Reset Form

Print Form

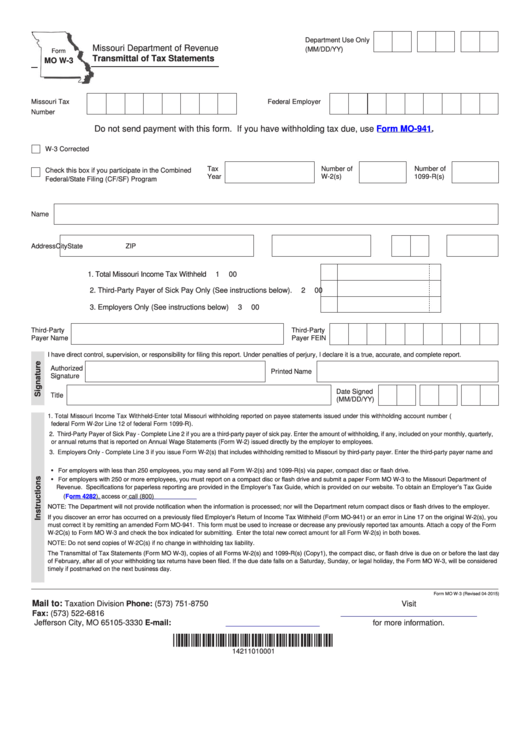

Department Use Only

Missouri Department of Revenue

(MM/DD/YY)

Form

Transmittal of Tax Statements

MO W-3

Missouri Tax I.D.

Federal Employer

Number

I.D. Number

Do not send payment with this form. If you have withholding tax due, use

Form

MO-941.

W-3 Corrected

Tax

Number of

Number of

Check this box if you participate in the Combined

Year

W-2(s)

1099-R(s)

Federal/State Filing (CF/SF) Program

Name

Address

City

State

ZIP

1. Total Missouri Income Tax Withheld..................................................

1

00

2. Third-Party Payer of Sick Pay Only (See instructions below). ........

2

00

3. Employers Only (See instructions below) .......................................

3

00

Third-Party

Third-Party

Payer Name

Payer FEIN

I have direct control, supervision, or responsibility for filing this report. Under penalties of perjury, I declare it is a true, accurate, and complete report.

Authorized

Printed Name

Signature

Date Signed

Title

(MM/DD/YY)

1. Total Missouri Income Tax Withheld-Enter total Missouri withholding reported on payee statements issued under this withholding account number (e.g. Box 17 of

federal Form W-2or Line 12 of federal Form 1099-R).

2. Third-Party Payer of Sick Pay - Complete Line 2 if you are a third-party payer of sick pay. Enter the amount of withholding, if any, included on your monthly, quarterly,

or annual returns that is reported on Annual Wage Statements (Form W-2) issued directly by the employer to employees.

3. Employers Only - Complete Line 3 if you issue Form W-2(s) that includes withholding remitted to Missouri by third-party payer. Enter the third-party payer name and

I.D. number in spaces provided.

• For employers with less than 250 employees, you may send all Form W-2(s) and 1099-R(s) via paper, compact disc or flash drive.

• For employers with 250 or more employees, you must report on a compact disc or flash drive and submit a paper Form MO W-3 to the Missouri Department of

Revenue. Specifications for paperless reporting are provided in the Employer’s Tax Guide, which is provided on our website. To obtain an Employer’s Tax Guide

(Form

4282), access

or call (800) 877-6881.Information should be labeled with the name and account number of the employer.

NOTE: The Department will not provide notification when the information is processed; nor will the Department return compact discs or flash drives to the employer.

If you discover an error has occurred on a previously filed Employer’s Return of Income Tax Withheld (Form MO-941) or an error in Line 17 on the original W-2(s), you

must correct it by remitting an amended Form MO-941. This form must be used to increase or decrease any previously reported tax amounts. Attach a copy of the Form

W-2C(s) to Form MO W-3 and check the box indicated for submitting. Enter the total new correct amount for all Form W-2(s) in both boxes.

NOTE: Do not send copies of W-2C(s) if no change in withholding tax liability.

The Transmittal of Tax Statements (Form MO W-3), copies of all Forms W-2(s) and 1099-R(s) (Copy1), the compact disc, or flash drive is due on or before the last day

of February, after all of your withholding tax returns have been filed. If the due date falls on a Saturday, Sunday, or legal holiday, the Form MO W-3, will be considered

timely if postmarked on the next business day.

Form MO W-3 (Revised 04-2015)

Mail to:

Taxation Division

Phone: (573) 751-8750

Visit

P.O. Box 3330

Fax: (573) 522-6816

Jefferson City, MO 65105-3330

E-mail:

withholding@dor.mo.gov

for more information.

*14211010001*

14211010001

1

1