Form 872-T - Instructions For Internal Revenue Service Employees

ADVERTISEMENT

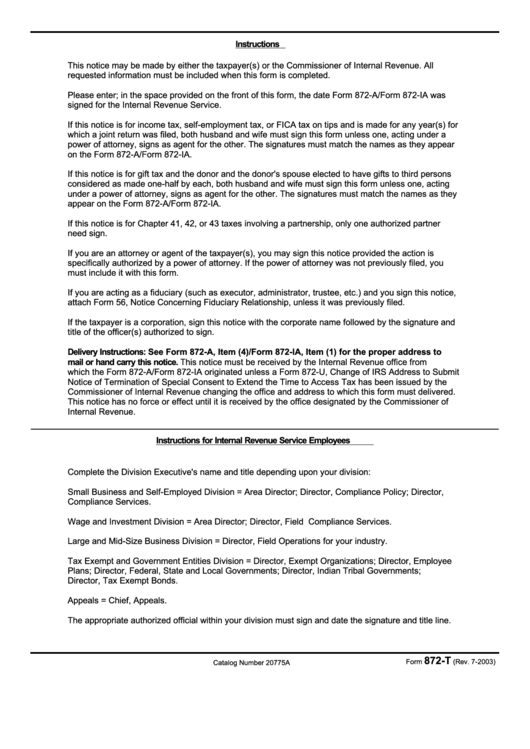

Instructions

This notice may be made by either the taxpayer(s) or the Commissioner of Internal Revenue. All

requested information must be included when this form is completed.

Please enter; in the space provided on the front of this form, the date Form 872-A/Form 872-IA was

signed for the Internal Revenue Service.

If this notice is for income tax, self-employment tax, or FICA tax on tips and is made for any year(s) for

which a joint return was filed, both husband and wife must sign this form unless one, acting under a

power of attorney, signs as agent for the other. The signatures must match the names as they appear

on the Form 872-A/Form 872-IA.

If this notice is for gift tax and the donor and the donor's spouse elected to have gifts to third persons

considered as made one-half by each, both husband and wife must sign this form unless one, acting

under a power of attorney, signs as agent for the other. The signatures must match the names as they

appear on the Form 872-A/Form 872-IA.

If this notice is for Chapter 41, 42, or 43 taxes involving a partnership, only one authorized partner

need sign.

If you are an attorney or agent of the taxpayer(s), you may sign this notice provided the action is

specifically authorized by a power of attorney. If the power of attorney was not previously filed, you

must include it with this form.

If you are acting as a fiduciary (such as executor, administrator, trustee, etc.) and you sign this notice,

attach Form 56, Notice Concerning Fiduciary Relationship, unless it was previously filed.

If the taxpayer is a corporation, sign this notice with the corporate name followed by the signature and

title of the officer(s) authorized to sign.

Delivery Instructions: See Form 872-A, Item (4)/Form 872-IA, Item (1) for the proper address to

mail or hand carry this notice. This notice must be received by the Internal Revenue office from

which the Form 872-A/Form 872-IA originated unless a Form 872-U, Change of IRS Address to Submit

Notice of Termination of Special Consent to Extend the Time to Access Tax has been issued by the

Commissioner of Internal Revenue changing the office and address to which this form must delivered.

This notice has no force or effect until it is received by the office designated by the Commissioner of

Internal Revenue.

Instructions for Internal Revenue Service Employees

Complete the Division Executive's name and title depending upon your division:

Small Business and Self-Employed Division = Area Director; Director, Compliance Policy; Director,

Compliance Services.

Wage and Investment Division = Area Director; Director, Field Compliance Services.

Large and Mid-Size Business Division = Director, Field Operations for your industry.

Tax Exempt and Government Entities Division = Director, Exempt Organizations; Director, Employee

Plans; Director, Federal, State and Local Governments; Director, Indian Tribal Governments;

Director, Tax Exempt Bonds.

Appeals = Chief, Appeals.

The appropriate authorized official within your division must sign and date the signature and title line.

872-T

Form

(Rev. 7-2003)

Catalog Number 20775A

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Life

1

1