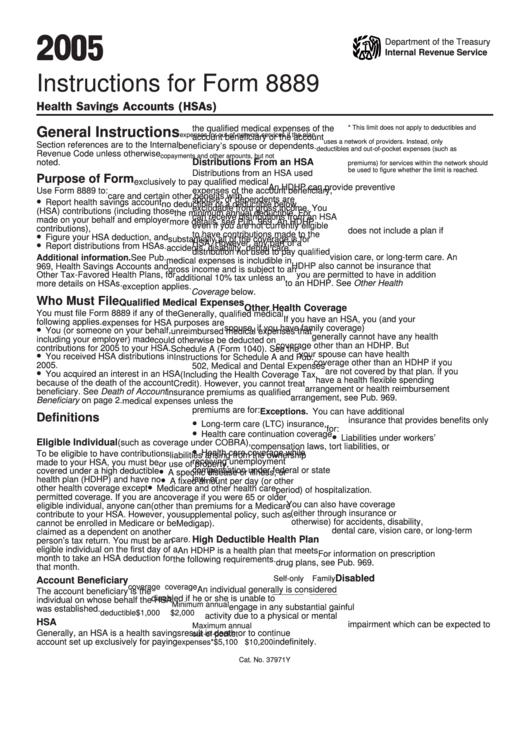

Instructions For Form 8889 - Health Savings Accounts - 2005

ADVERTISEMENT

05

2 0

Department of the Treasury

Internal Revenue Service

Instructions for Form 8889

Health Savings Accounts (HSAs)

the qualified medical expenses of the

* This limit does not apply to deductibles and

General Instructions

expenses for out-of-network services if the plan

account beneficiary or the account

uses a network of providers. Instead, only

Section references are to the Internal

beneficiary’s spouse or dependents.

deductibles and out-of-pocket expenses (such as

Revenue Code unless otherwise

copayments and other amounts, but not

Distributions From an HSA

noted.

premiums) for services within the network should

be used to figure whether the limit is reached.

Distributions from an HSA used

Purpose of Form

exclusively to pay qualified medical

An HDHP can provide preventive

expenses of the account beneficiary,

Use Form 8889 to:

care and certain other benefits with

•

spouse, or dependents are

Report health savings account

no deductible or a deductible below

excludable from gross income. You

(HSA) contributions (including those

the minimum annual deductible. For

can receive distributions from an HSA

made on your behalf and employer

more details, see Pub. 969. An HDHP

even if you are not currently eligible

contributions),

does not include a plan if

•

to have contributions made to the

Figure your HSA deduction, and

substantially all of the coverage is for

•

HSA. However, any part of a

Report distributions from HSAs.

accidents, disability, dental care,

distribution not used to pay qualified

vision care, or long-term care. An

Additional information. See Pub.

medical expenses is includible in

HDHP also cannot be insurance that

969, Health Savings Accounts and

gross income and is subject to an

Other Tax-Favored Health Plans, for

you are permitted to have in addition

additional 10% tax unless an

to an HDHP. See Other Health

more details on HSAs.

exception applies.

Coverage below.

Who Must File

Qualified Medical Expenses

Other Health Coverage

You must file Form 8889 if any of the

Generally, qualified medical

If you have an HSA, you (and your

following applies.

expenses for HSA purposes are

•

spouse, if you have family coverage)

You (or someone on your behalf,

unreimbursed medical expenses that

generally cannot have any health

including your employer) made

could otherwise be deducted on

coverage other than an HDHP. But

contributions for 2005 to your HSA.

Schedule A (Form 1040). See the

•

your spouse can have health

You received HSA distributions in

Instructions for Schedule A and Pub.

coverage other than an HDHP if you

2005.

502, Medical and Dental Expenses

•

are not covered by that plan. If you

You acquired an interest in an HSA

(Including the Health Coverage Tax

have a health flexible spending

because of the death of the account

Credit). However, you cannot treat

arrangement or health reimbursement

beneficiary. See Death of Account

insurance premiums as qualified

arrangement, see Pub. 969.

Beneficiary on page 2.

medical expenses unless the

premiums are for:

Exceptions. You can have additional

Definitions

•

insurance that provides benefits only

Long-term care (LTC) insurance,

for:

•

•

Health care continuation coverage

Liabilities under workers’

Eligible Individual

(such as coverage under COBRA),

compensation laws, tort liabilities, or

•

Health care coverage while

To be eligible to have contributions

liabilities arising from the ownership

receiving unemployment

made to your HSA, you must be

or use of property,

•

compensation under federal or state

covered under a high deductible

A specific disease or illness, or

•

law, or

health plan (HDHP) and have no

A fixed amount per day (or other

•

other health coverage except

Medicare and other health care

period) of hospitalization.

permitted coverage. If you are an

coverage if you were 65 or older

You can also have coverage

eligible individual, anyone can

(other than premiums for a Medicare

(either through insurance or

contribute to your HSA. However, you

supplemental policy, such as

otherwise) for accidents, disability,

cannot be enrolled in Medicare or be

Medigap).

dental care, vision care, or long-term

claimed as a dependent on another

High Deductible Health Plan

care.

person’s tax return. You must be an

eligible individual on the first day of a

An HDHP is a health plan that meets

For information on prescription

month to take an HSA deduction for

the following requirements.

drug plans, see Pub. 969.

that month.

Disabled

Self-only

Family

Account Beneficiary

coverage coverage

An individual generally is considered

The account beneficiary is the

disabled if he or she is unable to

individual on whose behalf the HSA

Minimum annual

engage in any substantial gainful

was established.

deductible

$1,000

$2,000

activity due to a physical or mental

HSA

impairment which can be expected to

Maximum annual

Generally, an HSA is a health savings

result in death or to continue

out-of-pocket

account set up exclusively for paying

indefinitely.

expenses*

$5,100 $10,200

Cat. No. 37971Y

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5