Form W-1 - Employers Quarterly Return Of Tax Withheld With Instructions

ADVERTISEMENT

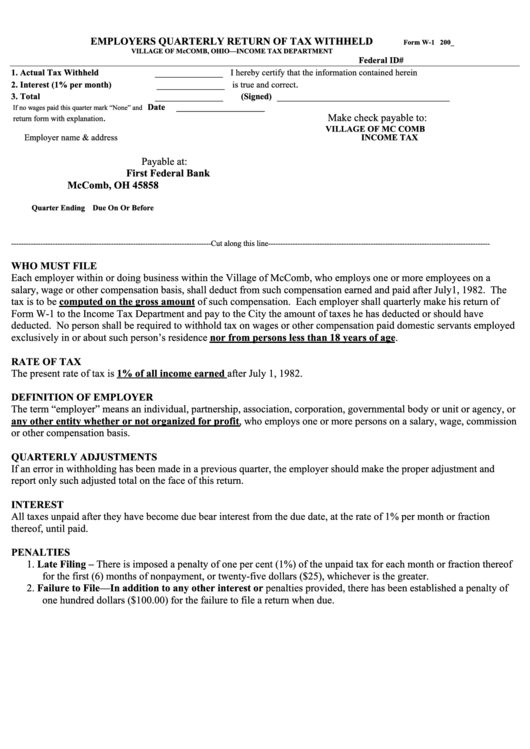

EMPLOYERS QUARTERLY RETURN OF TAX WITHHELD

Form W-1 200_

VILLAGE OF McCOMB, OHIO—INCOME TAX DEPARTMENT

Federal ID#

_____________

1. Actual Tax Withheld

I hereby certify that the information contained herein

_____________

.

2. Interest (1% per month)

is true and correct

_____________

_________________________________

3. Total

(Signed)

Date

____________________

If no wages paid this quarter mark “None” and

.

Make check payable to:

return form with explanation

VILLAGE OF MC COMB

Employer name & address

INCOME TAX

Payable at:

First Federal Bank

McComb, OH 45858

Quarter Ending Due On Or Before

----------------------------------------------------------------------------------Cut along this line-------------------------------------------------------------------------------------------

WHO MUST FILE

Each employer within or doing business within the Village of McComb, who employs one or more employees on a

salary, wage or other compensation basis, shall deduct from such compensation earned and paid after July1, 1982. The

tax is to be computed on the gross amount of such compensation. Each employer shall quarterly make his return of

Form W-1 to the Income Tax Department and pay to the City the amount of taxes he has deducted or should have

deducted. No person shall be required to withhold tax on wages or other compensation paid domestic servants employed

exclusively in or about such person’s residence nor from persons less than 18 years of age.

RATE OF TAX

The present rate of tax is 1% of all income earned after July 1, 1982.

DEFINITION OF EMPLOYER

The term “employer” means an individual, partnership, association, corporation, governmental body or unit or agency, or

any other entity whether or not organized for profit, who employs one or more persons on a salary, wage, commission

or other compensation basis.

QUARTERLY ADJUSTMENTS

If an error in withholding has been made in a previous quarter, the employer should make the proper adjustment and

report only such adjusted total on the face of this return.

INTEREST

All taxes unpaid after they have become due bear interest from the due date, at the rate of 1% per month or fraction

thereof, until paid.

PENALTIES

1. Late Filing – There is imposed a penalty of one per cent (1%) of the unpaid tax for each month or fraction thereof

for the first (6) months of nonpayment, or twenty-five dollars ($25), whichever is the greater.

2. Failure to File—In addition to any other interest or penalties provided, there has been established a penalty of

one hundred dollars ($100.00) for the failure to file a return when due.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1