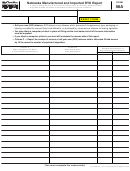

Column D

Column A

Column C

Column B

Total Number of Ounces of

Name of Supplier From Whom

Total Number of Individual

Brand Family Name of Cigarettes

RYO Tobacco Sold in Nebraska

You Purchased the Cigarettes

Cigarettes Stamped and Sold in

or RYO Tobacco

Ounces

Equivalent

or RYO Tobacco

Nebraska for Each Brand

1 Total number of individual cigarettes and ounces/equivalent

cigarettes of RYO tobacco (total of all lines in Columns C and D or

from your attached printout). Do not add lines 1 and 1a together............ 1

1a

2 Enter the total number of individual cigarettes reported on Form 55

for the same tax period covered by this report (total of line 20 or 26

multiplied by 20 plus the total of line 20A or 26A multiplied by 25).......... 2

3 Subtract line 2 from line 1 ........................................................................ 3

Please explain any difference in the number of cigarettes.

You must provide the name of an individual that the Department of Revenue or Attorney General’s Office may contact for the purpose of

obtaining information regarding this report.

Name of Authorized Contact Person

Title

(

)

(

)

Daytime Telephone Number

FAX Number

E-mail Address

Under penalties of law, I declare that I have examined this report, including accompanying schedules and statements, and

to the best of my knowledge and belief, it is correct and complete.

sign

here

Authorized Signature

Authorized Signature

Authorized Signature

Authorized Signature

Signature of Preparer Other than Taxpayer

Signature of Preparer Other than Taxpayer

Signature of Preparer Other than Taxpayer

Signature of Preparer Other than Taxpayer

Title

Date

Address

Date

Check our Web site for the Directory of Cigarettes and Roll-Your-Own Tobacco Products that are approved for sale in Nebraska

.

INSTRUCTIONS

together and enter that number for each brand family on

COLUMN A. Print the name of the supplier from whom

the corresponding line under Column C.

your company purchased each brand family of cigarettes

that your company stamped and sold in Nebraska for the

COLUMN D. Enter the total number of ounces of RYO

tax period covered by this report and any roll-your-own

tobacco products by brand family that your company

(RYO) tobacco that was reported on your Nebraska Tobacco

reported on Form 56 and sold in Nebraska.

Products Tax Return, Form 56, and sold to customers in

Convert the number of ounces to equivalent cigarettes. To

Nebraska.

convert ounces to equivalent cigarettes divide ounces by .09.

COLUMN B. Print the brand family name of the RYO

Roll-your-own (RYO) tobacco. RYO tobacco is any

tobacco sold in Nebraska and any cigarettes that you

tobacco which, because of its appearance, type, packaging,

stamped and sold in Nebraska.

or labeling is suitable for use and likely to be offered to, or

COLUMN C. Enter the total number of individual cigarettes

purchased by, consumers as tobacco for making cigarettes.

by brand family that your company stamped and sold

LINE 2. Enter the total number of individual cigarettes

in Nebraska to consumers, retailers, and other Nebraska

stamped and sold as reported on your Nebraska Cigarette

licensed cigarette wholesale dealers.

Tax Report, Form 55, for the same tax period. To calculate

Example: Determine the total number of packs or

the number of individual cigarettes to report on line 2, add

cartons of each brand family of cigarettes stamped

together the number of packs reported on line 20 or line 26

for Company X. Multiply the total number of packs

and line 20a or line 26a, Form 55, multiplied by 20 and 25

or cartons of cigarettes by the number of individual

cigarettes respectively. Add these two amounts together and

cigarettes in each pack or carton. Add these numbers

report the total number of individual cigarettes on line 2.

Mail this form to: NEBRASKA DEPARTMENT OF REVENUE, P.O. BOX 94818, LINCOLN, NE 68509-4818

1

1 2

2