INSTRUCTIONS

WHO MUST FILE. The fi rst owner of tobacco products other

VERIFICATION AND AUDIT. Records to substantiate this

than cigarettes in Nebraska must fi le a Nebraska Tobacco Products

return, the Nebraska Schedule I, and Form 55A must be retained

Tax Return, Form 56, for each tax period. The fi rst owner of

and be available for a period of at least three years after the due

tobacco products in Nebraska cannot transfer the tax liability

date of the return.

to any other person who holds a tobacco products license (i.e.,

SPECIFIC INSTRUCTIONS

tobacco products cannot be sold tax-free between persons who

LINE 1. Enter the total net invoice amount of all tobacco products

hold tobacco products licenses). Tobacco products include cigars,

other than cigarettes imported into Nebraska this month plus the

roll-your-own tobacco, cheroots, stogies, periques, granulated,

total amount of tobacco products manufactured and sold to others

plug cut, crimp cut, ready rubbed, and other smoking tobacco,

in this state from Nebraska Schedule I, Form 56, line 1.

snuff, snuff fl our, cavendish, plug and twist tobacco, fi ne cut and

LINE 2. Enter the total net invoice amount of all tobacco products

other chewing tobacco, shorts, refuse scraps, clippings, cuttings,

other than cigarettes exported to other states from Nebraska

and sweepings of tobacco, and other kinds and forms of tobacco,

Schedule I, Form 56, line 2. Any amount of tobacco products

prepared in such manner as to be suitable for chewing or smoking

claimed as an export on this line must have been included on line 1

in a pipe or otherwise.

of this return or on a prior return.

The fi rst owner is any person engaged in the business of selling

LINE 3. Enter the total net invoice amount of all tobacco products other

tobacco products in this state who imports or causes to be imported

than cigarettes sold to the federal government or its agencies. Retain

into Nebraska tobacco products to be sold in this state, and any

evidence of sale to the federal government with your records.

person who makes, manufactures, or fabricates and sells tobacco

products in Nebraska. The fi rst owner of tobacco products in this

LINE 9. Credit is allowed for the tax paid on tobacco products other

state includes retailers who purchase directly from nonlicensed

than cigarettes which are returned to the manufacturer as unsalable.

suppliers located outside Nebraska. Suppliers of tobacco products

Credit memoranda for returned tobacco products are issued by

other than cigarettes engaged in business outside Nebraska may

the Nebraska Department of Revenue and must be attached to the

obtain a tobacco products license. Out-of-state suppliers who

Nebraska Tobacco Products Tax Return, Form 56, on which credit

obtain a tobacco products license become the fi rst owners of the

is claimed. Do not attach the manufacturer’s affi davit or claim

tobacco products imported into Nebraska.

credit before the credit memorandum has been issued.

WHEN AND WHERE TO FILE. This return, properly signed

Credit for the tax paid by the retailer will also be given for tobacco

and accompanied by check or money order payable to the

products sold tax-free to reservation Indians where transfer of title

Nebraska Department of Revenue, will be considered timely fi led

and possession occur within the boundaries of an Indian reservation

if postmarked on or before the tenth day of the month following

in Nebraska. Retailers must complete a Nebraska Refund Claim

the month covered by the return. A return is required even if no

for Cigarettes Sold to Native American Indians, Form 68. Form 68

tobacco products tax is due.

must be attached to the Nebraska Tobacco Products Tax Return,

Form 56.

Mail this return and payment to the Nebraska Department of

Revenue, P.O. Box 94818, Lincoln, Nebraska 68509-4818.

LINE 11. A balance due resulting from a partial payment,

mathematical or clerical errors, and interest relating to prior returns

PREIDENTIFIED RETURN. This return is to be used only by the

will be entered in this space by the department. The amount of

tobacco products licensee whose name is printed on it. If you have

not received a preidentifi ed return for a reporting period, request

interest includes interest on unpaid tax through the due date of this

return. If the amount due is paid before the due date, the interest

a duplicate from the department. Do not fi le returns which have

will be recomputed and a credit will be given on your next return.

not been preidentifi ed. If the business name, location, or mailing

If the amount entered has been paid by a previous remittance, it

address is not correct, mark through the incorrect information and

should be disregarded when computing the amount to remit on

plainly print the correct information.

line 12. A credit will be indicated by the word “subtract” and can

INTEREST. Interest on the unpaid tax will be assessed at the

be subtracted from the amount due on line 10. If line 11 shows an

rate printed on line 11 from the due date until the date payment

amount due, add that amount to line 10.

is received.

LINE 12. Attach a check or money order payable to the Nebraska

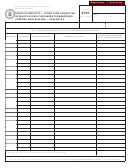

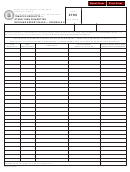

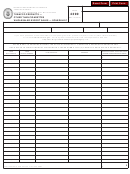

NEBRASKA SCHEDULE I

Department of Revenue for the amount reported on line 12.

Tobacco Products Imported or

NEBRASKA CIGARETTE DIRECTORY. Y. Y Check our Web

Manufactured and Exported

site for the “Nebraska Directory of Certifi ed Tobacco Product

A Nebraska Schedule I, Form 56, is supplied with each

Manufacturers and Brands” that are approved for sale in Nebraska.

preidentifi ed tax return. The schedule provides space to record

Any cigarettes or RYO tobacco not included on the Directory that

pertinent information on tobacco products other than cigarettes

have been sold, offered for sale, or possessed for sale in this state,

imported or caused to be imported into Nebraska and tobacco

shall be deemed contraband and subject to seizure and forfeiture.

products manufactured and sold in this state. The schedule must

It is necessary to review our Web site on a continuing basis to be

be completed and attached to the return.

aware of changes made to this Directory.

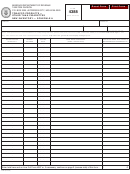

Nebraska Manufactured and Imported Cigarette Report,

SIGNATURES. This return must be signed by the owner, partner,

Form 55A. A Form 55A is supplied with each Form 56. This form is

or corporate offi cer. If the taxpayer authorizes another person to

required to be completed to report any roll-your-own (RYO) tobacco

sign this return, there must be a power of attorney on fi le with the

reported on this Form 56 and sold to customers in Nebraska. RYO

department.

is any tobacco which, because of its appearance, type, packaging, or

labeling is suitable for use and likely to be offered to, or purchased

Any person who is paid for preparing a taxpayer’s return must also

by, consumers as tobacco for making cigarettes.

sign the return as preparer.

1

1 2

2