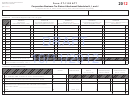

Form Ct-1120 Esb - Estimated Corporation Business Tax Page 2

ADVERTISEMENT

DEPARTMENT OF REVENUE SERVICES

CHECK HERE

IF CLOSING MONTH HAS

2002

CT-1120 ESD

STATE OF CONNECTICUT

CHANGED AND ATTACH EXPLANATION.

Payment Coupon - Fourth Installment

PO Box 2965 Hartford CT 06104-2965

ESTIMATED CORPORATION BUSINESS TAX

FOR INCOME YEAR ENDING

(Rev. 1/02)

D

Tax shown on preceding year return multiplied by 100%

CT TAX REGISTRATION NUMBER

1

1

(1.00). See instructions on reverse side of this coupon.

DRS USE ONLY

2

Current year fourth installment (from Schedule 1 , Line 4)

2

–

– 20

3

Fourth installment due (lesser of Line 1 or Line 2)

3

FEDERAL EMPLOYER IDENTIFICATION NO.

Amount paid with Forms CT-1120 ESA, CT-1120 ESB, and CT-1120 ESC

4

plus overpayment from preceding year

4

IS THIS A COMBINED RETURN? (“X” One)

YES

NO

5

Payment due with this coupon (Subtract Line 4 from Line 3)

5

DUE DATE:

No later than the 15th day of the 12th month of the

Corporation Name

income year.

NOTE:

If the due date falls on a Saturday, Sunday, or legal

holiday, the next business day is the due date.

Number and Street

MAKE CHECK OR MONEY ORDER PAYABLE TO:

COMMISSIONER OF REVENUE SERVICES

City or Town

State

ZIP Code

MAIL TO:

Department of Revenue Services

PO Box 2965

Hartford CT 06104-2965

✃

cut here

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

✁

cut here

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

DEPARTMENT OF REVENUE SERVICES

CHECK HERE

IF CLOSING MONTH HAS

2002

CT-1120 ESC

STATE OF CONNECTICUT

CHANGED AND ATTACH EXPLANATION.

Payment Coupon - Third Installment

PO Box 2965 Hartford CT 06104-2965

ESTIMATED CORPORATION BUSINESS TAX

FOR INCOME YEAR ENDING

(Rev. 1/02)

C

CT TAX REGISTRATION NUMBER

Tax shown on preceding year return multiplied by 80%

1

1

(.80). See instructions on reverse side of this coupon.

DRS USE ONLY

2

Current year third installment (from Schedule 1 , Line 4)

2

–

– 20

3

Third installment due (lesser of Line 1 or Line 2)

3

FEDERAL EMPLOYER IDENTIFICATION NO.

Amount paid with Forms CT-1120 ESA and CT-1120 ESB

4

plus overpayment from preceding year

4

IS THIS A COMBINED RETURN? (“X” One)

YES

NO

5

Payment due with this coupon (Subtract Line 4 from Line 3)

5

DUE DATE:

No later than the 15th day of the 9th month of the

Corporation Name

income year.

NOTE:

If the due date falls on a Saturday, Sunday, or legal

holiday, the next business day is the due date.

Number and Street

MAKE CHECK OR MONEY ORDER PAYABLE TO:

COMMISSIONER OF REVENUE SERVICES

City or Town

State

ZIP Code

MAIL TO:

Department of Revenue Services

PO Box 2965

Hartford CT 06104-2965

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2