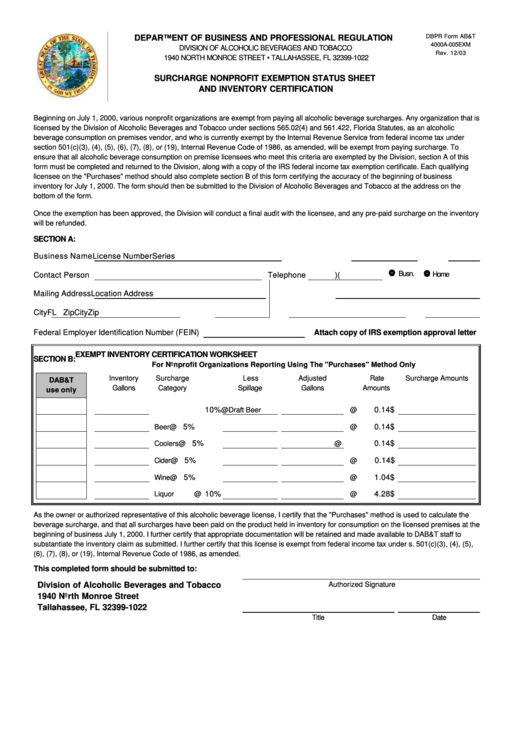

Dbpr Form Ab&t 4000a-005exm - Exempt Inventory Certification Worksheet -

ADVERTISEMENT

DBPR Form AB&T

DEPARTMENT OF BUSINESS AND PROFESSIONAL REGULATION

4000A-005EXM

DIVISION OF ALCOHOLIC BEVERAGES AND TOBACCO

Rev. 12/03

1940 NORTH MONROE STREET • TALLAHASSEE, FL 32399-1022

SURCHARGE NONPROFIT EXEMPTION STATUS SHEET

AND INVENTORY CERTIFICATION

Beginning on July 1, 2000, various nonprofit organizations are exempt from paying all alcoholic beverage surcharges. Any organization that is

licensed by the Division of Alcoholic Beverages and Tobacco under sections 565.02(4) and 561.422, Florida Statutes, as an alcoholic

beverage consumption on premises vendor, and who is currently exempt by the Internal Revenue Service from federal income tax under

section 501(c)(3), (4), (5), (6), (7), (8), or (19), Internal Revenue Code of 1986, as amended, will be exempt from paying surcharge. To

ensure that all alcoholic beverage consumption on premise licensees who meet this criteria are exempted by the Division, section A of this

form must be completed and returned to the Division, along with a copy of the IRS federal income tax exemption certificate. Each qualifying

licensee on the "Purchases" method should also complete section B of this form certifying the accuracy of the beginning of business

inventory for July 1, 2000. The form should then be submitted to the Division of Alcoholic Beverages and Tobacco at the address on the

bottom of the form.

Once the exemption has been approved, the Division will conduct a final audit with the licensee, and any pre-paid surcharge on the inventory

will be refunded.

SECTION A:

Business Name

License Number

Series

Busn.

Contact Person

Telephone

(

)

Home

Mailing Address

Location Address

City

FL Zip

City

Zip

Federal Employer Identification Number (FEIN)

Attach copy of IRS exemption approval letter

EXEMPT INVENTORY CERTIFICATION WORKSHEET

SECTION B:

For Nonprofit Organizations Reporting Using The "Purchases" Method Only

Inventory

Surcharge

Less

Adjusted

Rate

Surcharge Amounts

DAB&T

Gallons

Category

Spillage

Gallons

Amounts

use only

10%

$

0.14

Draft Beer

@

@

5%

$

0.14

Beer

@

@

5%

$

0.14

Coolers

@

@

5%

$

0.14

Cider

@

@

5%

$

1.04

Wine

@

@

10%

$

4.28

Liquor

@

@

As the owner or authorized representative of this alcoholic beverage license, I certify that the "Purchases" method is used to calculate the

beverage surcharge, and that all surcharges have been paid on the product held in inventory for consumption on the licensed premises at the

beginning of business July 1, 2000. I further certify that appropriate documentation will be retained and made available to DAB&T staff to

substantiate the inventory claim as submitted. I further certify that this license is exempt from federal income tax under s. 501(c)(3), (4), (5),

(6), (7), (8), or (19), Internal Revenue Code of 1986, as amended.

This completed form should be submitted to:

Authorized Signature

Division of Alcoholic Beverages and Tobacco

1940 North Monroe Street

Tallahassee, FL 32399-1022

Title

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1