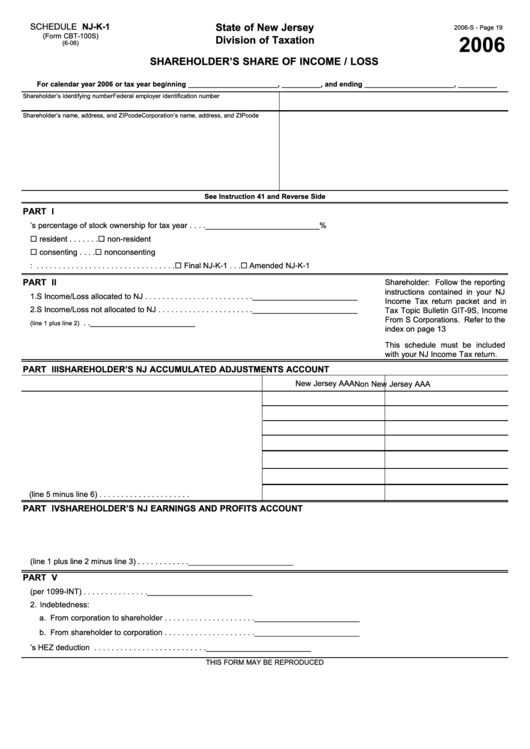

Form Cbt-100s - Shareholder'S Share Of Income / Loss - Division Of Taxation Of State Of New Jersey - 2006

ADVERTISEMENT

SCHEDULE NJ-K-1

State of New Jersey

2006-S - Page 19

(Form CBT-100S)

2006

Division of Taxation

(6-06)

SHAREHOLDER’S SHARE OF INCOME / LOSS

For calendar year 2006 or tax year beginning _______________________, __________, and ending _______________________, __________

Shareholder’s identifying number

Federal employer identification number

Shareholder’s name, address, and ZIP code

Corporation’s name, address, and ZIP code

See Instruction 41 and Reverse Side

PART I

1. Shareholder’s percentage of stock ownership for tax year . . . . __________________________%

2. Shareholder . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

resident . . . . . . .

non-resident

3. Shareholder . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

consenting . . . .

nonconsenting

4. Check applicable box: . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Final NJ-K-1 . . .

Amended NJ-K-1

PART II

Shareholder: Follow the reporting

instructions contained in your NJ

1. S Income/Loss allocated to NJ . . . . . . . . . . . . . . . . . . . . . . . . . ________________________

Income Tax return packet and in

2. S Income/Loss not allocated to NJ . . . . . . . . . . . . . . . . . . . . . . ________________________

Tax Topic Bulletin GIT-9S, Income

From S Corporations. Refer to the

3. Pro rata share of S Corporation Income/Loss

. . ________________________

(line 1 plus line 2)

index on page 13

4. Total payments made on behalf of shareholder . . . . . . . . . . . . ________________________

This schedule must be included

5. Distributions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ________________________

with your NJ Income Tax return.

PART III

SHAREHOLDER’S NJ ACCUMULATED ADJUSTMENTS ACCOUNT

New Jersey AAA

Non New Jersey AAA

1. Beginning balance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2. Income/Loss . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3. Other Income/Loss . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4. Other reductions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5. Total lines 1-4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6. Distributions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7. Ending Balance (line 5 minus line 6) . . . . . . . . . . . . . . . . . . . . .

PART IV

SHAREHOLDER’S NJ EARNINGS AND PROFITS ACCOUNT

1. Beginning balance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ________________________

2. Additions/Adjustments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ________________________

3. Dividends received . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ________________________

4. Ending balance (line 1 plus line 2 minus line 3) . . . . . . . . . . . . ________________________

PART V

1. Interest paid to shareholder (per 1099-INT) . . . . . . . . . . . . . . . ________________________

2. Indebtedness:

a. From corporation to shareholder . . . . . . . . . . . . . . . . . . . . . ________________________

b. From shareholder to corporation . . . . . . . . . . . . . . . . . . . . . ________________________

3. Shareholder’s HEZ deduction . . . . . . . . . . . . . . . . . . . . . . . . . . ________________________

THIS FORM MAY BE REPRODUCED

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1