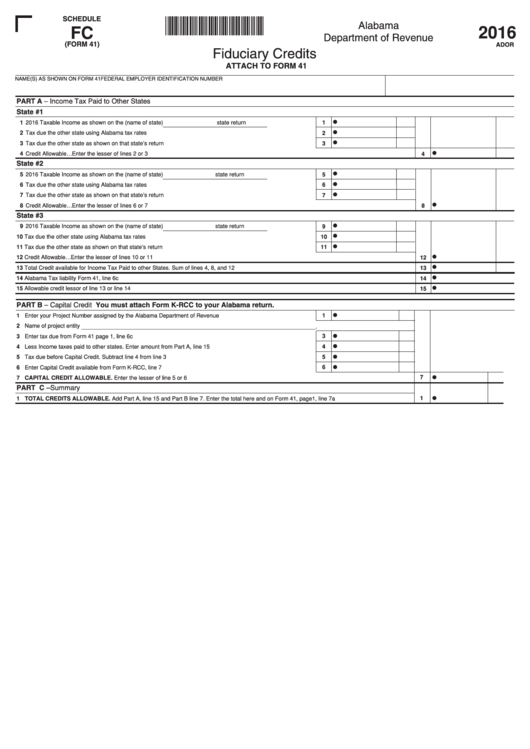

SCHEDULE

160011FC

Alabama

2016

FC

Department of Revenue

(FORM 41)

ADOR

Fiduciary Credits

RESET

ATTACH TO FORM 41

NAME(S) AS SHOWN ON FORM 41

FEDERAL EMPLOYER IDENTIFICATION NUMBER

PART A – Income Tax Paid to Other States

State #1

1 2016 Taxable Income as shown on the (name of state)

state return . . . . .

2 Tax due the other state using Alabama tax rates . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3 Tax due the other state as shown on that state’s return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4 Credit Allowable…Enter the lesser of lines 2 or 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

State #2

5 2016 Taxable Income as shown on the (name of state)

state return . . . . .

6 Tax due the other state using Alabama tax rates . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7 Tax due the other state as shown on that state’s return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8 Credit Allowable…Enter the lesser of lines 6 or 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

State #3

9 2016 Taxable Income as shown on the (name of state)

state return . . . . .

10 Tax due the other state using Alabama tax rates . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11 Tax due the other state as shown on that state’s return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12 Credit Allowable…Enter the lesser of lines 10 or 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

13 Total Credit available for Income Tax Paid to other States. Sum of lines 4, 8, and 12 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

14 Alabama Tax liability Form 41, line 6c . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

15 Allowable credit lessor of line 13 or line 14. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15

PART B – Capital Credit You must attach Form K-RCC to your Alabama return.

1 Enter your Project Number assigned by the Alabama Department of Revenue. . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

2 Name of project entity __________________________________________________________________________.

3 Enter tax due from Form 41 page 1, line 6c . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

4 Less Income taxes paid to other states. Enter amount from Part A, line 15 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

5

5 Tax due before Capital Credit. Subtract line 4 from line 3. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6 Enter Capital Credit available from Form K-RCC, line 7. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

7

7 CAPITAL CREDIT ALLOWABLE. Enter the lesser of line 5 or 6. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

PART C – Summary

1

1 TOTAL CREDITS ALLOWABLE. Add Part A, line 15 and Part B line 7. Enter the total here and on Form 41, page1, line 7a. . . . . . . . . . . . . . . . . . . . . . . . .

1

1