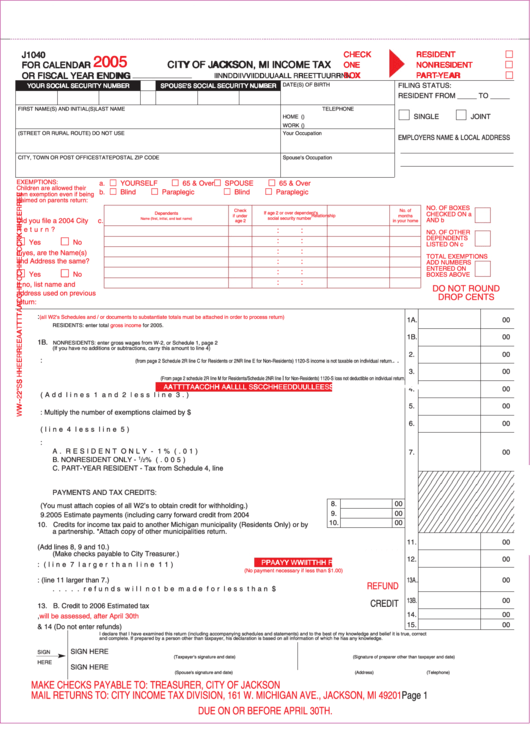

Form J1040 - Income Tax Individual Return - City Of Jackson - 2005

ADVERTISEMENT

□

J J 1 1 0 0 4 4 0 0

C C H H E E C C K K

R R E E S S I I D D E E N N T T

2 2 0 0 0 0 5 5

C C I I T T Y Y O O F F J J A A C C K K S S O O N N , , M M I I I I N N C C O O M M E E T T A A X X

□

F F O O R R C C A A L L E E N N D D A A R R

O O N N E E

N N O O N N R R E E S S I I D D E E N N T T

□

O O R R F F I I S S C C A A L L Y Y E E A A R R E E N N D D I I N N G G

B B O O X X

P P A A R R T T - - Y Y E E A A R R

I I N N D D I I V V I I D D U U A A L L R R E E T T U U R R N N

DATE(S) OF BIRTH

FILING STATUS:

Y Y O O U U R R S S O O C C I I A A L L S S E E C C U U R R I I T T Y Y N N U U M M B B E E R R

S S P P O O U U S S E E ' ' S S S S O O C C I I A A L L S S E E C C U U R R I I T T Y Y N N U U M M B B E E R R

RESIDENT FROM _____ TO _____

FIRST NAME(S) AND INITIAL(S)

LAST NAME

TELEPHONE

SINGLE

JOINT

HOME (

)

WORK (

)

(STREET OR RURAL ROUTE) DO NOT USE P.O. BOX

Your Occupation

EMPLOYERS NAME & LOCAL ADDRESS

_____________________________

CITY, TOWN OR POST OFFICE

STATE

POSTAL ZIP CODE

Spouse's Occupation

_____________________________

EXEMPTIONS:

a. □ YOURSELF

□ 65 & Over

□ SPOUSE

□ 65 & Over

Children are allowed their

b. □ Blind

□ Paraplegic

□ Blind

□ Paraplegic

own exemption even if being

claimed on parents return:

NO. OF BOXES

Check

No. of

Dependents

If age 2 or over dependent's

CHECKED ON a

if under

Relationship

months

social security number

Name (first, initial, and last name)

Did you file a 2004 City

c.

AND b

age 2

in your home

Return? . . . . . . . . . . . .

:

:

NO. OF OTHER

DEPENDENTS

□

□

:

:

Yes

No

LISTED ON c

:

:

If yes, are the Name(s)

TOTAL EXEMPTIONS

and Address the same?

:

:

ADD NUMBERS

ENTERED ON

:

:

□

□

Yes

No

BOXES ABOVE

:

:

If no, list name and

DO NOT ROUND

address used on previous

DROP CENTS

return: . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1A. TOTAL INCOME:

(all W2's Schedules and / or documents to substantiate totals must be attached in order to process return)

1A.

00

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

RESIDENTS: enter total

gross income

for 2005.

1B.

00

1B.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

NONRESIDENTS: enter gross wages from W-2, or Schedule 1, page 2

(If you have no additions or subtractions, carry this amount to line 4)

2.

00

2. ADDITIONS TO INCOME:

. .

(from page 2 Schedule 2R line C for Residents or 2NR line E for Non-Residents) 1120-S income is not taxable on individual return.

I

3.

00

3. SUBTRACTIONS FROM INCOME

(From page 2 schedule 2R line M for Residents/Schedule 2NR line

for Non-Residents) 1120-S loss not deductible on individual return.

A A T T T T A A C C H H A A L L L L S S C C H H E E D D U U L L E E S S A A N N D D E E X X P P L L A A N N A A T T I I O O N N S S

4.

00

4. ADJUSTED INCOME (Add lines 1 and 2 less line 3.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5.

00

5. EXEMPTIONS: Multiply the number of exemptions claimed by $600.00. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6.

00

6. TAXABLE INCOME (line 4 less line 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7. TAX - Multiply amount on line 6 by one of the following:

A. RESIDENT ONLY - 1% (.01) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7.

00

1

B. NONRESIDENT ONLY -

/

% (.005). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

C. PART-YEAR RESIDENT - Tax from Schedule 4, line M . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

PAYMENTS AND TAX CREDITS:

8.

00

8. Jackson tax withheld (You must attach copies of all W2’s to obtain credit for withholding.)

9.

00

9. 2005 Estimate payments (including carry forward credit from 2004 J-1040 . . . . . . . . . . .

10.

00

10. Credits for income tax paid to another Michigan municipality (Residents Only) or by

a partnership. *Attach copy of other municipalities return.

11.

00

11. TOTAL PAYMENTS AND CREDITS (Add lines 8, 9 and 10.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(Make checks payable to City Treasurer.)

12.

00

P P A A Y Y W W I I T T H H R R E E T T U U R R N N

12. BALANCE DUE: (line 7 larger than line 11) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(No payment necessary if less than $1.00)

13. A. REFUND: (line 11 larger than 7.)

13A..

00

REFUND

. . . . . refunds will not be made for less than $1.00. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13B.

00

CREDIT

13. B. Credit to 2006 Estimated tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14.

00

14. Interest and penalty,

will be assessed, after April 30th

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15.

00

15. TOTAL AMOUNT DUE add lines 12 & 14 (Do not enter refunds) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

I declare that I have examined this return (including accompanying schedules and statements) and to the best of my knowledge and belief it is true, correct

and complete. If prepared by a person other than taxpayer, his declaration is based on all information of which he has any knowledge.

SIGN HERE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

SIGN

(Taxpayer's signature and date)

(Signature of preparer other than taxpayer and date)

HERE

SIGN HERE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(Spouse's signature and date)

(Address)

(Telephone)

MAKE CHECKS PAYABLE TO: TREASURER, CITY OF JACKSON

MAIL RETURNS TO: CITY INCOME TAX DIVISION, 161 W. MICHIGAN AVE., JACKSON, MI 49201

Page 1

DUE ON OR BEFORE APRIL 30TH.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4