Form W-1 - Employers Return Of Tax Withheld

ADVERTISEMENT

Form

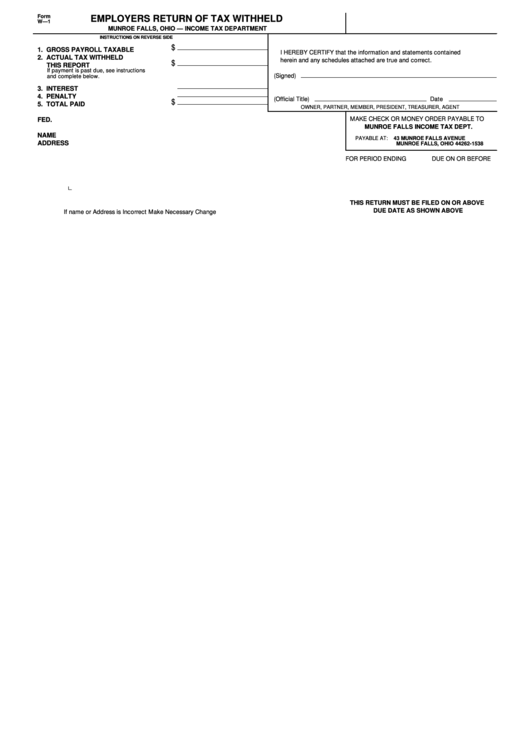

EMPLOYERS RETURN OF TAX WITHHELD

W—1

MUNROE FALLS, OHIO — INCOME TAX DEPARTMENT

INSTRUCTIONS ON REVERSE SIDE

$

1. GROSS PAYROLL TAXABLE

I HEREBY CERTIFY that the information and statements contained

2. ACTUAL TAX WITHHELD

herein and any schedules attached are true and correct.

$

THIS REPORT

If payment is past due, see instructions

(Signed)

and complete below.

3. INTEREST

4. PENALTY

(Official Title)

Date

$

5. TOTAL PAID

OWNER, PARTNER, MEMBER, PRESIDENT, TREASURER, AGENT

MAKE CHECK OR MONEY ORDER PAYABLE TO

FED. I.D. NO.

MUNROE FALLS INCOME TAX DEPT.

NAME

PAYABLE AT:

43 MUNROE FALLS AVENUE

ADDRESS

MUNROE FALLS, OHIO 44262-1538

FOR PERIOD ENDING

DUE ON OR BEFORE

THIS RETURN MUST BE FILED ON OR ABOVE

If name or Address is Incorrect Make Necessary Change

DUE DATE AS SHOWN ABOVE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1