K

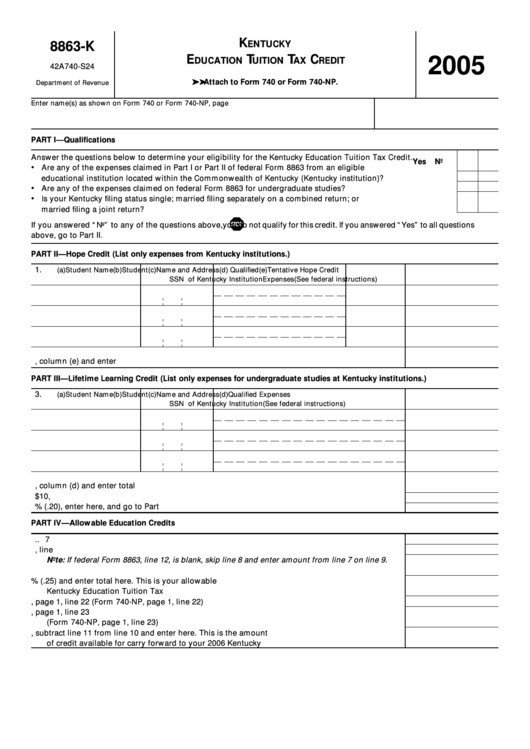

8863-K

ENTUCKY

E

T

T

C

2005

DUCATION

UITION

AX

REDIT

42A740-S24

➤ ➤ ➤ ➤ ➤ Attach to Form 740 or Form 740-NP.

Department of Revenue

Enter name(s) as shown on Form 740 or Form 740-NP , page 1.

Your Social Security Number

PART I—Qualifications

Answer the questions below to determine your eligibility for the Kentucky Education Tuition Tax Credit.

Yes

No

•

Are any of the expenses claimed in Part I or Part II of federal Form 8863 from an eligible

educational institution located within the Commonwealth of Kentucky (Kentucky institution)? ..............................

•

Are any of the expenses claimed on federal Form 8863 for undergraduate studies? ................................................

•

Is your Kentucky filing status single; married filing separately on a combined return; or

married filing a joint return? ............................................................................................................................................

If you answered “No” to any of the questions above,

you do not qualify for this credit. If you answered “Yes” to all questions

above, go to Part II.

PART II—Hope Credit (List only expenses from Kentucky institutions.)

1.

(a) Student Name

(b) Student

(c) Name and Address

(d) Qualified

(e) Tentative Hope Credit

SSN

of Kentucky Institution

Expenses

(See federal instructions)

2. Tentative Hope Credit. Add amounts on line 1, column (e) and enter here ................................... 2

PART III—Lifetime Learning Credit (List only expenses for undergraduate studies at Kentucky institutions.)

3.

(a) Student Name

(b) Student

(c) Name and Address

(d) Qualified Expenses

SSN

of Kentucky Institution

(See federal instructions)

4. Add the amounts on line 3, column (d) and enter total here ........................................................... 4

5. Enter the smaller of line 4 or $10,000 ................................................................................................ 5

6. Tentative Lifetime Learning Credit. Multiply line 5 by 20% (.20), enter here, and go to Part IV ... 6

PART IV—Allowable Education Credits

7. Tentative education credits. Add lines 2 and 6 ................................................................................. 7

8. Enter decimal amount from federal Form 8863, line 12 ................................................................... 8

Note: If federal Form 8863, line 12, is blank, skip line 8 and enter amount from line 7 on line 9.

9. Multiply line 7 by decimal amount on line 8 and enter here ........................................................... 9

10. Multiply amount on line 9 by 25% (.25) and enter total here. This is your allowable

Kentucky Education Tuition Tax Credit .............................................................................................. 10

11. Enter the tentative tax from Form 740, page 1, line 22 (Form 740-NP, page 1, line 22) ................ 11

12. Enter the smaller of line 10 or line 11 here and on Form 740, page 1, line 23

(Form 740-NP, page 1, line 23) ............................................................................................................ 12

13. If line 11 is less than line 10, subtract line 11 from line 10 and enter here. This is the amount

of credit available for carry forward to your 2006 Kentucky return ................................................ 13

1

1