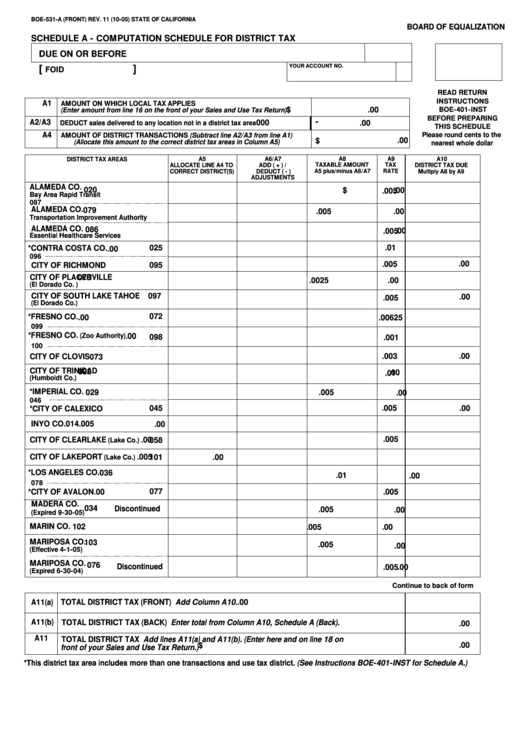

BOE-531-A (FRONT) REV. 11 (10-05)

STATE OF CALIFORNIA

BOARD OF EQUALIZATION

SCHEDULE A - COMPUTATION SCHEDULE FOR DISTRICT TAX

DUE ON OR BEFORE

[

]

YOUR ACCOUNT NO.

FOID

READ RETURN

INSTRUCTIONS

A1

AMOUNT ON WHICH LOCAL TAX APPLIES

$

.00

BOE-401-INST

(Enter amount from line 16 on the front of your Sales and Use Tax Return)

BEFORE PREPARING

-

A2/A3

000

.00

DEDUCT sales delivered to any location not in a district tax area

THIS SCHEDULE

A4

Please round cents to the

AMOUNT OF DISTRICT TRANSACTIONS (Subtract line A2/A3 from line A1)

$

.00

(Allocate this amount to the correct district tax areas in Column A5)

nearest whole dollar

A5

A6/A7

A8

A9

A10

DISTRICT TAX AREAS

TAXABLE AMOUNT

TAX

ALLOCATE LINE A4 TO

ADD ( + ) /

DISTRICT TAX DUE

A5 plus/minus A6/A7

RATE

CORRECT DISTRICT(S)

DEDUCT ( - )

Multiply A8 by A9

ADJUSTMENTS

ALAMEDA CO.

020

$

.00

.005

Bay Area Rapid Transit

087

ALAMEDA CO.

079

.005

.00

Transportation Improvement Authority

ALAMEDA CO.

086

.005

.00

Essential Healthcare Services

.01

*CONTRA COSTA CO.

025

.00

096

.005

.00

CITY OF RICHMOND

095

CITY OF PLACERVILLE

070

.0025

.00

(El Dorado Co. )

CITY OF SOUTH LAKE TAHOE

097

.00

.005

(El Dorado Co.)

*FRESNO CO.

072

.00625

.00

099

*FRESNO CO.

(Zoo Authority)

.00

098

.001

100

.003

.00

CITY OF CLOVIS

073

CITY OF TRINIDAD

092

.00

.01

(Humboldt Co.)

*IMPERIAL CO.

029

.005

.00

046

.005

045

.00

*CITY OF CALEXICO

INYO CO.

014

.005

.00

.005

CITY OF CLEARLAKE

058

.00

(Lake Co.)

CITY OF LAKEPORT

.005

.00

101

(Lake Co.)

*LOS ANGELES CO.

036

.01

.00

078

077

.005

*CITY OF AVALON

.00

MADERA CO.

034

Discontinued

.005

.00

(Expired 9-30-05)

MARIN CO.

102

.005

.00

MARIPOSA CO.

103

.005

.00

(Effective 4-1-05)

MARIPOSA CO.

076

Discontinued

.005

.00

(Expired 6-30-04)

Continue to back of form

A11(a)

TOTAL DISTRICT TAX (FRONT) Add Column A10.

.00

A11(b) TOTAL DISTRICT TAX (BACK) Enter total from Column A10, Schedule A (Back).

.00

A11

TOTAL DISTRICT TAX Add lines A11(a) and A11(b). (Enter here and on line 18 on

$

.00

front of your Sales and Use Tax Return.)

*This district tax area includes more than one transactions and use tax district. (See Instructions BOE-401-INST for Schedule A.)

1

1 2

2