Form Wv/it-102-1 - Affidavit Of Income Tax Withheld By Employer During The Calendar Year Form

ADVERTISEMENT

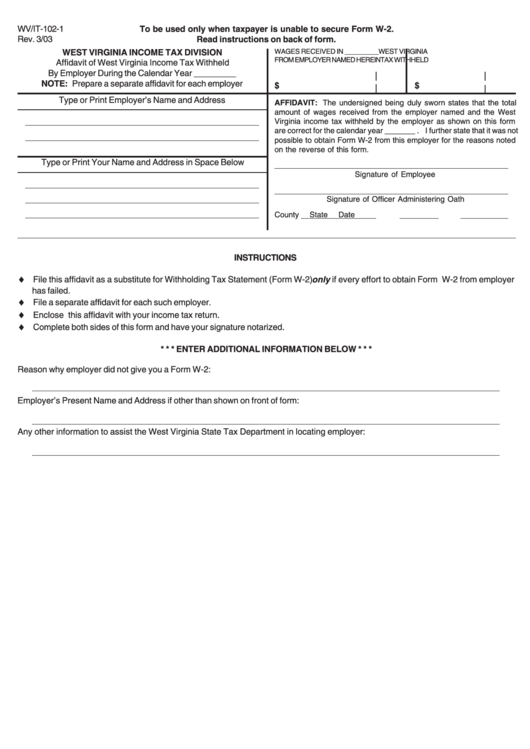

WV/IT-102-1

To be used only when taxpayer is unable to secure Form W-2.

Rev. 3/03

Read instructions on back of form.

WAGES RECEIVED IN _________

WEST VIRGINIA

WEST VIRGINIA INCOME TAX DIVISION

FROM EMPLOYER NAMED HEREIN

TAX WITHHELD

Affidavit of West Virginia Income Tax Withheld

By Employer During the Calendar Year _________

NOTE: Prepare a separate affidavit for each employer

$

$

Type or Print Employer’s Name and Address

AFFIDAVIT: The undersigned being duly sworn states that the total

amount of wages received from the employer named and the West

Virginia income tax withheld by the employer as shown on this form

are correct for the calendar year _______ . I further state that it was not

possible to obtain Form W-2 from this employer for the reasons noted

on the reverse of this form.

Type or Print Your Name and Address in Space Below

Signature of Employee

Signature of Officer Administering Oath

County

State

Date

INSTRUCTIONS

♦

File this affidavit as a substitute for Withholding Tax Statement (Form W-2) only if every effort to obtain Form W-2 from employer

has failed.

♦

File a separate affidavit for each such employer.

♦

Enclose this affidavit with your income tax return.

♦

Complete both sides of this form and have your signature notarized.

* * * ENTER ADDITIONAL INFORMATION BELOW * * *

Reason why employer did not give you a Form W-2:

Employer’s Present Name and Address if other than shown on front of form:

Any other information to assist the West Virginia State Tax Department in locating employer:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1