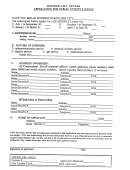

Application Form For Tax Or License Number - Jefferson County Page 2

ADVERTISEMENT

Instructions for Filing for Tax or License Number(s)

Page 2

1.

A Social Security Number can only be used for a Sole Proprietorship that has no employees or a Limited Liability Corporation that

has no employees. A Federal Employer Identification Number (FEIN) must be used for all others. (A FEIN can be obtained from

the Internal Revenue Service by calling 1-866-816-2065.)

2.

If you have more than one business location, you are required to file consolidated returns for Sales Tax, Seller's Use Tax,

Consumer's Use Tax and Occupational Tax. Each location is required to have a separate business license. Please list below all

locations within the State of Alabama. Attach additional sheets as needed.

For Office Use Only

Chain Codes/

Location Codes

Store #

Account #

Mun.

Insp.

Show Legal Name, DBA and Address for each location:

1.

2.

3.

4.

5.

If you are currently buying a State of Alabama chain store license as required by Title 40, Chapter 12, Section 315 of the 1975

Code of Alabama as amended, please list the county in which the license is purchased:

3. Please list the names of all Owners, Officers, Partners, or Members.

Name:

Title:

Social Security #:

Name:

Title:

Social Security #:

Name:

Title:

Social Security #:

4.

Some taxpayers request tax forms be mailed to different locations. For example, you may want your sales tax forms sent to your

CPA's office and your occupational tax forms sent to an outside payroll company. Jefferson County will gladly accommodate such

requests. Please list below which type of tax forms you want mailed differently and specify the address you want Jefferson County

to use. Attach an additional sheet if necessary.

Type of Tax:

Address for forms and correspondence to be mailed:

Phone #:

Contact:

Type of Tax:

Address for forms and correspondence to be mailed:

Phone #:

Contact:

Type of Tax:

Address for forms and correspondence to be mailed:

Phone #:

Contact:

Type of Tax:

Address for forms and correspondence to be mailed:

Phone #:

Contact:

LIMITED POWER OF ATTORNEY

I authorize the Jefferson County Department of Revenue to mail tax forms and correspondence as directed above. I acknowledge

that the person/company listed above is an employee and/or agent for my business and grant them a power of attorney to discuss

tax issues with Jefferson County, AL. I understand that this does not relieve my responsibility to ensure all taxes are filed timely

and accurately. I agree to notify Jefferson County in writing, if any of the above information changes, or if I wish to stop using the

above listed agent.

Please Print Name

Signature

Title

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2