Az Form 140 Py - Part-Year Resident Personal Income Tax Return 2001

ADVERTISEMENT

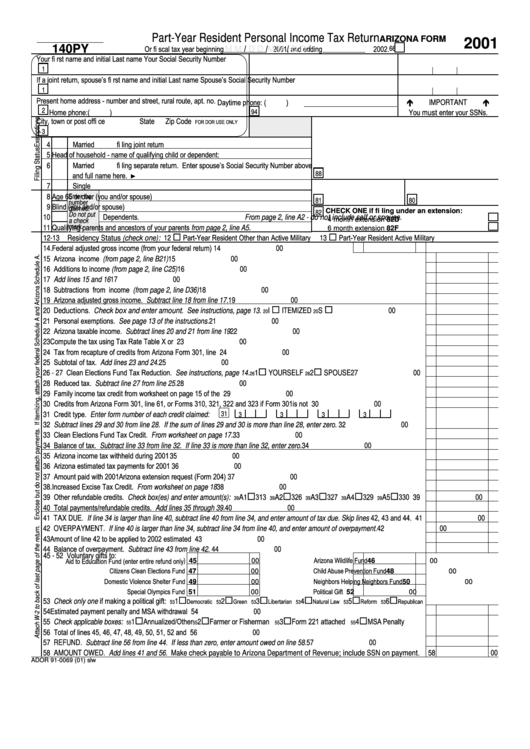

Part-Year Resident Personal Income Tax Return

ARIZONA FORM

2001

/

/

/

/

140PY

66

Or fi scal tax year beginning

2001, and ending

2002.

M M

D D

M M

D D

Your fi rst name and initial

Last name

Your Social Security Number

1

If a joint return, spouse’s fi rst name and initial

Last name

Spouse’s Social Security Number

1

Present home address - number and street, rural route, apt. no.

Daytime phone: (

)

IMPORTANT

"

"

2

94

Home phone: (

)

You must enter your SSNs.

City, town or post offi ce

State

Zip Code

FOR DOR USE ONLY

3

4

Married fi ling joint return

5

Head of household - name of qualifying child or dependent:

6

Married fi ling separate return. Enter spouse’s Social Security Number above

88

and full name here.

►

7

Single

8

Age 65 or over (you and/or spouse)

Enter the

81

80

number

9

Blind (you and/or spouse)

claimed.

82

CHECK ONE if fi ling under an extension:

Do not put

10

Dependents. From page 2, line A2 - do not include self or spouse.

a check

4 month extension

82D

mark.

11

Qualifying parents and ancestors of your parents from page 2, line A5.

6 month extension

82F

!

!

12-13 Residency Status (check one): 12

Part-Year Resident Other than Active Military

13

Part-Year Resident Active Military

14. Federal adjusted gross income (from your federal return)........................................................................... 14

00

15 Arizona income (from page 2, line B21) ............................................................................................................................................... 15

00

16 Additions to income (from page 2, line C25)......................................................................................................................................... 16

00

17 Add lines 15 and 16 .............................................................................................................................................................................. 17

00

18 Subtractions from income (from page 2, line D36) ............................................................................................................................... 18

00

19 Arizona adjusted gross income. Subtract line 18 from line 17............................................................................................................. 19

00

!

!

20 Deductions. Check box and enter amount. See instructions, page 13.

I

ITEMIZED

S

STANDARD ..... 20

00

20

20

21 Personal exemptions. See page 13 of the instructions........................................................................................................................ 21

00

22 Arizona taxable income. Subtract lines 20 and 21 from line 19........................................................................................................... 22

00

23 Compute the tax using Tax Rate Table X or Y ...................................................................................................................................... 23

00

24 Tax from recapture of credits from Arizona Form 301, line 33 .............................................................................................................. 24

00

25 Subtotal of tax. Add lines 23 and 24. ................................................................................................................................................... 25

00

!

!

26 - 27 Clean Elections Fund Tax Reduction. See instructions, page 14.

1

YOURSELF

2

SPOUSE............ 27

00

26

26

28 Reduced tax. Subtract line 27 from line 25.......................................................................................................................................... 28

00

29 Family income tax credit from worksheet on page 15 of the instructions ............................................................................................. 29

00

30 Credits from Arizona Form 301, line 61, or Forms 310, 321, 322 and 323 if Form 301 is not required................................................ 30

00

31 Credit type. Enter form number of each credit claimed:

31

3

3

3

3

32 Subtract lines 29 and 30 from line 28. If the sum of lines 29 and 30 is more than line 28, enter zero. ............................................... 32

00

33 Clean Elections Fund Tax Credit. From worksheet on page 17........................................................................................................... 33

00

34 Balance of tax. Subtract line 33 from line 32. If line 33 is more than line 32, enter zero. ................................................................... 34

00

35 Arizona income tax withheld during 2001 ............................................................................................................................................. 35

00

36 Arizona estimated tax payments for 2001 ............................................................................................................................................ 36

00

37 Amount paid with 2001 Arizona extension request (Form 204) ............................................................................................................ 37

00

38. Increased Excise Tax Credit. From worksheet on page 18.................................................................................................................. 38

00

!

!

!

!

!

39 Other refundable credits. Check box(es) and enter amount(s):

A1

313

A2

326

A3

327

A4

329

A5

330 ...... 39

00

39

39

39

39

39

40 Total payments/refundable credits. Add lines 35 through 39. .............................................................................................................. 40

00

41 TAX DUE. If line 34 is larger than line 40, subtract line 40 from line 34, and enter amount of tax due. Skip lines 42, 43 and 44. ..... 41

00

42 OVERPAYMENT. If line 40 is larger than line 34, subtract line 34 from line 40, and enter amount of overpayment.......................... 42

00

43 Amount of line 42 to be applied to 2002 estimated tax......................................................................................................................... 43

00

44 Balance of overpayment. Subtract line 43 from line 42. ...................................................................................................................... 44

00

45 - 52 Voluntary gifts to:

Aid to Education Fund (enter entire refund only ) 45

Arizona Wildlife Fund 46

00

00

Citizens Clean Elections Fund 47

Child Abuse Prevention Fund 48

00

00

Domestic Violence Shelter Fund 49

00 Neighbors Helping Neighbors Fund 50

00

Special Olympics Fund 51

Political Gift 52

00

00

!

!

!

!

!

!

53 Check only one if making a political gift:

1

2

3

4

5

6

Democratic

Green

Libertarian

Natural Law

Reform

Republican

53

53

53

53

53

53

54 Estimated payment penalty and MSA withdrawal penalty .................................................................................................................... 54

00

!

!

!

!

55 Check applicable boxes:

1

Annualized/Other

2

Farmer or Fisherman

3

Form 221 attached

4

MSA Penalty

55

55

55

55

56 Total of lines 45, 46, 47, 48, 49, 50, 51, 52 and 54............................................................................................................................... 56

00

57 REFUND. Subtract line 56 from line 44. If less than zero, enter amount owed on line 58. ................................................................ 57

00

58 AMOUNT OWED. Add lines 41 and 56. Make check payable to Arizona Department of Revenue; include SSN on payment.

58

00

ADOR 91-0069 (01) slw

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2