Monthly Sales Tax Return Form - City Of Saint Paul, Alaska - 2008

ADVERTISEMENT

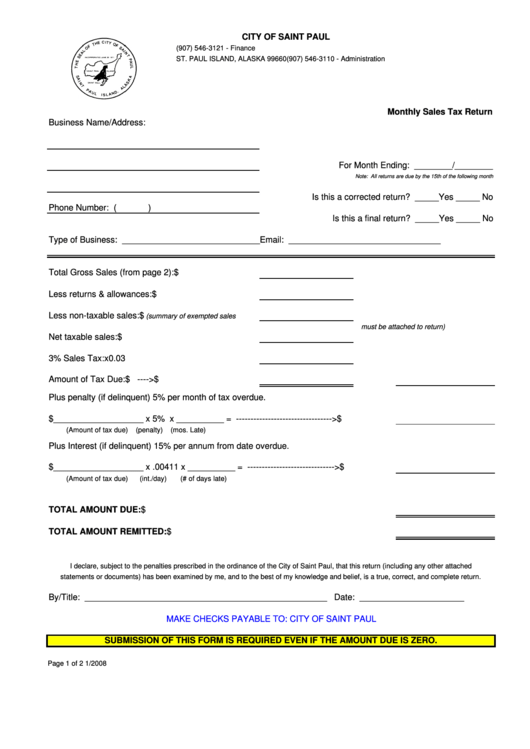

CITY OF SAINT PAUL

P.O. BOX 901

(907) 546-3121 - Finance

ST. PAUL ISLAND, ALASKA 99660

(907) 546-3110 - Administration

Monthly Sales Tax Return

Business Name/Address:

For Month Ending: ________/________

Note: All returns are due by the 15th of the following month

Is this a corrected return? _____Yes _____ No

Phone Number: (

)

Is this a final return? _____Yes _____ No

Type of Business: _____________________________

Email: ________________________________

Total Gross Sales (from page 2):

$

Less returns & allowances:

$

Less non-taxable sales:

$

(summary of exempted sales

must be attached to return)

Net taxable sales:

$

3% Sales Tax:

x

0.03

Amount of Tax Due:

$

---->

$

Plus penalty (if delinquent) 5% per month of tax overdue.

$___________________ x 5% x __________ = --------------------------------->

$

(Amount of tax due)

(penalty)

(mos. Late)

Plus Interest (if delinquent) 15% per annum from date overdue.

$___________________ x .00411 x __________ = ------------------------------>

$

(Amount of tax due)

(int./day)

(# of days late)

TOTAL AMOUNT DUE:

$

TOTAL AMOUNT REMITTED:

$

I declare, subject to the penalties prescribed in the ordinance of the City of Saint Paul, that this return (including any other attached

statements or documents) has been examined by me, and to the best of my knowledge and belief, is a true, correct, and complete return.

By/Title: ___________________________________________________ Date: ______________________

MAKE CHECKS PAYABLE TO: CITY OF SAINT PAUL

SUBMISSION OF THIS FORM IS REQUIRED EVEN IF THE AMOUNT DUE IS ZERO.

Page 1 of 2

1/2008

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2