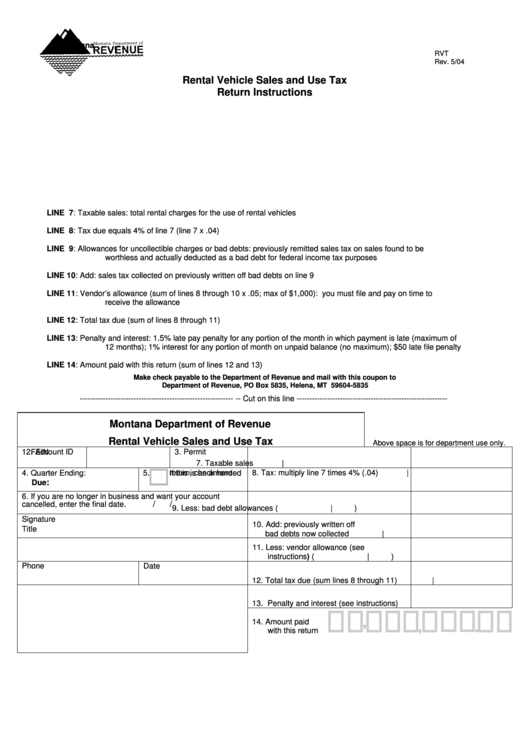

Montana

RVT

Rev. 5/04

Rental Vehicle Sales and Use Tax

Return Instructions

LINE 7:

Taxable sales: total rental charges for the use of rental vehicles

LINE 8:

Tax due equals 4% of line 7 (line 7 x .04)

LINE 9:

Allowances for uncollectible charges or bad debts: previously remitted sales tax on sales found to be

worthless and actually deducted as a bad debt for federal income tax purposes

LINE 10:

Add: sales tax collected on previously written off bad debts on line 9

LINE 11:

Vendor’s allowance (sum of lines 8 through 10 x .05; max of $1,000): you must file and pay on time to

receive the allowance

LINE 12:

Total tax due (sum of lines 8 through 11)

LINE 13:

Penalty and interest: 1.5% late pay penalty for any portion of the month in which payment is late (maximum of

12 months); 1% interest for any portion of month on unpaid balance (no maximum); $50 late file penalty

LINE 14:

Amount paid with this return (sum of lines 12 and 13)

Make check payable to the Department of Revenue and mail with this coupon to

Department of Revenue, PO Box 5835, Helena, MT 59604-5835

------------------------------------------------------------

-- Cut on this line -----------------------------------------------------------

Montana Department of Revenue

Rental Vehicle Sales and Use Tax

Above space is for department use only.

1. FEIN

2. Account ID

3. Permit

7. Taxable sales

|

4. Quarter Ending:

5.

If this is an amended

:

return, check here

8. Tax: multiply line 7 times 4% (.04)

|

Due

6. If you are no longer in business and want your account

.

/

/

cancelled, enter the final date

9. Less: bad debt allowances

(

|

)

Signature

10. Add: previously written off

bad debts now collected

|

Title

11. Less: vendor allowance (see

instructions)

(

|

)

Phone

Date

12. Total tax due (sum lines 8 through 11)

|

13. Penalty and interest (see instructions)

14. Amount paid

,

,

.

with this return

1

1