Instructions For Form 1040x - Amended U.s. Individual Income Tax Return - 2007

ADVERTISEMENT

Department of the Treasury

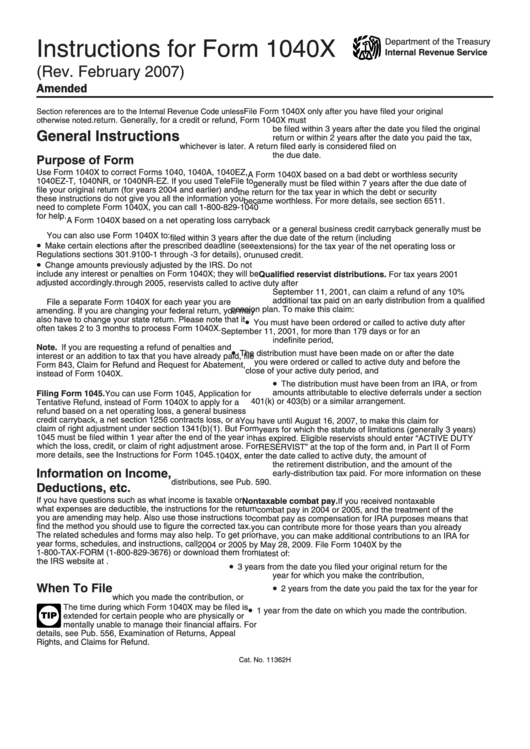

Instructions for Form 1040X

Internal Revenue Service

(Rev. February 2007)

Amended U.S. Individual Income Tax Return

File Form 1040X only after you have filed your original

Section references are to the Internal Revenue Code unless

return. Generally, for a credit or refund, Form 1040X must

otherwise noted.

be filed within 3 years after the date you filed the original

General Instructions

return or within 2 years after the date you paid the tax,

whichever is later. A return filed early is considered filed on

the due date.

Purpose of Form

Use Form 1040X to correct Forms 1040, 1040A, 1040EZ,

A Form 1040X based on a bad debt or worthless security

1040EZ-T, 1040NR, or 1040NR-EZ. If you used TeleFile to

generally must be filed within 7 years after the due date of

file your original return (for years 2004 and earlier) and

the return for the tax year in which the debt or security

these instructions do not give you all the information you

became worthless. For more details, see section 6511.

need to complete Form 1040X, you can call 1-800-829-1040

for help.

A Form 1040X based on a net operating loss carryback

or a general business credit carryback generally must be

You can also use Form 1040X to:

filed within 3 years after the due date of the return (including

•

Make certain elections after the prescribed deadline (see

extensions) for the tax year of the net operating loss or

Regulations sections 301.9100-1 through -3 for details), or

unused credit.

•

Change amounts previously adjusted by the IRS. Do not

include any interest or penalties on Form 1040X; they will be

Qualified reservist distributions. For tax years 2001

adjusted accordingly.

through 2005, reservists called to active duty after

September 11, 2001, can claim a refund of any 10%

additional tax paid on an early distribution from a qualified

File a separate Form 1040X for each year you are

pension plan. To make this claim:

amending. If you are changing your federal return, you may

•

also have to change your state return. Please note that it

You must have been ordered or called to active duty after

often takes 2 to 3 months to process Form 1040X.

September 11, 2001, for more than 179 days or for an

indefinite period,

Note. If you are requesting a refund of penalties and

•

The distribution must have been made on or after the date

interest or an addition to tax that you have already paid, file

you were ordered or called to active duty and before the

Form 843, Claim for Refund and Request for Abatement,

close of your active duty period, and

instead of Form 1040X.

•

The distribution must have been from an IRA, or from

amounts attributable to elective deferrals under a section

Filing Form 1045. You can use Form 1045, Application for

401(k) or 403(b) or a similar arrangement.

Tentative Refund, instead of Form 1040X to apply for a

refund based on a net operating loss, a general business

credit carryback, a net section 1256 contracts loss, or a

You have until August 16, 2007, to make this claim for

claim of right adjustment under section 1341(b)(1). But Form

years for which the statute of limitations (generally 3 years)

1045 must be filed within 1 year after the end of the year in

has expired. Eligible reservists should enter “ACTIVE DUTY

which the loss, credit, or claim of right adjustment arose. For

RESERVIST” at the top of the form and, in Part II of Form

more details, see the Instructions for Form 1045.

1040X, enter the date called to active duty, the amount of

the retirement distribution, and the amount of the

Information on Income,

early-distribution tax paid. For more information on these

distributions, see Pub. 590.

Deductions, etc.

If you have questions such as what income is taxable or

Nontaxable combat pay. If you received nontaxable

what expenses are deductible, the instructions for the return

combat pay in 2004 or 2005, and the treatment of the

you are amending may help. Also use those instructions to

combat pay as compensation for IRA purposes means that

find the method you should use to figure the corrected tax.

you can contribute more for those years than you already

The related schedules and forms may also help. To get prior

have, you can make additional contributions to an IRA for

year forms, schedules, and instructions, call

2004 or 2005 by May 28, 2009. File Form 1040X by the

1-800-TAX-FORM (1-800-829-3676) or download them from

latest of:

the IRS website at

•

3 years from the date you filed your original return for the

year for which you make the contribution,

•

When To File

2 years from the date you paid the tax for the year for

which you made the contribution, or

The time during which Form 1040X may be filed is

•

1 year from the date on which you made the contribution.

TIP

extended for certain people who are physically or

mentally unable to manage their financial affairs. For

details, see Pub. 556, Examination of Returns, Appeal

Rights, and Claims for Refund.

Cat. No. 11362H

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7