BOE-571-L (S3B) REV. 10 (8-05)

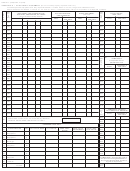

Part II: DECLARATION OF PROPERTY BELONGING TO YOU

Report book cost (100 percent of actual cost). Include excise, sales, and use taxes, freight-in, installation charges, and all

other relevant costs. Report any additional information which will assist the Assessor in arriving at a fair market value. Include

finance charges for buildings and improvements that are constructed or otherwise produced for an enterprise’s own use

(including assets constructed or produced by others) for which deposits or progress payments have been made. Do not

include finance charges for purchased equipment.

LINE 1. SUPPLIES. Report supplies on hand, such as stationery and office supplies, chemicals used to produce a chemical

or physical reaction, janitorial and lavatory supplies, fuel, sandpaper, etc., at their current replacement costs. Include medical,

legal, or accounting supplies held by a person in connection with a profession that is primarily a service activity. Do not

include supplies which will become a component part of the product you manufacture or sell.

LINE 2. EQUIPMENT. Enter total from Schedule A, line 35 (see instructions for Schedule A).

LINE 3. EQUIPMENT OUT ON LEASE, RENT, OR CONDITIONAL SALE TO OTHERS. Report cost on line 3 and attach

schedules showing the following (equipment actually out on lease or rent, equipment out on a conditional sale agreement, and

equipment held for lease or rent which you have used or intend to use must be reported). Equipment held for lease or rent and

not otherwise used by you is exempt and should not be reported.

Equipment out on lease, rent, or conditional sale. (1) Name and address of party in possession, (2) location of the

property, (3) quantity and description, (4) date of acquisition, (5) your cost, selling price, and annual rent, (6) lease or

identification number, (7) date and duration of lease, (8) how acquired (purchased, manufactured, or other — explain), (9)

whether a lease or a conditional sale agreement. If the property is used by a free public library or a free museum or is used

exclusively by a public school, community college, state college, state university, church, or a nonprofit college it may be

exempt from property taxes, provided the lessor’s exemption claim is filed by February 15. Obtain form BOE-263, Lessors’

Exemption Claim, from the Assessor. Also include equipment on your premises held for lease or rent which you have

used or intend to use. Report your cost and your selling price by year of acquisition.

LINE 4. BUILDINGS, BUILDING IMPROVEMENTS, AND/OR LEASEHOLD IMPROVEMENTS, LAND IMPROVEMENTS,

LAND AND LAND DEVELOPMENT. Enter total from Schedule B, line 71 (see instructions for Schedule B).

LINE 5. CONSTRUCTION IN PROGRESS. If you have unallocated costs of construction in progress for improvements to

land, machinery, equipment, furniture, buildings or other improvements, or leasehold improvements, attach an itemized listing.

Include all tangible property, even though not entered on your books and records. Enter the total on PART II, line 5.

LINE 6. ALTERNATE OR IN-LIEU SCHEDULE. If the Assessor enclosed form BOE-571-L, Alternate Schedule A, with this

property statement, complete the alternate schedule as directed and report the total cost on line 6.

LINES 7-8. OTHER. Describe and report the cost of tangible property not reported elsewhere on this form.

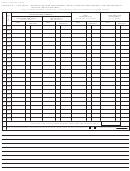

Part III: DECLARATION OF PROPERTY BELONGING TO OTHERS

If property belonging to others, or their business entities, is located on your premises, report the owner’s name and mailing

address. If it is leased equipment, read your agreement carefully and enter A (Lessor) or B (Lessee), and whether lessor or

lessee has the tax obligation. For assessment purposes, the Assessor will consider, but is not bound to, the contractual

agreement.

1.

LEASED EQUIPMENT. Report the year of acquisition, the year of manufacture, description of the leased property,

the lease contract number or other identification number, the total installed cost to purchase (including sales tax),

and the annual rent; do not include in Schedule A or B (see No. 3, below).

2.

LEASE-PURCHASE OPTION EQUIPMENT. Report here all equipment acquired on lease-purchase option on

which the final payment remains to be made. Enter the year of acquisition, the year of manufacture, description

of the leased property, the lease contract number or other identification number, the total installed cost to pur-

chase (including sales tax), and the annual rent. If final payment has been made, report full cost in Schedule A or

B (see No. 3, below).

3.

CAPITALIZED LEASED EQUIPMENT. Report here all leased equipment that has been capitalized at the present

value of the minimum lease payments on which a final payment remains to be made. Enter the year of acquisition,

the year of manufacture, description of the leased property, the lease contract number or other identification

number, and the total installed cost to purchase (including sales tax). Do not include in Schedule A or B unless

final payment has been made.

1

1 2

2 3

3 4

4 5

5 6

6 7

7