Form 1100-Ext - Corporation Income Tax Request For Extension 2001

ADVERTISEMENT

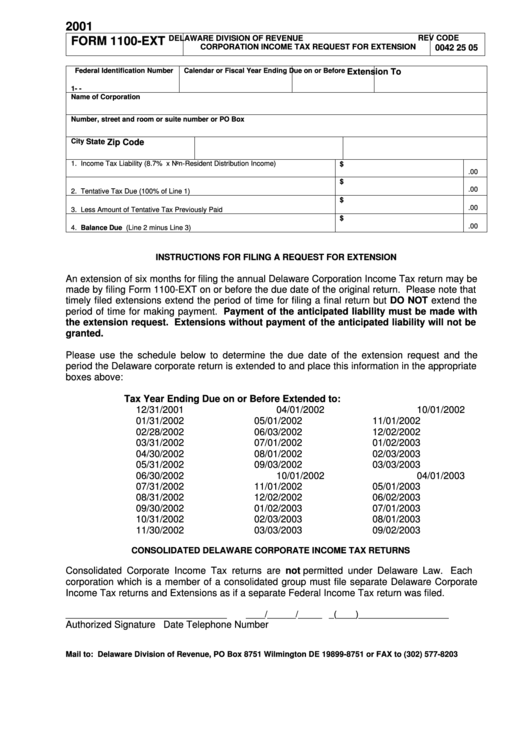

2001

DELAWARE DIVISION OF REVENUE

REV CODE

FORM 1100-EXT

CORPORATION INCOME TAX REQUEST FOR EXTENSION

0042 25 05

Federal Identification Number

Calendar or Fiscal Year Ending

Due on or Before

Extension To

1- -

Name of Corporation

Number, street and room or suite number or PO Box

City

State

Zip Code

$

1. Income Tax Liability (8.7% x Non-Resident Distribution Income)

.00

$

.00

2. Tentative Tax Due (100% of Line 1)

$

.00

3. Less Amount of Tentative Tax Previously Paid

$

.00

4. Balance Due (Line 2 minus Line 3)

INSTRUCTIONS FOR FILING A REQUEST FOR EXTENSION

An extension of six months for filing the annual Delaware Corporation Income Tax return may be

made by filing Form 1100-EXT on or before the due date of the original return. Please note that

timely filed extensions extend the period of time for filing a final return but DO NOT extend the

period of time for making payment. Payment of the anticipated liability must be made with

the extension request. Extensions without payment of the anticipated liability will not be

granted.

Please use the schedule below to determine the due date of the extension request and the

period the Delaware corporate return is extended to and place this information in the appropriate

boxes above:

Tax Year Ending

Due on or Before

Extended to:

12/31/2001

04/01/2002

10/01/2002

01/31/2002

05/01/2002

11/01/2002

02/28/2002

06/03/2002

12/02/2002

03/31/2002

07/01/2002

01/02/2003

04/30/2002

08/01/2002

02/03/2003

05/31/2002

09/03/2002

03/03/2003

06/30/2002

10/01/2002

04/01/2003

07/31/2002

11/01/2002

05/01/2003

08/31/2002

12/02/2002

06/02/2003

09/30/2002

01/02/2003

07/01/2003

10/31/2002

02/03/2003

08/01/2003

11/30/2002

03/03/2003

09/02/2003

CONSOLIDATED DELAWARE CORPORATE INCOME TAX RETURNS

Consolidated Corporate Income Tax returns are not permitted under Delaware Law. Each

corporation which is a member of a consolidated group must file separate Delaware Corporate

Income Tax returns and Extensions as if a separate Federal Income Tax return was filed.

__________________________________

____/______/_____ _(____)___________________

Authorized Signature

Date

Telephone Number

Mail to: Delaware Division of Revenue, PO Box 8751 Wilmington DE 19899-8751 or FAX to (302) 577-8203

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1