Form 3f - Instructions For Tax Form Installment

ADVERTISEMENT

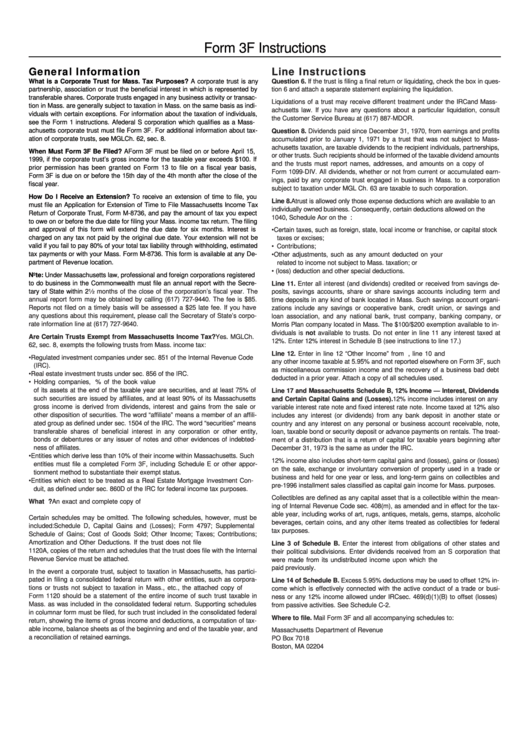

Form 3F Instructions

General Information

Line Instructions

What is a Corporate Trust for Mass. Tax Purposes? A corporate trust is any

Question 6. If the trust is filing a final return or liquidating, check the box in ques-

partnership, association or trust the beneficial interest in which is represented by

tion 6 and attach a separate statement explaining the liquidation.

transferable shares. Corporate trusts engaged in any business activity or transac-

Liquidations of a trust may receive different treatment under the IRC and Mass-

tion in Mass. are generally subject to taxation in Mass. on the same basis as indi-

achusetts law. If you have any questions about a particular liquidation, consult

viduals with certain exceptions. For information about the taxation of individuals,

the Customer Service Bureau at (617) 887-MDOR.

see the Form 1 instructions. A federal S corporation which qualifies as a Mass-

achusetts corporate trust must file Form 3F. For additional information about tax-

Question 8. Dividends paid since December 31, 1970, from earnings and profits

ation of corporate trusts, see MGL Ch. 62, sec. 8.

accumulated prior to January 1, 1971 by a trust that was not subject to Mass-

achusetts taxation, are taxable dividends to the recipient individuals, partnerships,

When Must Form 3F Be Filed? A Form 3F must be filed on or before April 15,

or other trusts. Such recipients should be informed of the taxable dividend amounts

1999, if the corporate trust’s gross income for the taxable year exceeds $100. If

and the trusts must report names, addresses, and amounts on a copy of U.S.

prior permission has been granted on Form 13 to file on a fiscal year basis,

Form 1099-DIV. All dividends, whether or not from current or accumulated earn-

Form 3F is due on or before the 15th day of the 4th month after the close of the

ings, paid by any corporate trust engaged in business in Mass. to a corporation

fiscal year.

subject to taxation under MGL Ch. 63 are taxable to such corporation.

How Do I Receive an Extension? To receive an extension of time to file, you

Line 8. A trust is allowed only those expense deductions which are available to an

must file an Application for Extension of Time to File Massachusetts Income Tax

individually owned business. Consequently, certain deductions allowed on the U.S.

Return of Corporate Trust, Form M-8736, and pay the amount of tax you expect

1040, Schedule A or on the U.S. 1120 or 1120A are not allowed. These include:

to owe on or before the due date for filing your Mass. income tax return. The filing

and approval of this form will extend the due date for six months. Interest is

• Certain taxes, such as foreign, state, local income or franchise, or capital stock

charged on any tax not paid by the original due date. Your extension will not be

taxes or excises;

valid if you fail to pay 80% of your total tax liability through withholding, estimated

• Contributions;

tax payments or with your Mass. Form M-8736. This form is available at any De-

• Other adjustments, such as any amount deducted on your U.S. return that is

partment of Revenue location.

related to income not subject to Mass. taxation; or

• U.S. net operating (loss) deduction and other special deductions.

Note: Under Massachusetts law, professional and foreign corporations registered

to do business in the Commonwealth must file an annual report with the Secre-

Line 11. Enter all interest (and dividends) credited or received from savings de-

tary of State within

2¹⁄₂ months of the close of the corporation’s fiscal year. The

posits, savings accounts, share or share savings accounts including term and

annual report form may be obtained by calling (617) 727-9440. The fee is $85.

time deposits in any kind of bank located in Mass. Such savings account organi-

Reports not filed on a timely basis will be assessed a $25 late fee. If you have

zations include any savings or cooperative bank, credit union, or savings and

any questions about this requirement, please call the Secretary of State’s corpo-

loan association, and any national bank, trust company, banking company, or

rate information line at (617) 727-9640.

