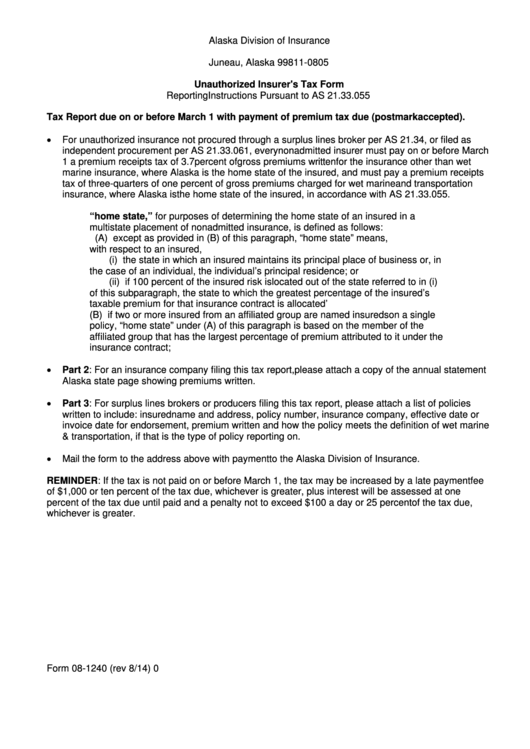

Alaska Division of Insurance

P.O. Box 110805

Juneau, Alaska 99811-0805

Unauthorized Insurer's Tax Form

Reporting Instructions Pursuant to AS 21.33.055

Tax Report due on or before March 1 with payment of premium tax due (postmark accepted).

•

For unauthorized insurance not procured through a surplus lines broker per AS 21.34, or filed as

independent procurement per AS 21.33.061, every nonadmitted insurer must pay on or before March

1 a premium receipts tax of 3.7 percent of gross premiums written for the insurance other than wet

marine insurance, where Alaska is the home state of the insured, and must pay a premium receipts

tax of three-quarters of one percent of gross premiums charged for wet marine and transportation

insurance, where Alaska is the home state of the insured, in accordance with AS 21.33.055.

“home state,” for purposes of determining the home state of an insured in a

multistate placement of nonadmitted insurance, is defined as follows:

(A) except as provided in (B) of this paragraph, “home state” means,

with respect to an insured,

(i) the state in which an insured maintains its principal place of business or, in

the case of an individual, the individual’s principal residence; or

(ii) if 100 percent of the insured risk is located out of the state referred to in (i)

of this subparagraph, the state to which the greatest percentage of the insured’s

taxable premium for that insurance contract is allocated’

(B) if two or more insured from an affiliated group are named insureds on a single

policy, “home state” under (A) of this paragraph is based on the member of the

affiliated group that has the largest percentage of premium attributed to it under the

insurance contract;

•

Part 2: For an insurance company filing this tax report, please attach a copy of the annual statement

Alaska state page showing premiums written.

•

Part 3: For surplus lines brokers or producers filing this tax report, please attach a list of policies

written to include: insured name and address, policy number, insurance company, effective date or

invoice date for endorsement, premium written and how the policy meets the definition of wet marine

& transportation, if that is the type of policy reporting on.

•

Mail the form to the address above with payment to the Alaska Division of Insurance.

REMINDER: If the tax is not paid on or before March 1, the tax may be increased by a late payment fee

of $1,000 or ten percent of the tax due, whichever is greater, plus interest will be assessed at one

percent of the tax due until paid and a penalty not to exceed $100 a day or 25 percent of the tax due,

whichever is greater.

Form 08-1240 (rev 8/14)

0

1

1 2

2