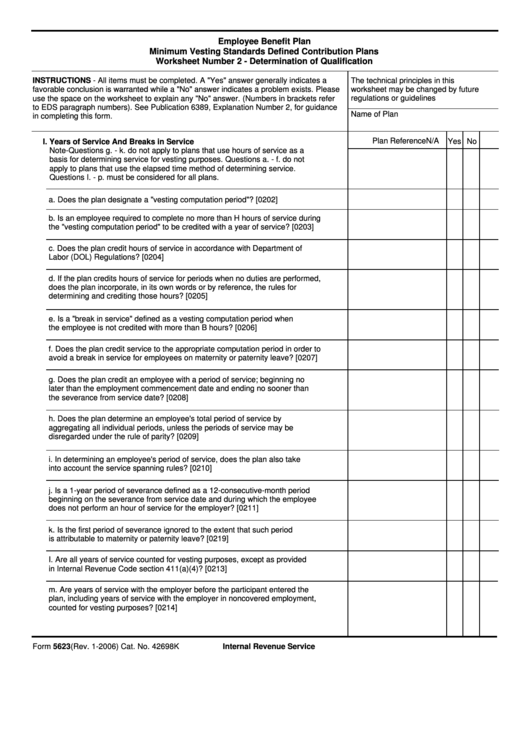

Employee Benefit Plan

Minimum Vesting Standards Defined Contribution Plans

Worksheet Number 2 - Determination of Qualification

INSTRUCTIONS - All items must be completed. A "Yes" answer generally indicates a

The technical principles in this

favorable conclusion is warranted while a "No" answer indicates a problem exists. Please

worksheet may be changed by future

regulations or guidelines

use the space on the worksheet to explain any "No" answer. (Numbers in brackets refer

to EDS paragraph numbers). See Publication 6389, Explanation Number 2, for guidance

Name of Plan

in completing this form.

Plan Reference

Yes No

N/A

I. Years of Service And Breaks in Service

Note-Questions g. - k. do not apply to plans that use hours of service as a

basis for determining service for vesting purposes. Questions a. - f. do not

apply to plans that use the elapsed time method of determining service.

Questions I. - p. must be considered for all plans.

a. Does the plan designate a "vesting computation period"? [0202]

b. Is an employee required to complete no more than H hours of service during

the "vesting computation period" to be credited with a year of service? [0203]

c. Does the plan credit hours of service in accordance with Department of

Labor (DOL) Regulations? [0204]

d. If the plan credits hours of service for periods when no duties are performed,

does the plan incorporate, in its own words or by reference, the rules for

determining and crediting those hours? [0205]

e. Is a "break in service" defined as a vesting computation period when

the employee is not credited with more than B hours? [0206]

f. Does the plan credit service to the appropriate computation period in order to

avoid a break in service for employees on maternity or paternity leave? [0207]

g. Does the plan credit an employee with a period of service; beginning no

later than the employment commencement date and ending no sooner than

the severance from service date? [0208]

h. Does the plan determine an employee's total period of service by

aggregating all individual periods, unless the periods of service may be

disregarded under the rule of parity? [0209]

i. In determining an employee's period of service, does the plan also take

into account the service spanning rules? [0210]

j. Is a 1-year period of severance defined as a 12-consecutive-month period

beginning on the severance from service date and during which the employee

does not perform an hour of service for the employer? [0211]

k. Is the first period of severance ignored to the extent that such period

is attributable to maternity or paternity leave? [0219]

I. Are all years of service counted for vesting purposes, except as provided

in Internal Revenue Code section 411(a)(4)? [0213]

m. Are years of service with the employer before the participant entered the

plan, including years of service with the employer in noncovered employment,

counted for vesting purposes? [0214]

Form 5623 (Rev. 1-2006) Cat. No. 42698K

Department of the Treasury-Internal Revenue Service

1

1 2

2 3

3 4

4