Form Bq-1 - Statement Form Of Estimated Tax Due

ADVERTISEMENT

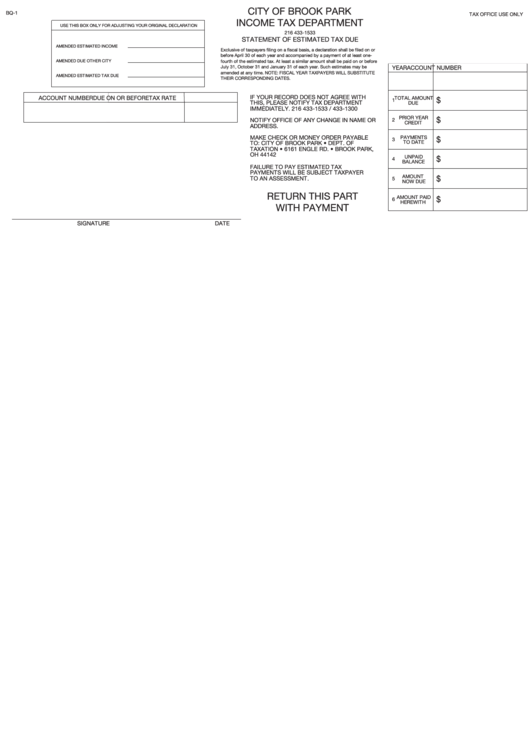

CITY OF BROOK PARK

BQ-1

TAX OFFICE USE ONLY

INCOME TAX DEPARTMENT

USE THIS BOX ONLY FOR ADJUSTING YOUR ORIGINAL DECLARATION

216 433-1533

STATEMENT OF ESTIMATED TAX DUE

AMENDED ESTIMATED INCOME

Exclusive of taxpayers filing on a fiscal basis, a declaration shall be filed on or

before April 30 of each year and accompanied by a payment of at least one-

AMENDED DUE OTHER CITY

fourth of the estimated tax. At least a similar amount shall be paid on or before

July 31, October 31 and January 31 of each year. Such estimates may be

YEAR

ACCOUNT NUMBER

amended at any time. NOTE: FISCAL YEAR TAXPA YERS WILL SUBSTITUTE

AMENDED ESTIMATED TAX DUE

THEIR CORRESPONDING DATES.

IF YOUR RECORD DOES NOT AGREE WITH

ACCOUNT NUMBER

DUE ON OR BEFORE

TAX RATE

TOTAL AMOUNT

$

1

THIS, PLEASE NOTIFY TAX DEPARTMENT

DUE

IMMEDIATELY . 216 433-1533 / 433-1300

PRIOR YEAR

$

NOTIFY OFFICE OF ANY CHANGE IN NAME OR

2

CREDIT

ADDRESS.

MAKE CHECK OR MONEY ORDER PAYABLE

PAYMENTS

$

3

TO DATE

TO: CITY OF BROOK PARK • DEPT. OF

TA XATION • 6161 ENGLE RD. • BROOK PARK,

OH 44142

UNPAID

$

4

BALANCE

FAILURE TO PAY ESTIMATED TAX

PAYMENTS WILL BE SUBJECT TAXPAYER

AMOUNT

$

TO AN ASSESSMENT.

5

NOW DUE

RETURN THIS PART

AMOUNT PAID

$

6

HEREWITH

WITH PAYMENT

SIGNATURE

DATE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1