Morris Plan company located in Mass. The $100/$200 exemption available to in-

dividuals is not available to trusts. Do not enter in line 11 any interest taxed at

Are Certain Trusts Exempt from Massachusetts Income Tax? Yes. MGL Ch.

12%. Enter 12% interest in Schedule B (see instructions to line 17.)

62, sec. 8, exempts the following trusts from Mass. income tax:

Line 12. Enter in line 12 “Other Income” from U.S. 1120 or 1120A, line 10 and

• Regulated investment companies under sec. 851 of the Internal Revenue Code

any other income taxable at 5.95% and not reported elsewhere on Form 3F, such

(IRC).

as miscellaneous commission income and the recovery of a business bad debt

• Real estate investment trusts under sec. 856 of the IRC.

deducted in a prior year. Attach a copy of all schedules used.

• Holding companies, i.e. any corporate trust in which 90% of the book value

of its assets at the end of the taxable year are securities, and at least 75% of

Line 17 and Massachusetts Schedule B, 12% Income — Interest, Dividends

such securities are issued by affiliates, and at least 90% of its Massachusetts

and Certain Capital Gains and (Losses). 12% income includes interest on any

gross income is derived from dividends, interest and gains from the sale or

variable interest rate note and fixed interest rate note. Income taxed at 12% also

other disposition of securities. The word “affiliate” means a member of an affili-

includes any interest (or dividends) from any bank deposit in another state or

ated group as defined under sec. 1504 of the IRC. The word “securities” means

country and any interest on any personal or business account receivable, note,

transferable shares of beneficial interest in any corporation or other entity,

loan, taxable bond or security deposit or advance payments on rentals. The treat-

bonds or debentures or any issuer of notes and other evidences of indebted-

ment of a distribution that is a return of capital for taxable years beginning after

ness of affiliates.

December 31, 1973 is the same as under the IRC.

• Entities which derive less than 10% of their income within Massachusetts. Such

12% income also includes short-term capital gains and (losses), gains or (losses)

entities must file a completed Form 3F, including Schedule E or other appor-

on the sale, exchange or involuntary conversion of property used in a trade or

tionment method to substantiate their exempt status.

business and held for one year or less, and long-term gains on collectibles and

• Entities which elect to be treated as a Real Estate Mortgage Investment Con-

pre-1996 installment sales classified as capital gain income for Mass. purposes.

duit, as defined under sec. 860D of the IRC for federal income tax purposes.

Collectibles are defined as any capital asset that is a collectible within the mean-

What U.S. Forms Must Accompany Form 3F? An exact and complete copy of

ing of Internal Revenue Code sec. 408(m), as amended and in effect for the tax-

U.S. Form 1120 or 1120A as filed must be attached and made part of the return.

able year, including works of art, rugs, antiques, metals, gems, stamps, alcoholic

Certain schedules may be omitted. The following schedules, however, must be

beverages, certain coins, and any other items treated as collectibles for federal

included: Schedule D, Capital Gains and (Losses); Form 4797; Supplemental

tax purposes.

Schedule of Gains; Cost of Goods Sold; Other Income; Taxes; Contributions;

Amortization and Other Deductions. If the trust does not file U.S. Form 1120 or

Line 3 of Schedule B. Enter the interest from obligations of other states and

1120A, copies of the return and schedules that the trust does file with the Internal

their political subdivisions. Enter dividends received from an S corporation that

Revenue Service must be attached.

were made from its undistributed income upon which the U.S. income tax was

paid previously.

In the event a corporate trust, subject to taxation in Massachusetts, has partici-

pated in filing a consolidated federal return with other entities, such as corpora-

Line 14 of Schedule B. Excess 5.95% deductions may be used to offset 12% in-

tions or trusts not subject to taxation in Mass., etc., the attached copy of U.S.

come which is effectively connected with the active conduct of a trade or busi-

Form 1120 should be a statement of the entire income of such trust taxable in

ness or any 12% income allowed under IRC sec. 469(d)(1)(B) to offset (losses)

Mass. as was included in the consolidated federal return. Supporting schedules

from passive activities. See Schedule C-2.

in columnar form must be filed, for such trust included in the consolidated federal

Where to file. Mail Form 3F and all accompanying schedules to:

return, showing the items of gross income and deductions, a computation of tax-

able income, balance sheets as of the beginning and end of the taxable year, and

Massachusetts Department of Revenue

a reconciliation of retained earnings.

PO Box 7018

Boston, MA 02204

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1