Form Ftb 3567bk C2 - Installment Agreement Request

ADVERTISEMENT

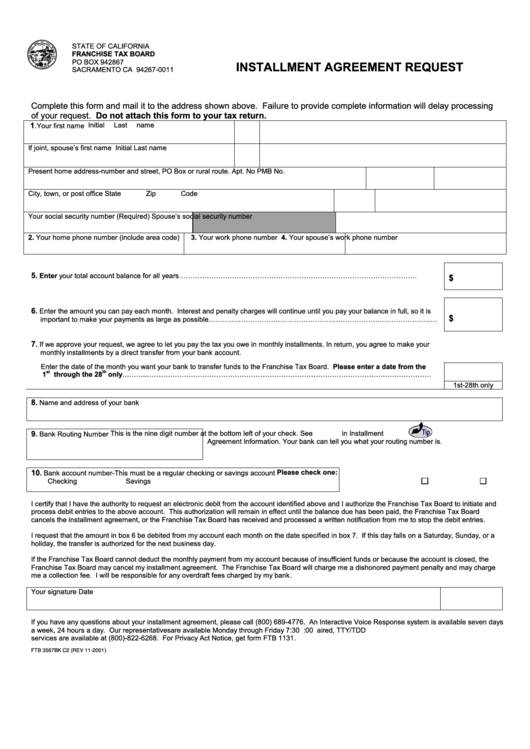

STATE OF CALIFORNIA

FRANCHISE TAX BOARD

PO BOX 942867

INSTALLMENT AGREEMENT REQUEST

SACRAMENTO CA 94267-0011

Complete this form and mail it to the address shown above. Failure to provide complete information will delay processing

of your request. Do not attach this form to your tax return.

1.

Initial

Last name

Your first name

If joint, spouse’s first name

Initial

Last name

Present home address-number and street, PO Box or rural route.

Apt. No

PMB No.

City, town, or post office

State

Zip Code

Your social security number (Required)

Spouse’s social security number

2. Your home phone number (include area code)

3. Your work phone number

4. Your spouse’s work phone number

5

. Enter your total account balance for all years………………………………………………………………………………………….

$

6

. Enter the amount you can pay each month. Interest and penalty charges will continue until you pay your balance in full, so it is

$

important to make your payments as large as possible………………………………………………………………………………………

7

. If we approve your request, we agree to let you pay the tax you owe in monthly installments. In return, you agree to make your

monthly installments by a direct transfer from your bank account.

Enter the date of the month you want your bank to transfer funds to the Franchise Tax Board. Please enter a date from the

st

th

1

through the 28

only………..……………………………………………………………………………………………………………

1st-28th only

8

. Name and address of your bank

9

This is the nine digit number at the bottom left of your check. See

in Installment

. Bank Routing Number

Agreement Information. Your bank can tell you what your routing number is.

10

Please check one:

. Bank account number-This must be a regular checking or savings account

Checking

Savings

I certify that I have the authority to request an electronic debit from the account identified above and I authorize the Franchise Tax Board to initiate and

process debit entries to the above account. This authorization will remain in effect until the balance due has been paid, the Franchise Tax Board

cancels the installment agreement, or the Franchise Tax Board has received and processed a written notification from me to stop the debit entries.

I request that the amount in box 6 be debited from my account each month on the date specified in box 7. If this day falls on a Saturday, Sunday, or a

holiday, the transfer is authorized for the next business day.

If the Franchise Tax Board cannot deduct the monthly payment from my account because of insufficient funds or because the account is closed, the

Franchise Tax Board may cancel my installment agreement. The Franchise Tax Board will charge me a dishonored payment penalty and may charge

me a collection fee. I will be responsible for any overdraft fees charged by my bank.

Your signature

Date

If you have any questions about your installment agreement, please call (800) 689-4776. An Interactive Voice Response system is available seven days

a week, 24 hours a day. Our representatives are available Monday through Friday 7:30 a.m. to 5:00 p.m. If you are hearing impaired, TTY/TDD

services are available at (800)-822-6268. For Privacy Act Notice, get form FTB 1131.

)

FTB 3567BK C2 (REV 11-2001

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1