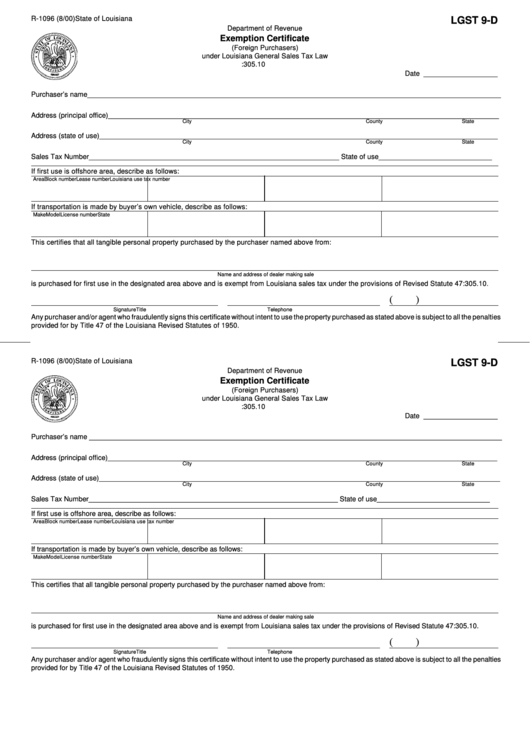

Form Lgst 9-D - Exemption Certificate (Foreign Purchasers) Under Louisiana General Sales Tax Law R.s. 47:305.10 - Department Of Revenue Of State Of Louisiana

ADVERTISEMENT

R-1096 (8/00)

State of Louisiana

LGST 9-D

Department of Revenue

Exemption Certificate

(Foreign Purchasers)

under Louisiana General Sales Tax Law

R.S. 47:305.10

Date ___________________

Purchaser’s name __________________________________________________________________________________________________________

Address (principal office) ____________________________________________________________________________________________________

City

County

State

Address (state of use) ______________________________________________________________________________________________________

City

County

State

Sales Tax Number ________________________________________________________________ State of use _____________________________

If first use is offshore area, describe as follows:

Area

Block number

Lease number

Louisiana use tax number

If transportation is made by buyer’s own vehicle, describe as follows:

Make

Model

License number

State

This certifies that all tangible personal property purchased by the purchaser named above from:

Name and address of dealer making sale

is purchased for first use in the designated area above and is exempt from Louisiana sales tax under the provisions of Revised Statute 47:305.10.

(

)

Signature

Title

Telephone

Any purchaser and/or agent who fraudulently signs this certificate without intent to use the property purchased as stated above is subject to all the penalties

provided for by Title 47 of the Louisiana Revised Statutes of 1950.

R-1096 (8/00)

State of Louisiana

LGST 9-D

Department of Revenue

Exemption Certificate

(Foreign Purchasers)

under Louisiana General Sales Tax Law

R.S. 47:305.10

Date ___________________

Purchaser’s name __________________________________________________________________________________________________________

Address (principal office) ____________________________________________________________________________________________________

City

County

State

Address (state of use) _______________________________________________________________________________________________________

City

County

State

Sales Tax Number ________________________________________________________________ State of use _____________________________

If first use is offshore area, describe as follows:

Area

Block number

Lease number

Louisiana use tax number

If transportation is made by buyer’s own vehicle, describe as follows:

Make

Model

License number

State

This certifies that all tangible personal property purchased by the purchaser named above from:

Name and address of dealer making sale

is purchased for first use in the designated area above and is exempt from Louisiana sales tax under the provisions of Revised Statute 47:305.10.

(

)

Signature

Title

Telephone

Any purchaser and/or agent who fraudulently signs this certificate without intent to use the property purchased as stated above is subject to all the penalties

provided for by Title 47 of the Louisiana Revised Statutes of 1950.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1