Form Ar8453-Pe - Arkansas Partnership Return Declaration For Electronic Filing - 2014

ADVERTISEMENT

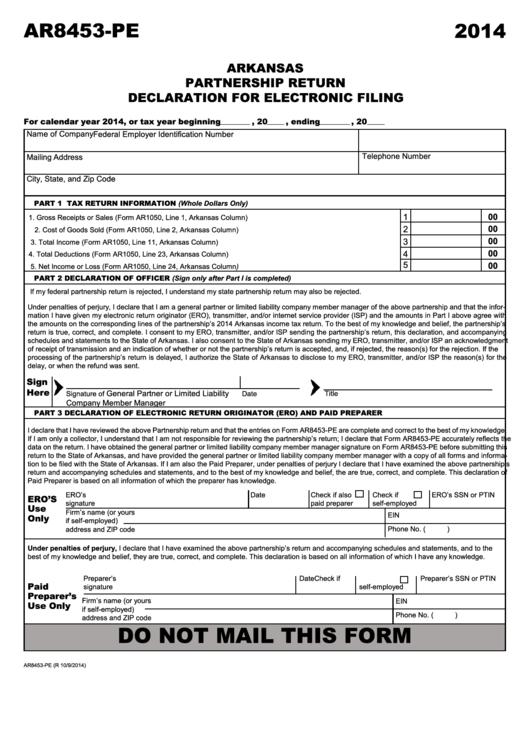

AR8453-PE

2014

ARKANSAS

PARTNERSHIP RETURN

DECLARATION FOR ELECTRONIC FILING

For calendar year 2014, or tax year beginning

, 20

, ending

, 20

Name of Company

Federal Employer Identification Number

Telephone Number

Mailing Address

City, State, and Zip Code

PART 1

TAX RETURN INFORMATION (Whole Dollars Only)

1

00

1.

Gross Receipts or Sales (Form AR1050, Line 1, Arkansas Column) .......................................................................

00

2

2.

Cost of Goods Sold (Form AR1050, Line 2, Arkansas Column) ...............................................................................

00

3

3.

Total Income (Form AR1050, Line 11, Arkansas Column) ........................................................................................

00

4

4.

Total Deductions (Form AR1050, Line 23, Arkansas Column)..................................................................................

5

00

5.

Net Income or Loss (Form AR1050, Line 24, Arkansas Column) .............................................................................

PART 2

DECLARATION OF OFFICER (Sign only after Part I is completed)

If my federal partnership return is rejected, I understand my state partnership return may also be rejected.

Under penalties of perjury, I declare that I am a general partner or limited liability company member manager of the above partnership and that the infor-

mation I have given my electronic return originator (ERO), transmitter, and/or internet service provider (ISP) and the amounts in Part I above agree with

the amounts on the corresponding lines of the partnership’s 2014 Arkansas income tax return. To the best of my knowledge and belief, the partnership’s

return is true, correct, and complete. I consent to my ERO, transmitter, and/or ISP sending the partnership’s return, this declaration, and accompanying

schedules and statements to the State of Arkansas. I also consent to the State of Arkansas sending my ERO, transmitter, and/or ISP an acknowledgment

of receipt of transmission and an indication of whether or not the partnership’s return is accepted, and, if rejected, the reason(s) for the rejection. If the

processing of the partnership’s return is delayed, I authorize the State of Arkansas to disclose to my ERO, transmitter, and/or ISP the reason(s) for the

delay, or when the refund was sent.

Sign

Here

General Partner or Limited Liability

Title

Signature of

Date

Company Member Manager

PART 3

DECLARATION OF ELECTRONIC RETURN ORIGINATOR (ERO) AND PAID PREPARER

I declare that I have reviewed the above Partnership return and that the entries on Form AR8453-PE are complete and correct to the best of my knowledge.

If I am only a collector, I understand that I am not responsible for reviewing the partnership’s return; I declare that Form AR8453-PE accurately reflects the

data on the return. I have obtained the general partner or limited liability company member manager signature on Form AR8453-PE before submitting this

return to the State of Arkansas, and have provided the general partner or limited liability company member manager with a copy of all forms and informa-

tion to be filed with the State of Arkansas. If I am also the Paid Preparer, under penalties of perjury I declare that I have examined the above partnership’s

return and accompanying schedules and statements, and to the best of my knowledge and belief, the are true, correct, and complete. This declaration of

Paid Preparer is based on all information of which the preparer has knowledge.

ERO’s

Date

Check if also

Check if

ERO’s SSN or PTIN

ERO’S

signature

paid preparer

self-employed

Use

Firm’s name (or yours

EIN

Only

if self-employed)

Phone No. (

)

address and ZIP code

Under penalties of perjury, I declare that I have examined the above partnership’s return and accompanying schedules and statements, and to the

best of my knowledge and belief, they are true, correct, and complete. This declaration is based on all information of which I have any knowledge.

Preparer’s

Date

Check if

Preparer’s SSN or PTIN

Paid

signature

self-employed

Preparer’s

Firm’s name (or yours

EIN

Use Only

if self-employed)

Phone No. (

)

address and ZIP code

DO NOT MAIL THIS FORM

AR8453-PE (R 10/9/2014)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2