Form It-800 - Opt-Out Record For Tax Practitioners

ADVERTISEMENT

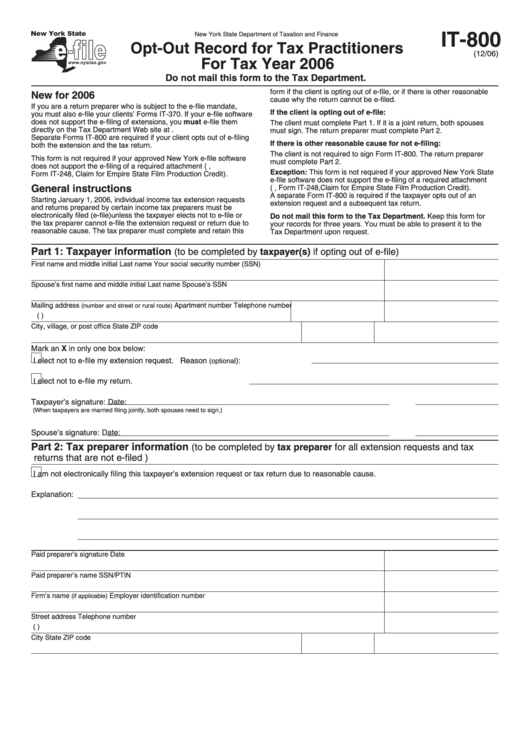

IT-800

New York State Department of Taxation and Finance

Opt-Out Record for Tax Practitioners

(12/06)

For Tax Year 2006

Do not mail this form to the Tax Department.

form if the client is opting out of e-file, or if there is other reasonable

New for 2006

cause why the return cannot be e-filed.

If you are a return preparer who is subject to the e-file mandate,

If the client is opting out of e-file:

you must also e-file your clients’ Forms IT-370. If your e-file software

does not support the e-filing of extensions, you must e-file them

The client must complete Part 1. If it is a joint return, both spouses

directly on the Tax Department Web site at

must sign. The return preparer must complete Part 2.

Separate Forms IT-800 are required if your client opts out of e-filing

If there is other reasonable cause for not e-filing:

both the extension and the tax return.

The client is not required to sign Form IT-800. The return preparer

This form is not required if your approved New York e-file software

must complete Part 2.

does not support the e-filing of a required attachment (e.g.,

Exception: This form is not required if your approved New York State

Form IT-248, Claim for Empire State Film Production Credit).

e-file software does not support the e-filing of a required attachment

General instructions

(e.g., Form IT-248, Claim for Empire State Film Production Credit).

A separate Form IT-800 is required if the taxpayer opts out of an

Starting January 1, 2006, individual income tax extension requests

extension request and a subsequent tax return.

and returns prepared by certain income tax preparers must be

electronically filed (e-file) unless the taxpayer elects not to e-file or

Do not mail this form to the Tax Department. Keep this form for

the tax preparer cannot e-file the extension request or return due to

your records for three years. You must be able to present it to the

reasonable cause. The tax preparer must complete and retain this

Tax Department upon request.

Part 1: Taxpayer information

(to be completed by taxpayer(s) if opting out of e-file)

First name and middle initial

Last name

Your social security number (SSN)

Spouse’s first name and middle initial

Last name

Spouse’s SSN

Mailing address

Apartment number

Telephone number

(number and street or rural route)

(

)

City, village, or post office

State

ZIP code

Mark an X in only one box below:

I elect not to e-file my extension request.

Reason

):

(optional

I elect not to e-file my return.

Taxpayer’s signature:

Date:

(When taxpayers are married filing jointly, both spouses need to sign.)

Spouse’s signature:

Date:

Part 2: Tax preparer information

(to be completed by tax preparer for all extension requests and tax

returns that are not e-filed )

I am not electronically filing this taxpayer’s extension request or tax return due to reasonable cause.

Explanation:

Paid preparer’s signature

Date

Paid preparer’s name

SSN/PTIN

Firm’s name

Employer identification number

(if applicable)

Street address

Telephone number

(

)

City

State

ZIP code

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1