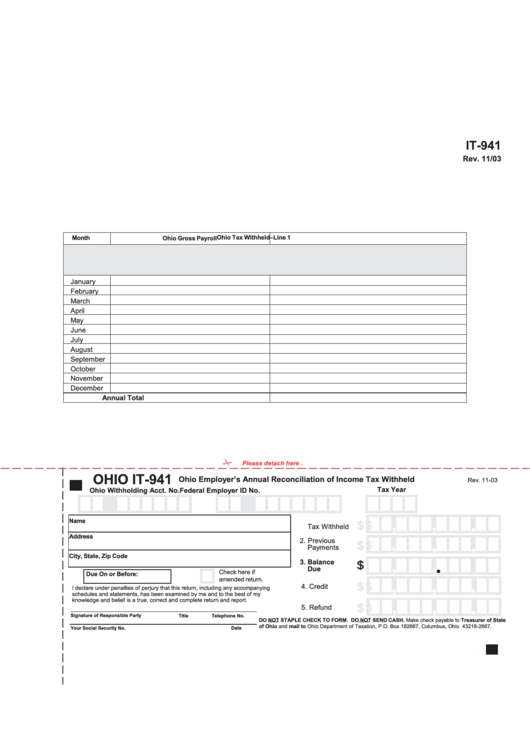

Form It-941 - Employer'S Annual Reconciliation Of Income Tax Withheld

ADVERTISEMENT

IT-941

Rev. 11/03

Ohio Tax Withheld–Line 1

Month

Ohio Gross Payroll

January

February

March

April

May

June

July

August

September

October

November

December

Annual Total

Please detach here .

OHIO IT-941

Ohio Employer’s Annual Reconciliation of Income Tax Withheld

Rev. 11-03

Tax Year

Federal Employer ID No.

Ohio Withholding Acct. No.

,

,

1. Ohio Income

Name

$ $ $ $ $

Tax Withheld

,

,

Address

2. Previous

$ $ $ $ $

Payments

City, State, Zip Code

,

,

3. Balance

$

Due

Check here if

Due On or Before:

,

,

,

,

amended return.

$ $ $ $ $

4. Credit

I declare under penalties of perjury that this return, including any accompanying

schedules and statements, has been examined by me and to the best of my

,

,

knowledge and belief is a true, correct and complete return and report.

$ $ $ $ $

5. Refund

Signature of Responsible Party

Title

Telephone No.

DO NOT STAPLE CHECK TO FORM. DO NOT SEND CASH. Make check payable to Treasurer of State

of Ohio and mail to Ohio Department of Taxation, P.O. Box 182667, Columbus, Ohio 43218-2667.

Date

Your Social Security No.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1