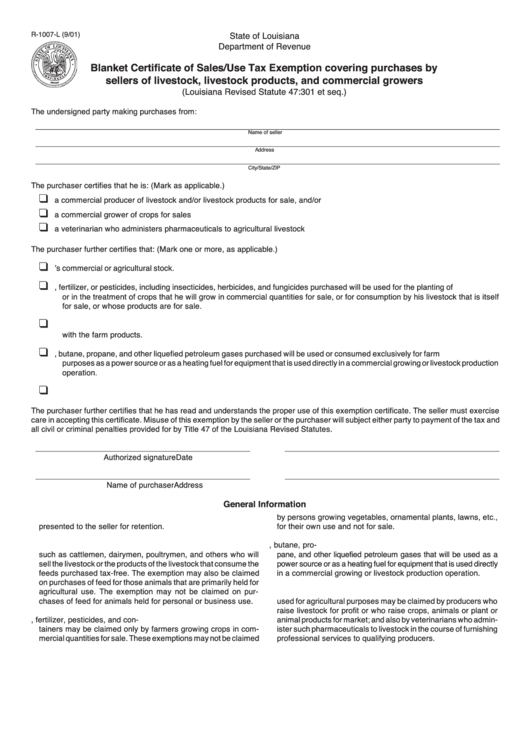

R-1007-L (9/01)

State of Louisiana

Department of Revenue

Blanket Certificate of Sales/Use Tax Exemption covering purchases by

sellers of livestock, livestock products, and commercial growers

(Louisiana Revised Statute 47:301 et seq.)

The undersigned party making purchases from:

__________________________________________________________________________________________________________

Name of seller

__________________________________________________________________________________________________________

Address

__________________________________________________________________________________________________________

City/State/ZIP

The purchaser certifies that he is: (Mark as applicable.)

❑

a commercial producer of livestock and/or livestock products for sale, and/or

❑

a commercial grower of crops for sales

❑

a veterinarian who administers pharmaceuticals to agricultural livestock

The purchaser further certifies that: (Mark one or more, as applicable.)

❑

1. The animal feed purchased will be consumed only by livestock that are part of the purchaser’s commercial or agricultural stock.

❑

2. The seeds, fertilizer, or pesticides, including insecticides, herbicides, and fungicides purchased will be used for the planting of

or in the treatment of crops that he will grow in commercial quantities for sale, or for consumption by his livestock that is itself

for sale, or whose products are for sale.

❑

3. The containers purchased will be used in the packaging for sale of farm products that he has grown. The containers will be sold

with the farm products.

❑

4. The diesel fuel, butane, propane, and other liquefied petroleum gases purchased will be used or consumed exclusively for farm

purposes as a power source or as a heating fuel for equipment that is used directly in a commercial growing or livestock production

operation.

❑

5. The pharmaceuticals will be administered to livestock used for agricultural purposes.

The purchaser further certifies that he has read and understands the proper use of this exemption certificate. The seller must exercise

care in accepting this certificate. Misuse of this exemption by the seller or the purchaser will subject either party to payment of the tax and

all civil or criminal penalties provided for by Title 47 of the Louisiana Revised Statutes.

_________________________________________________

_________________________________________________

Authorized signature

Date

_________________________________________________

_________________________________________________

Name of purchaser

Address

General Information

1. This form is to be completed by the purchaser annually and

by persons growing vegetables, ornamental plants, lawns, etc.,

presented to the seller for retention.

for their own use and not for sale.

2. The exemption on animal feeds may be claimed by purchasers

4. An exemption can be claimed only on diesel fuel, butane, pro-

such as cattlemen, dairymen, poultrymen, and others who will

pane, and other liquefied petroleum gases that will be used as a

sell the livestock or the products of the livestock that consume the

power source or as a heating fuel for equipment that is used directly

feeds purchased tax-free. The exemption may also be claimed

in a commercial growing or livestock production operation.

on purchases of feed for those animals that are primarily held for

agricultural use. The exemption may not be claimed on pur-

5. The exclusion for pharmaceuticals administered to livestock

chases of feed for animals held for personal or business use.

used for agricultural purposes may be claimed by producers who

raise livestock for profit or who raise crops, animals or plant or

3. The exemptions covering seeds, fertilizer, pesticides, and con-

animal products for market; and also by veterinarians who admin-

tainers may be claimed only by farmers growing crops in com-

ister such pharmaceuticals to livestock in the course of furnishing

mercial quantities for sale. These exemptions may not be claimed

professional services to qualifying producers.

1

1