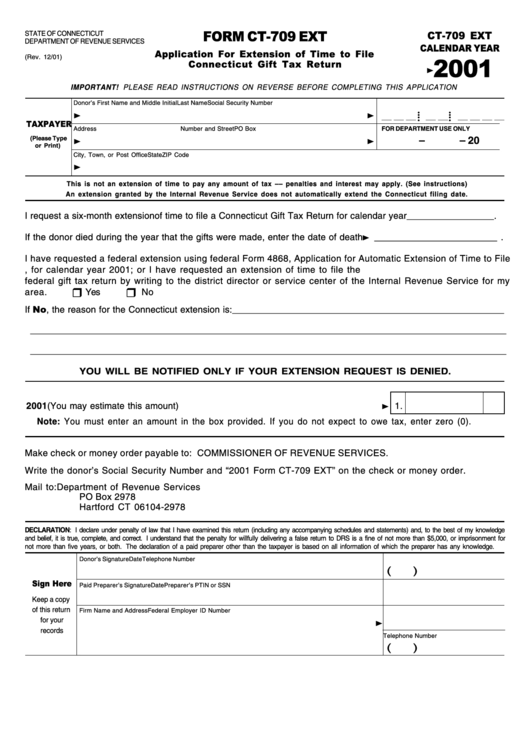

FORM CT-709 EXT

CT-709 EXT

STATE OF CONNECTICUT

DEPARTMENT OF REVENUE SERVICES

CALENDAR YEAR

Application For Extension of Time to File

2001

(Rev. 12/01)

Connecticut Gift Tax Return

IMPORTANT! PLEASE READ INSTRUCTIONS ON REVERSE BEFORE COMPLETING THIS APPLICATION

Donor’s First Name and Middle Initial

Last Name

Social Security Number

• •

• •

__ __ __

__ __

__ __ __ __

• •

• •

TAXPAYER

Address

Number and Street

PO Box

FOR DEPARTMENT USE ONLY

(Please Type

–

– 20

or Print)

City, Town, or Post Office

State

ZIP Code

This is not an extension of time to pay any amount of tax –– penalties and interest may apply. (See instructions)

An extension granted by the Internal Revenue Service does not automatically extend the Connecticut filing date.

I request a six-month extension of time to file a Connecticut Gift Tax Return for calendar year _________________ .

If the donor died during the year that the gifts were made, enter the date of death

________________________ .

I have requested a federal extension using federal Form 4868, Application for Automatic Extension of Time to File

U.S. Individual Income Tax Return, for calendar year 2001; or I have requested an extension of time to file the

federal gift tax return by writing to the district director or service center of the Internal Revenue Service for my

area.

Yes

No

If No, the reason for the Connecticut extension is: _____________________________________________________

_____________________________________________________________________________________________

_____________________________________________________________________________________________

YOU WILL BE NOTIFIED ONLY IF YOUR EXTENSION REQUEST IS DENIED.

1. Total Connecticut gift tax liability for 2001 (You may estimate this amount) ............

1.

Note: You must enter an amount in the box provided. If you do not expect to owe tax, enter zero (0).

Make check or money order payable to: COMMISSIONER OF REVENUE SERVICES.

Write the donor’s Social Security Number and “2001 Form CT-709 EXT” on the check or money order.

Mail to:

Department of Revenue Services

PO Box 2978

Hartford CT 06104-2978

DECLARATION: I declare under penalty of law that I have examined this return (including any accompanying schedules and statements) and, to the best of my knowledge

and belief, it is true, complete, and correct. I understand that the penalty for willfully delivering a false return to DRS is a fine of not more than $5,000, or imprisonment for

not more than five years, or both. The declaration of a paid preparer other than the taxpayer is based on all information of which the preparer has any knowledge.

Donor’s Signature

Date

Telephone Number

(

)

Sign Here

Paid Preparer’s Signature

Date

Preparer’s PTIN or SSN

Keep a copy

of this return

Firm Name and Address

Federal Employer ID Number

for your

records

Telephone Number

(

)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1